Pre-market Update (Updated 9:00am eastern):

- US futures are down almost -1% ahead of the open.

- European markets are trading -1.1% lower.

- Asian markets are traded -0.6% lower.

Economic Reports Due out (Times are EST): Chicago Fed national Activity Index (8:30am), New Home Sales (10am), Dallas Fed Manufacturing Survey (10:30am)

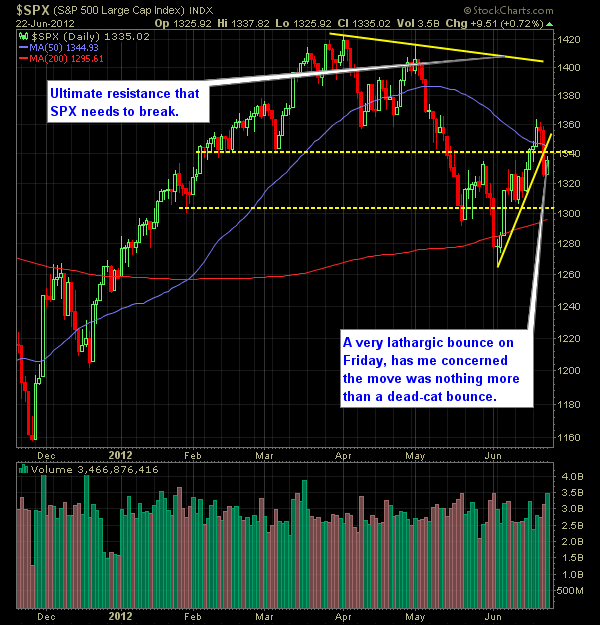

Technical Outlook (SPX):

- SPX manage to pair some of its losses with a descent bounce on Friday.

- Found support at the previous inverse head and shoulders breakout level of 1324.

- If we fail to hold this level, a likely test comes again of 1306.

- The 10-day moving average was reclaimed on Friday.

- The 100-day moving average has been a tough resistance barrier for the market of late.

- In order to resume the rally that started off of the 6/4 lows, bulls need to drive price back above 1360.

- Market is nearing oversold levels in the short-term. One or two more good sell-offs should do it.

- There is an established uptrend in place on SPX off of the 6/4 lows with consecutive higher-highs and higher-lows now (two of each).

- SPX has a confirmed the inverse head and shoulders price pattern in place.

- 30-minute chart shows price action pulling back to support and the previous area where significant consolidation occurred.

- VIX at 18 and below the bearish mark of 20.

My Opinions & Trades:

- I’ll be looking to add a mix of long and short positions to the portfolio

- Probably 2-3 in total.

- Thursday’s continual sell-off puts fear right back into this market. The Friday bounce felt like a dead-cat bounce and nothing more.

- I’m willing to add more shorts to the portfolio at this point.

- No new positions to the portfolio on Friday.

- I am still long AMZN at $221.60 and WNR at $20.51 and short CHD at $52.74

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.