$PAAS holding up well today and could finally breakout of the declining trend-line

$ARKK bear flag and declining trend-line still causing trouble for investors… and Cathie Woods is the most overrated trader of my lifetime.

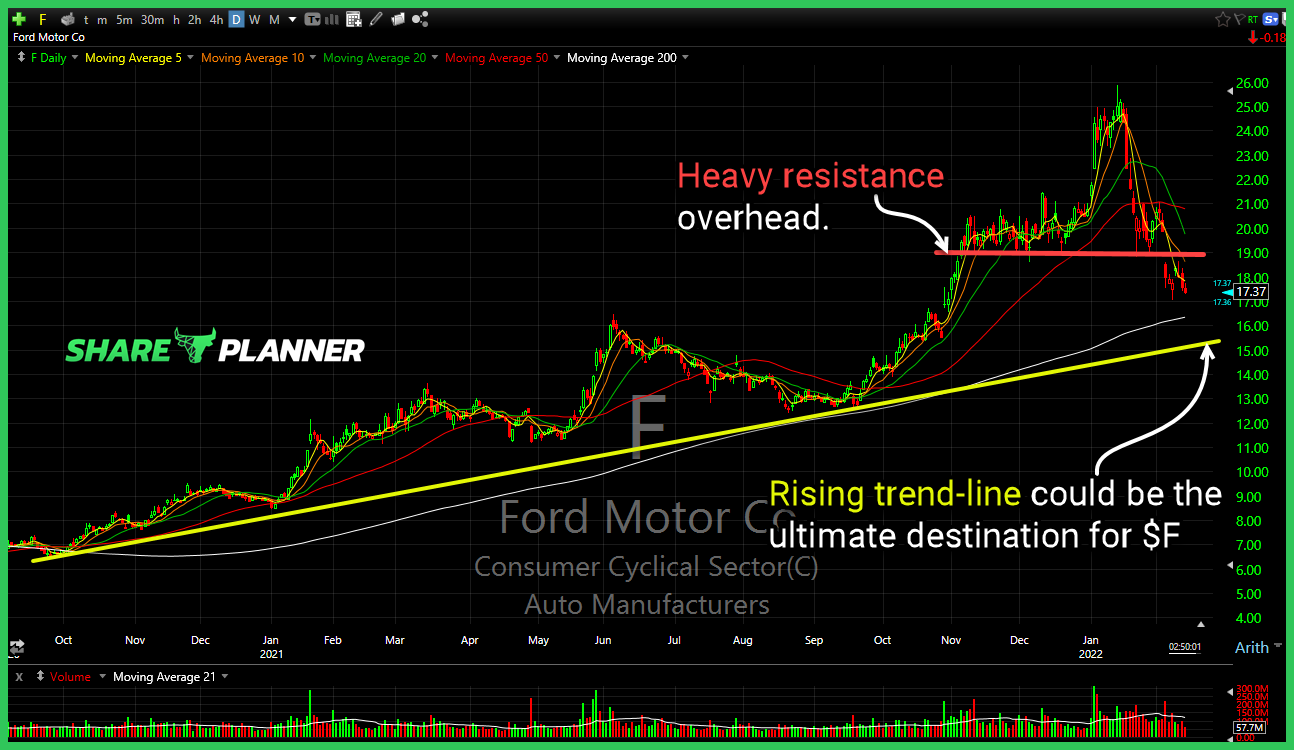

$F has room to fall before any substantial support kicks in.

$AMD taking its talents to $100

Himax Technologies (HMAX) hourly chart not too shabby. Held up well today relative to the rest of the market. Astra Space (ASTR) gotta get your rocket out of the garage SoFi Technologies (SOFI) remains under a ton of resistance that it simply can't seem to push through. Affirm (AFRM) cup and handle pattern

$PFE bouncing off key support.

$AMD testing, but not yet breaking through resistance yet.

Advanced Micro Devices (AMD) struggling with short-term resistance. Unity Software (U) pulling back to its major, and only long-term support level. Facebook (FB) - the reason you never hold any trade through earnings. With Crude Oil Futures (CL)> $90/barrel, Hess (HES) gearing up for a breakout of its own.

$PYPL 1) Major gap filled today going back to May of 2020, 2) major price support being tested here from 2019. Not worth buying on the day, of, but worth watching to see if there is a willingness to bounce off the level in the days ahead.

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation has eased somewhat but remains elevated. Russia's war against Ukraine is causing tremendous human and economic hardship and is contributing to elevated global uncertainty. The Committee is highly attentive