Below is a list of 16 potential takeover targets based on value and the ability to acquire the company. I didn’t put a limit on the size of the company, so there are some ‘Gigantors’ in the list below, but nothing like a Wal-Mart or Microsoft or anything close to it. All of the companies

By far one of my best screens in determining who is buying what on The Street. What you will find are those stocks that, among other variables that I use, 1) Gaining an increased amount of coverage by brokerage firms and analysts, and 2) Being upgraded on a regular basis. This is a good screen to

What we have below is a handful of stocks that are showing signs of, or already in the process of, breaking down as the smart money seems to be leaving them in a very subtle manner. As I thumbed through the different charts I noticed stocks trading at its peak, and finally showing some vulnerability, and

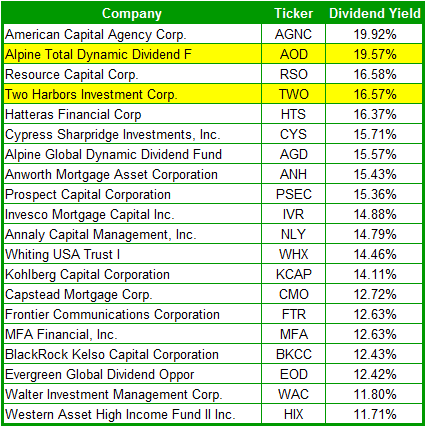

A lot of investors will use market sell-offs like the one we have been experiencing over the past month, to pick up high-dividend yielding stocks on the cheap. As the stock goes down, assuming they don’t cut the value of their dividend in the process, their payout goes up relative to the price per share

The two stocks below are mainly those stocks that have been on a solid uptrend of late, but are starting to show signs of breaking down along with a loss of interest by the street as a whole. So if you are looking to short this market, use the stocks below as bit of a

Here is a new screen that I will make sure to post from time to time as it merits. What you’ll find below are 12 companies that insiders are significant owners of. Some of these stocks, the management owns as much as 88% of the outstanding shares. That means that you have a low-float, and

If you are looking for some conservative plays out there, thinking that we are only on the cusp of a protracted downturn in the market (like I do!) and you are looking to get long on some defensive stocks (for what reasons I’m not sure), I would look no further than the list below. I’ve

This particular stock screen has tripled in results since the last time I ran it, which was about two weeks ago, that is primarily due to the fact that stocks in general are getting knocked down so hard, that many of your more well managed are getting extremely cheap relative to their book-price (the value

When considering the selling we have seen throughout the past month and a half, a title such as the one to this post, is no doubt bold. The screen results are nearly half of what they were from a month ago (previously 15), which means the stocks below represent some of the market’s strongest upward

You probably don’t recognize this as one of my stock screens that I have used in the past, that is because I just created it this weekend. For both technical and fundamental traders/investors this stock screen carries a lot of importance. Almost every stock out there has at least a firm or two covering them,