Yikes! Netflix just can’t stay out of the news. At least today it was a good announcement about their expansion into the UK. By now it is no surprise that Netflix has taking a bad bounce and dropped over half of its value. Since then it has been a rollercoaster ride only touched by the

Welcome to the world of Options! This is a very scary world with many twist and turns to help you lose your way. Options are wonderful tools once you harness the knowledge. Unfortunately they can be deadly when used without caution. Don’t just rush out there and put your portfolio at risk; take the

The US options exchange started with the founding of the CBOE (Chicago Board Options Exchange) in 1973. At the beginning there were a total of 16 equities that had only call options. In 1977 they began to trade put options. There are now over 5 different exchanges actively trading options. In 1975 the SEC (Securities

An option gives the buyer the right to buy or sell the underlying at a specified price and time. At the same time, the seller has the obligation to take the opposite side and fulfill the option upon exercise. That means that the buyer can choose if they want to exercise the option, but the

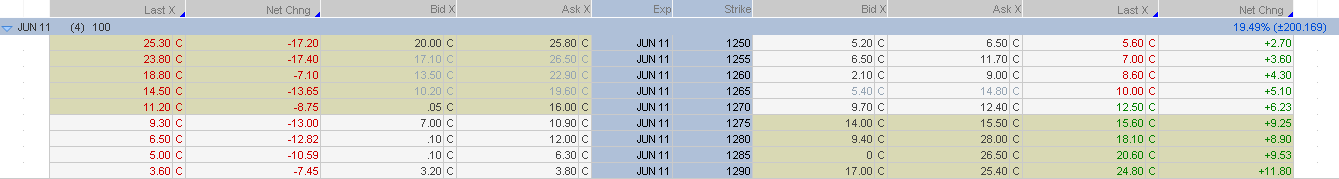

In-the-Money (ITM): For a call option this means that the underlying is trading above the strike price. For example ABC is trading at 30 and the call option has a strike price of 25. This call option is ITM. For a put option this means the underlying is trading below the strike price. For example

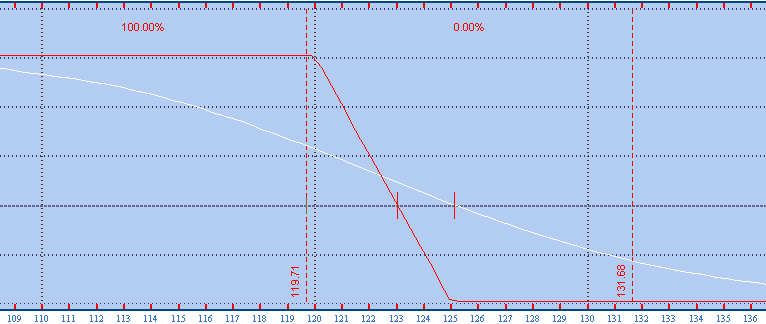

11/29/11 - Trade Review on SPY 125/120 Bear Put Vertical Spread New trade review posted that one of our fellow traders did on the SPY. Check it out to see why he used a vertical spread, when he took his profit, and what his further action should be. SPY 125/120 Vertical Spread 11/19/11 - Reworked

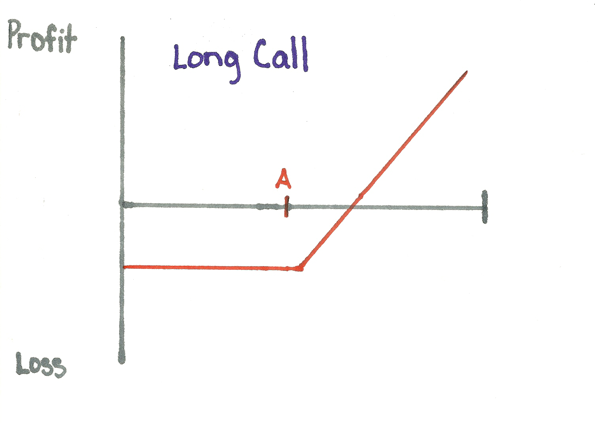

Name: Long Call Description: The long call gives the buyer the right to purchase the stock at the strike price. You want to buy a call if you believe the price of the underlying is going to go up. Calls offer insurance over buying the stock outright since you can only lose the price of

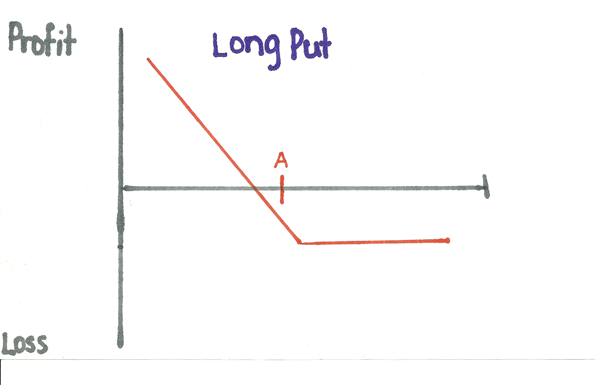

Name: Long Put Setup: Buy (long) a put Bias: Bearish

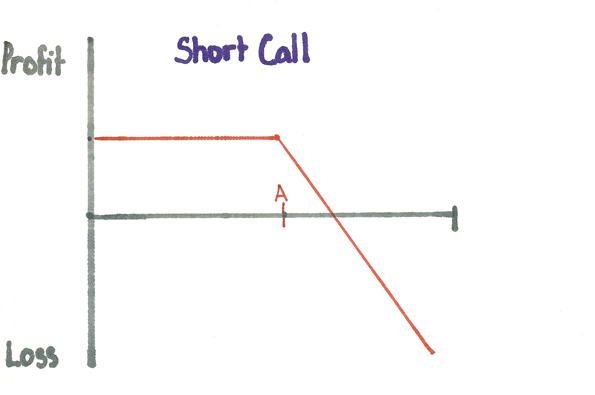

Name: Short Call Setup: Sell (short) a call Bias: Neutral to Bearish