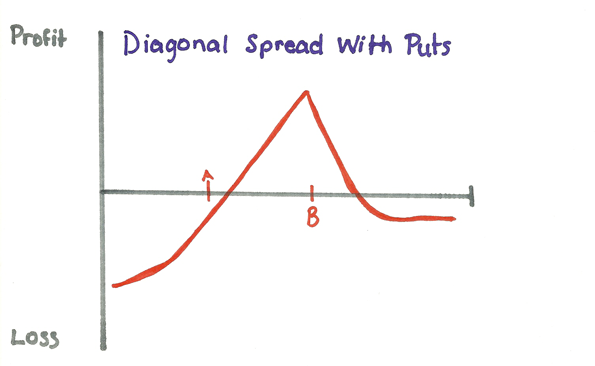

Name: Diagonal Spread w/ Puts Setup: Sell (short) out-of-the-money Strike B put (front month) and Buy (long) Strike A put at a later month (back month) and When the short put expires sell another put at Strike B Bias: Neutral to Bullish

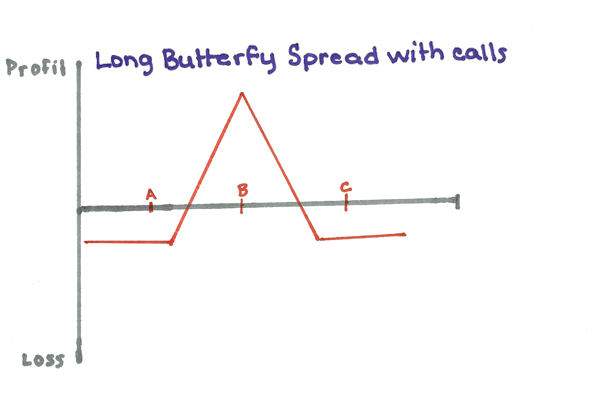

Name: Long Butterfly w/ Calls Setup: Buy (long) Strike A call and Sell (short) 2 Strike B calls and Buy (long) Strike C call Bias: Neutral

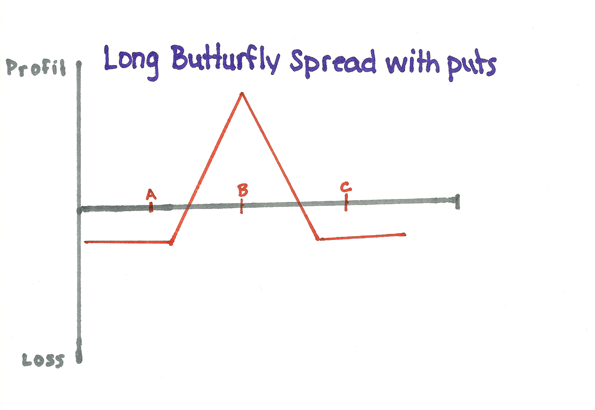

Name: Long Butterfly w/ Puts Setup: Buy (long) Strike A put and Sell (short) 2 Strike B puts and Buy (long) Strike C put Bias: Neutral

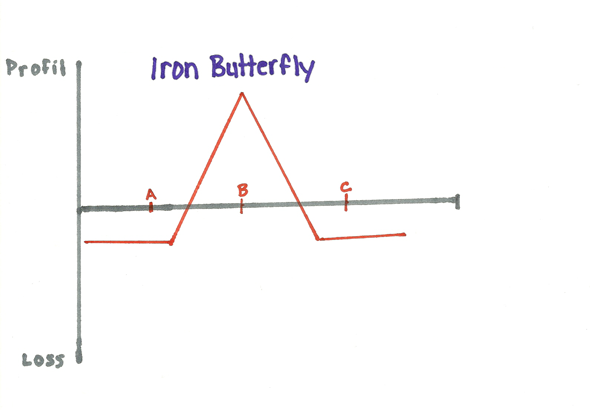

Name: Iron Butterfly Setup: Buy (long) Strike A put and Sell (short) Strike B put and Sell (short) Strike B call and Buy (long) Strike C call Bias: Neutral

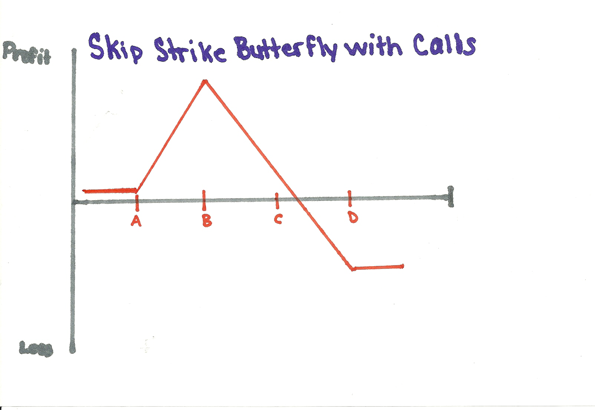

Name: Broken Wing Butterfly w/ Calls Setup: Buy (long) Strike A call and Sell (short) 2 Strike B calls and Buy (long) Strike D call Bias: Slightly Bullish

