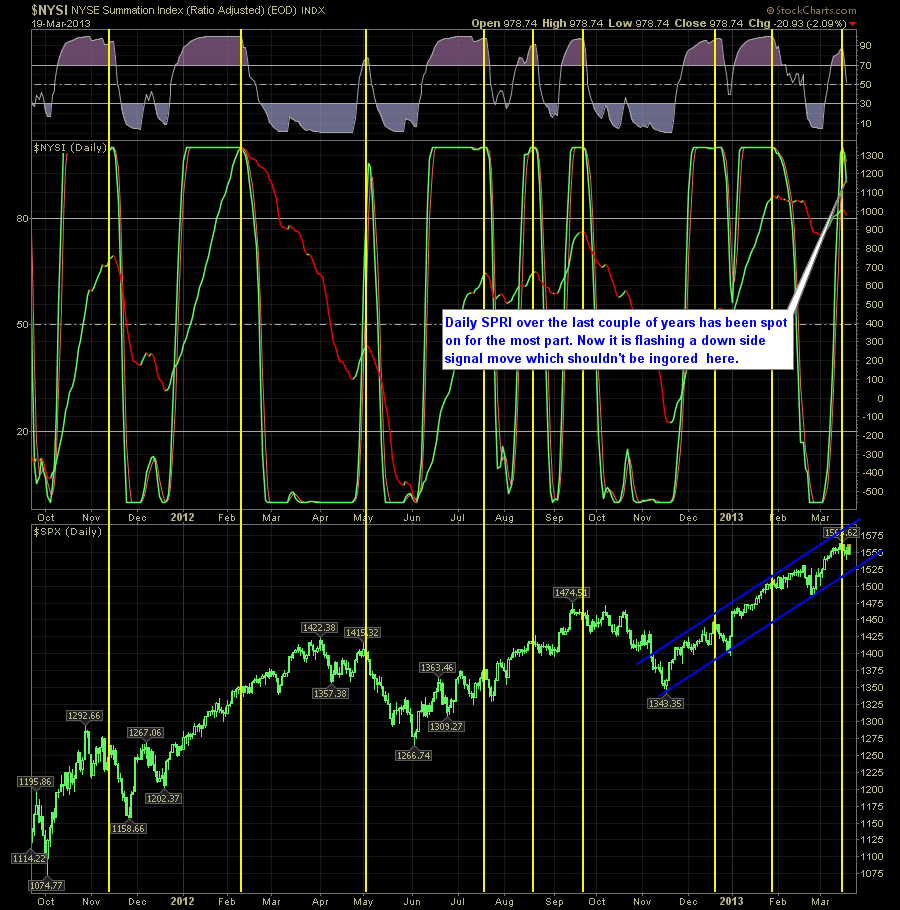

Daily Reversal Indicator has been spot-on over the last couple of years I don't typically publish the daily look into the SPRI. Traditionally it has been from the view of the weekly chart. But these two different time frames can often times produce a completely different look. Right now the daily SPRI is indicating that

The ineffectiveness of the drug war & tax dollar waste Quick Glance at the Market Heat Map and Industries Notables: Basic Materials across the board were the markets worst performers. Consumer Goods and Healthcare had a surprising amount of strength in it today. Banks still showing a lot of pain while Tech managed

This is what the mean by “Just Buy the Dip” A nice 5-minute chart of the /ES contract from last night until today’s close. Quick Glance at the Market Heat Map and Industries Notables: You can almost bank on Apple (AAPL) being up any day that the market is down. How much worse would

25 Years of VIX Quick Glance at the Market Heat Map and Industries Notables: 3 companies had huge days: AAPL, BAC, WFC Services showed weakness again. The rest of tech was pretty lousy. Be sure to check out my latest swing trades and overall past performance

Reversal Indicator Might Be Signaling a New Bull Market While in the short-term the market could benefit from a few points of a move lower (jestly speaking), there's no doubt that the market is moving into territory that is completely new terrain. While we understand that it isn't so much because of a new golden

Pre-market update (updated 8am eastern): European markets are brading 0.4% higher. Asian markets traded flat. US futures are trading slightly higher ahead of the opening bell. Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30am), International Trade (8:30am), Jobless Claims (8:30am), Quarterly Services (10am), EIA Natural Gas Report (10:30am), Consumer Credit (3pm) Technical

Pre-market update (updated 8am eastern): European markets are brading 0.4% higher. Asian markets traded flat. US futures are trading slightly higher ahead of the opening bell. Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30am), International Trade (8:30am), Jobless Claims (8:30am), Quarterly Services (10am), EIA Natural Gas Report (10:30am), Consumer Credit (3pm) Technical

I get very weary when we trade outside the upper Bollinger Band Quick Glance at the Market Heat Map and Industries Notables: The leaders of tech were a major drag: AAPL, MSFT & GOOG A few of the big banks were abnormally higher. Precious metals were showing some strength in the Basic Materials

Never a Dip That Doesn’t Get Bought Up! This market continues to be a bear trap at every juncture where there’s a sell-off of any kind. The VIX is in the 13’s – and for good measure; fearing the downside to this ever-rising market is a fool’s game to most. But for those who have

Historic day for the Dow Quick Glance at the Market Heat Map and Industries Notables: Apple (AAPL) finally aligned itself with the market on an up-day. Technology nearly flawless. Banks weren’t all there, and didn’t show as much enthusiasm. Be sure to check out my latest swing trades and overall past performance