VIX was crushed today.

$VIX crushed

Indicators of economic activity and employment have continued to strengthen. Job gains have been strong in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

$BIG with heavy resistance overhead with price level and trend-line resistance.

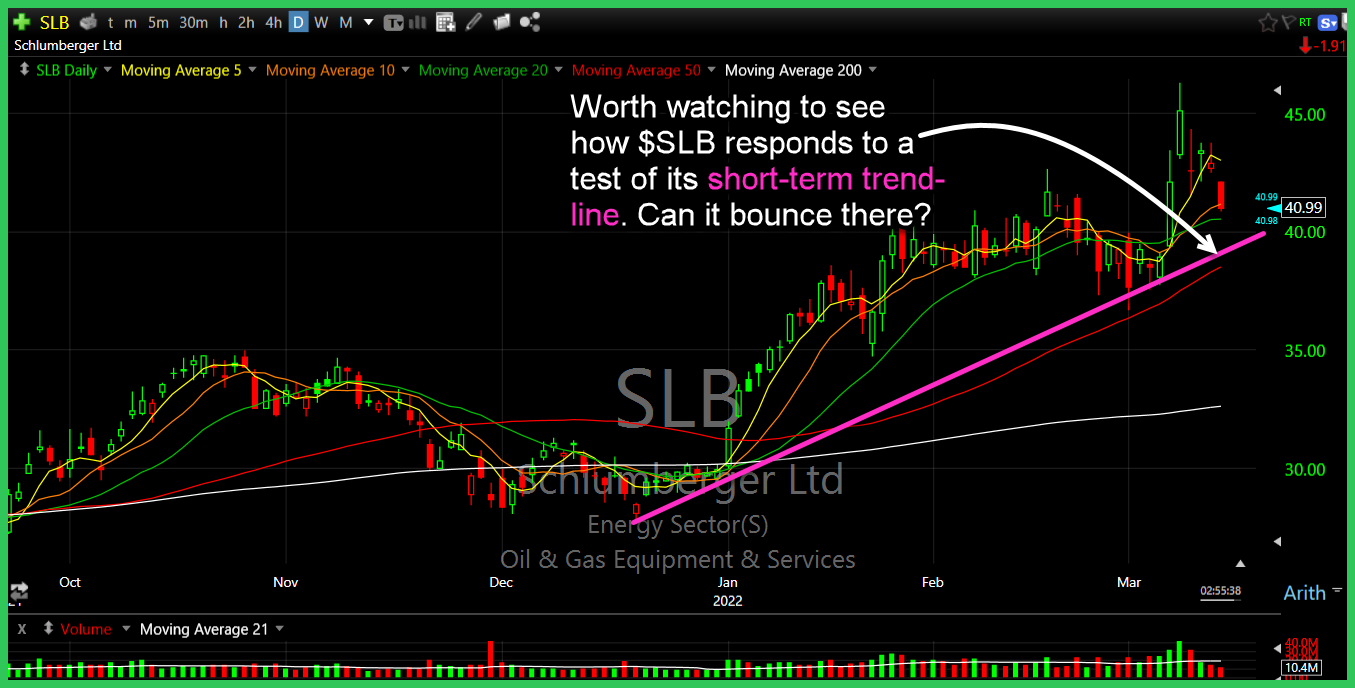

Worth watching to see how $SLB responds to a test of its short-term trend-line. Can it bounce there?

$URI facing stiff overhead resistance.

For the better part of a month, I've been saying that Digital World Acquisition (DWAC) is a problem chart as long as it stays below major resistance. Crude Oil Futures (CL) pulling back to its long-term support level at $109-110 Home Depot (HD) declining trend-line weighing on price. Can't get bullish on the

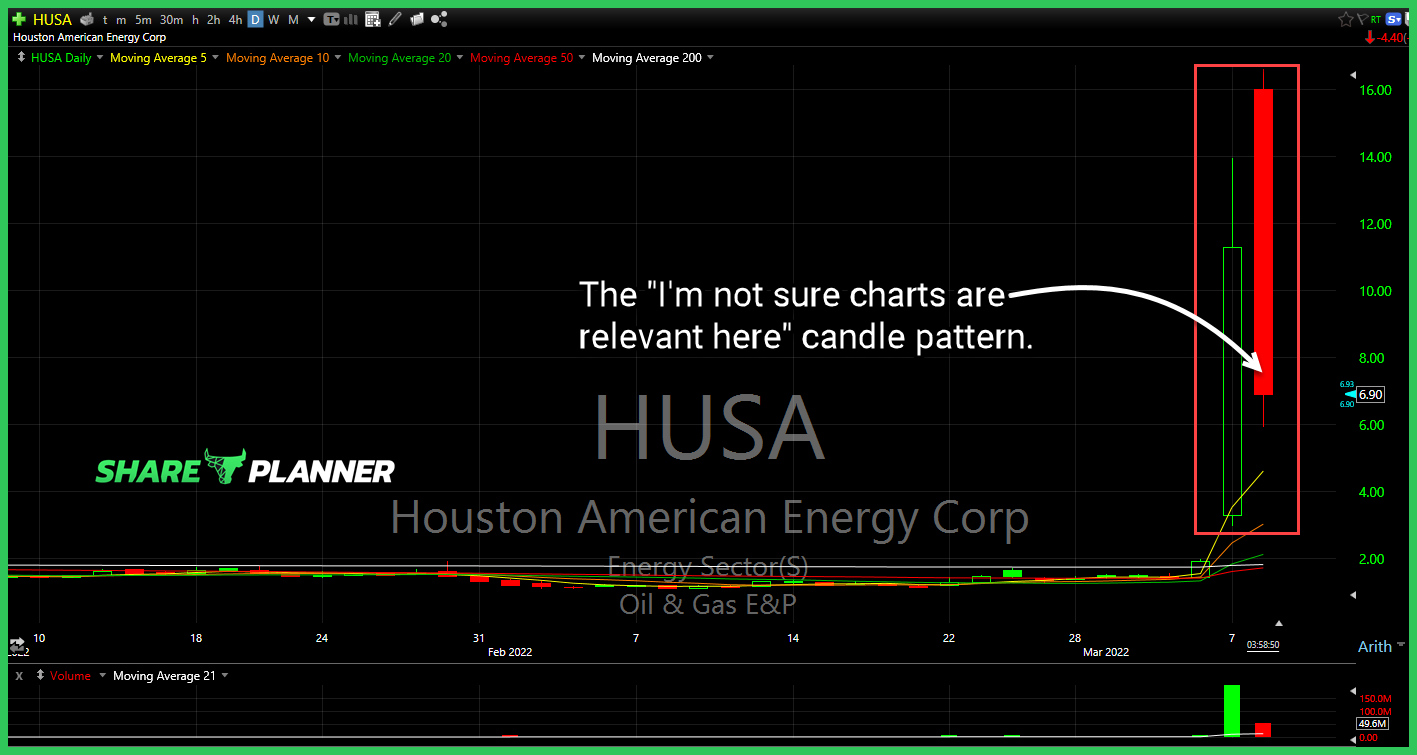

This is certainly one of my favorites: the “I’m not sure charts are relevant here” candle pattern.

$BTC.X Bitcoin double top forming, though it will be a difficult one to confirm.

$KR rally – is this a product of them increasing earnings, revenue, or both? If the former, then they are capitalizing on inflation rather than adjusting to inflation, right? Perhaps more are eating at home and less eating out?