$NIO testing critical support. If it can hold there is the potential for a triple bottom, but if it doesn’t, there’s little support underneath.

$CRM with a declining trend-line in play. $UPST looks impressive here with that basing pattern and inverse head and shoulders pattern. $AFL bouncing at two significant levels of support.

Unlike $SLV, the $GLD breakout has been well underway.

Yet there are people out there buying the dip on $RSX

Life Time Group (LTH) held support well yesterday The Mosaic Company (MOS) with an extreme move and testing the upper band today. Quite possibly the most stubborn resistance level of the last 18 months. Spurs on every single market rally. with an extreme move and testing the upper band today. CBOE Market Volatility

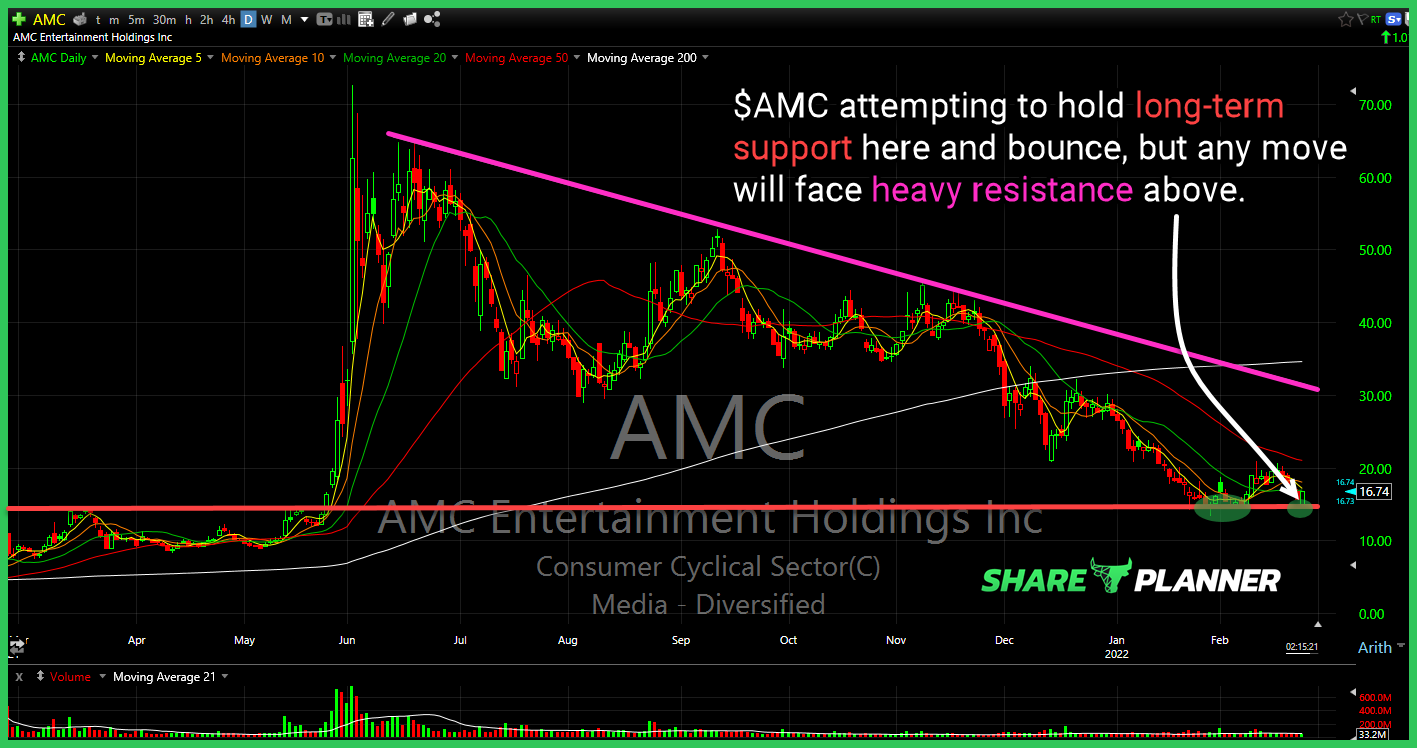

$AMC testing major support here.

