After yesterday, thoughts on the street was that perhaps we would get a sympathy bounce out of the market, but the way futures are looking, it doesn’t appear to be so. Different from my usual morning trade-setups, I thought I’d publish my running watch list of stocks with their ideal stop-loss. Some of these

Below is a list of 11 potential takeover targets based on value and the ability to acquire the company. I didn’t put a limit on the size of the company, so there are some ‘Gigantors’ in the list below, but nothing like a Wal-Mart or Microsoft or anything close to it. All of the companies

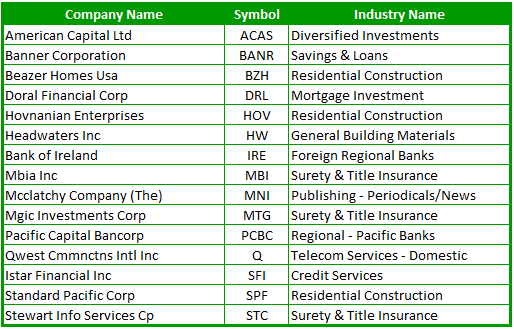

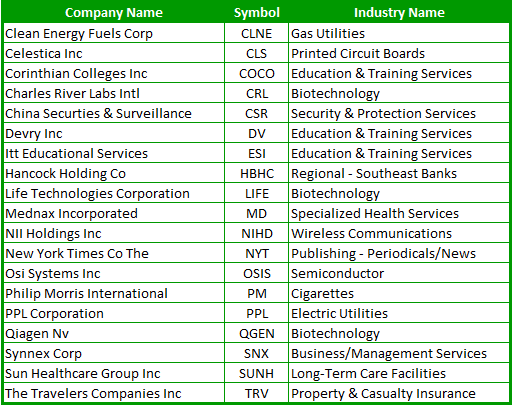

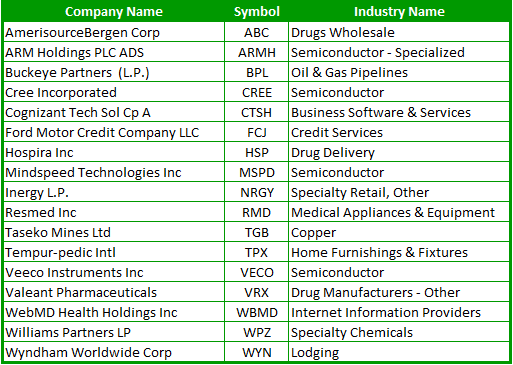

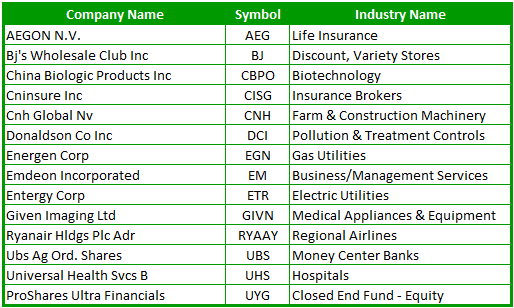

Below are a list of small-cap stocks that have been heavily shorted by the street, and should the market or the individual stock start rallying, could really see its share price launch into the stratosphere because of the bears being forced to cover their short positions in the stock. No joke, based on the number

Here’s a look at the Best and Worst Industries of the past month across the board. The losing industries have crept back up some when comparing it to last month in which there were barely any losers at all. As for observations, the Toy & Hobby Stores along with Music & Video stores seem to

If you are looking for some conservative plays out there, thinking that there are pending storms on the horizon in the economy and markets, I would look no further than the list below. I’ve run a screen to find those stocks least affected by the market’s moods and emotions, and these here are to be

Here’s a relatively new screen for you that I ran last night, and will look to update every month. What you will find below is the highest paying dividend stocks/funds currently being traded. The annual dividend payouts range from 12% all the way up to 29% (TNE). Most of them you will see are connected

Below are the screen results of stocks that have a book value per share that is more than its price per share. Like last time, I just want stocks selling at a THIRD of their book value. Before it was half – so the parameters are tightening. Also, I wanted only those stocks that are

What we have below is a handful of stocks that are showing signs of an impending breakdown as the money seems to be leaving them in a very subtle manner. In order for these setups to work, you are going to need some cooperation from the general market, as these stocks like any other (they are

This here happens to be one of my favorite stock screens that I run, that’s because the stocks below, represent some of the most technically sound companies being traded today. These stocks have managed to keep their uptrend intact despite market conditions that can be quite volatile, and when they do pull back from time

The stocks below are mainly those stocks that have been on a solid uptrend of late, but are starting to show signs of breaking down along with a loss of interest by the street as a whole. So if you are looking to short this market, which definitely takes some guts (but the potential for