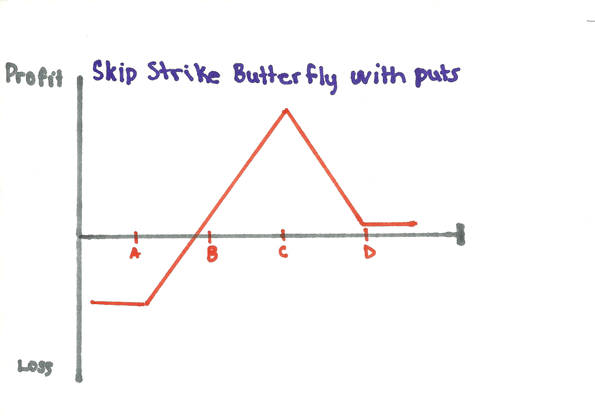

Name: Broken Wing Butterfly w/ Calls Setup: Buy (long) Strike A put and Sell (short) 2 Strike C puts and Buy (long) Strike D put Bias: Slightly Bearish

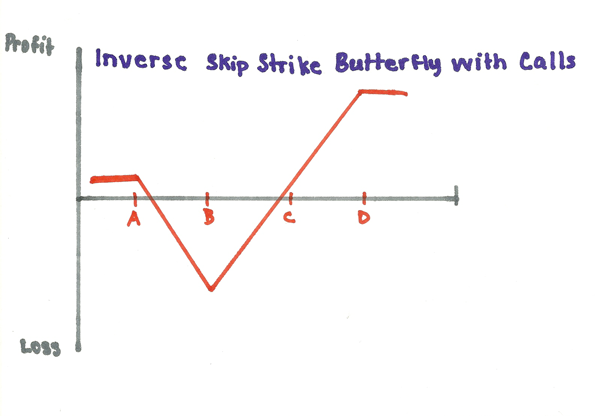

Name: Inverse Broken Wing Butterfly w/ Calls Setup: Sell (short) Strike A call and Buy (long) 2 Strike B calls and Sell (short) Strike D call Bias: Slightly Bullish

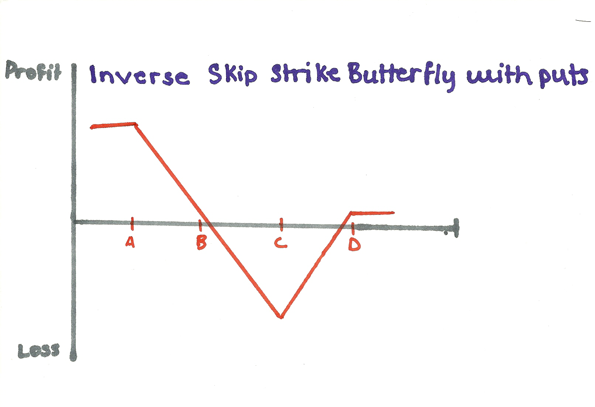

Name: Inverse Broken Wing Butterfly w/ Puts Setup: Sell (short) Strike A put and Buy (long) 2 Strike C puts and Sell (short) Strike D put Bias: Extremely Bearish

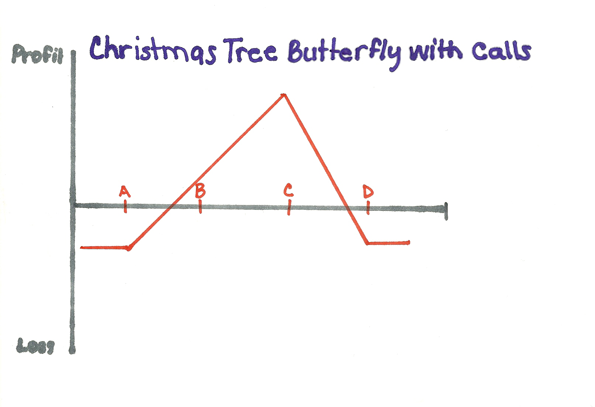

Name: Christmas Tree Butterfly w/ Calls Setup: Buy (long) Strike A call and Sell (short) 3 Strike C calls and Buy (long) 2 Strike D calls Bias: Slightly Bullish

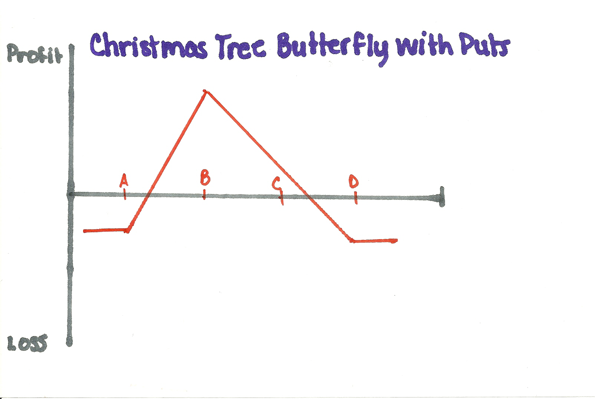

Name: Christmas Tree Butterfly w/ Puts Setup: Buy (long) 2 Strike A puts and Sell (short) 3 Strike B puts and Buy (long) Strike D put Bias: Slightly Bearish