$SOFI trying to find some support here at their all-time lows. Any bounce means very little until it can break the downtrend above.

Macy's (M) testing key support levels right now. Nvidia (NVDA) once again trying to hold its 200-day moving average. Home Depot (HD) major support broken following its earnings. Digital World Acquisition (DWAC) pulling back to the breakout level - a key moment for the stock.

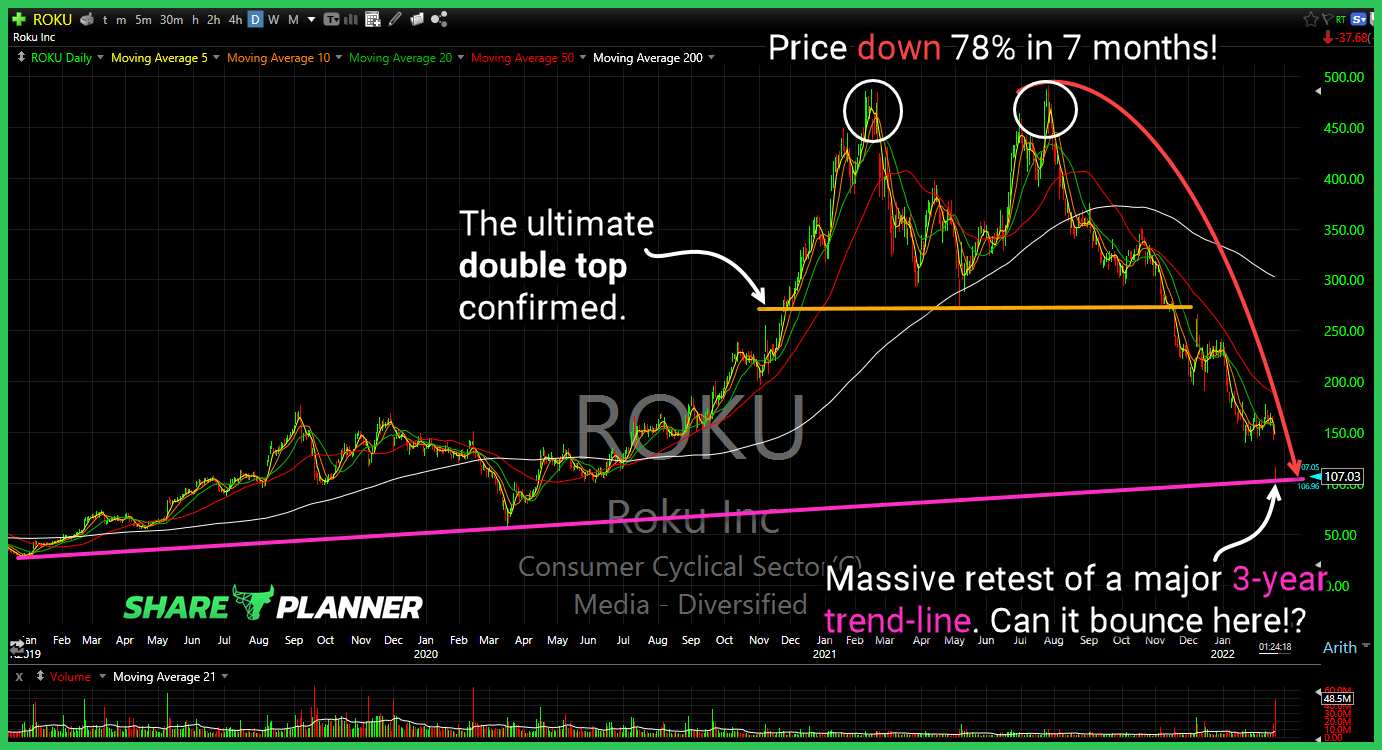

$ROKU has pulled back to a major trend-line from 3 years ago. Not worth catching the falling knife right now, but if it can start to form a base around support, it could provide a opportunity to get long in the next few weeks.

$MO breaking out of a multi-year inverse head and shoulders pattern with a 7.15% divi. One of the few long-term plays out there.