In-the-Money (ITM): For a call option this means that the underlying is trading above the strike price. For example ABC is trading at 30 and the call option has a strike price of 25. This call option is ITM. For a put option this means the underlying is trading below the strike price. For example ABC is trading at 45 and the put option has a strike of 50. This put option is ITM.

At-the-Money (ATM): This indicates the underlying price is around the strike price. For example ABC is trading at 50 and the option strike is 50. This goes for both puts and calls. If you cannot tell which strike is closer than look for the strike with a delta closer to .50.

Out-of-the-Money (OTM): For a call option this means the underlying is trading below the strike price. For example ABC is trading at 15 with the call option strike at 20. This call option is OTM. For a put option this means the underlying is trading above the strike price. For example ABC is trading at 75 and the put option has a strike of 70. This put option is OTM.

Intrinsic Value: The amount the option is in-the-money. Only In-the-Money (ITM) options carry intrinsic value.

Time Value: Sets the value of time till expiration. An option that is Out-of-the-Money (OTM) only has time value. If an option is In-the-Money (ITM) it is made up of both Intrinsic Value and Time Value.

Exercise: To exercise an option contract means you are fulfilling the contract and closing it out. If you exercise a call option you are buying the shares at the strike price. If you exercise a put you are selling the shares at the strike price.

Assignment: An option assignment is the other side of the option being exercised. In this case you are not the buyer of the option instead you are the seller or writer of the option. When a buyer exercises an option the writer gets assigned. If you are a writer of a call option that gets exercised then you have to give the buyer your shares. If you are a writer of a put option then you will receive the shares when assigned.

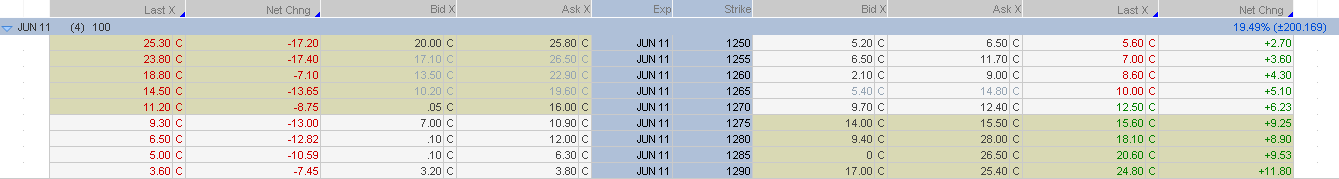

Option Chain: An option chain displays all the necessary information for the underlying asset. The options are listed by the expiration month and then broken down by all the strikes available. Usually Calls are listed on the left side and Puts listed on the right side. Option Chains can provide a wide variety of information from something basic such as the bid/ask to more specific information such as the option greeks.

Example of an option chain:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.