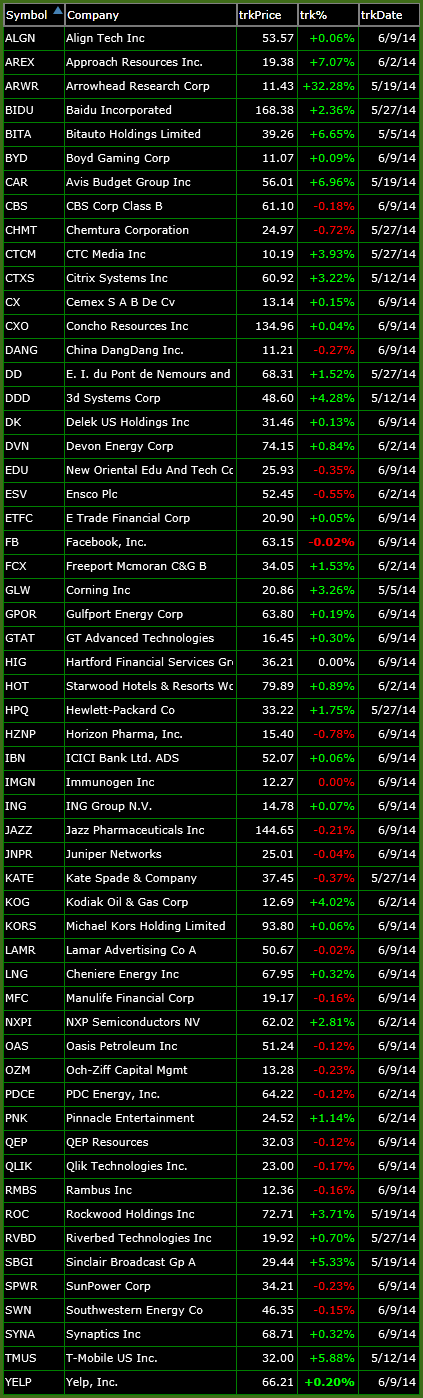

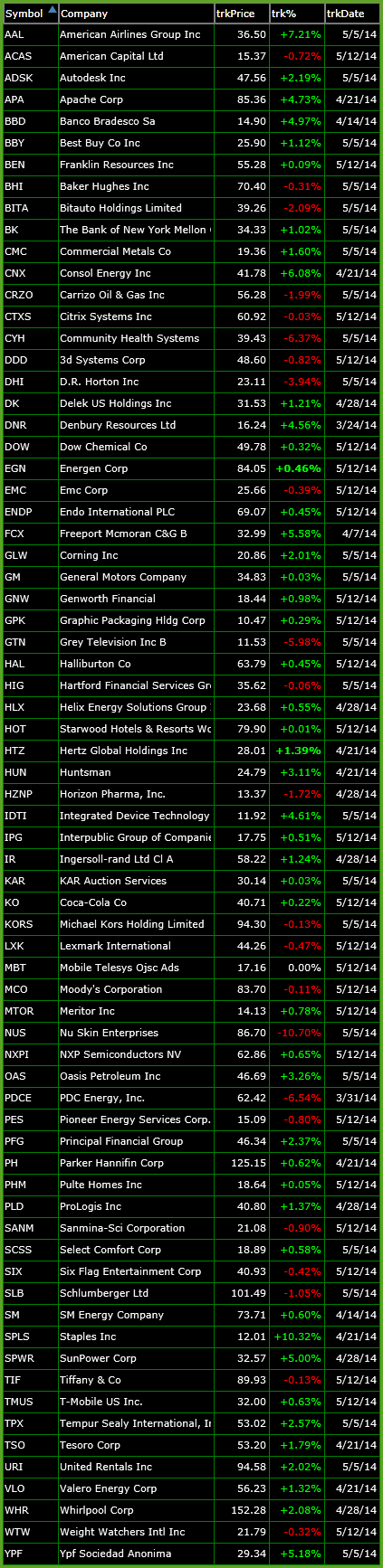

My weekly bullish trade setups is out! The list is definitely a lot smaller than what we have seen in recent weeks. Much of that has to do with the S&P 500 having rallied eleven of the last thirteen trading sessions. When that happens, stocks are going to become over-extended and much less attractive as

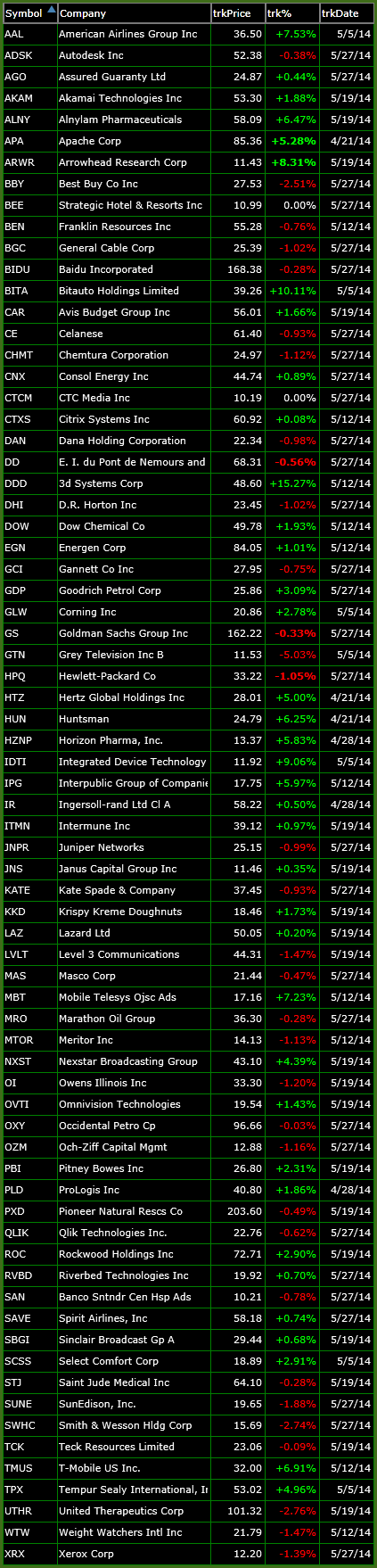

The bearish watch-list has become a moving target in recent weeks But that’s a good thing, that means there is a strong trend in the other direction to pounce on as most of the bearish setups today are seeing a lot of them broken tomorrow, which renders them useless. So what you will want to

This week’s short list of trade setups – Short in size of the list and short in terms of price action. A lot of the previous short setups, for obvious reasons have fallen prey to the market rally, which is to be expected when the overall market is breaking out to the upside. I don’t

We have a shortened week and a market that is breaking into new territory on the S&P 500. The Russell is finally trying to wipe away it’s 2014 down trend and the NASDAQ is breaking out of a recently formed base. All reasons to be focusing mainly on the long side of the trade this

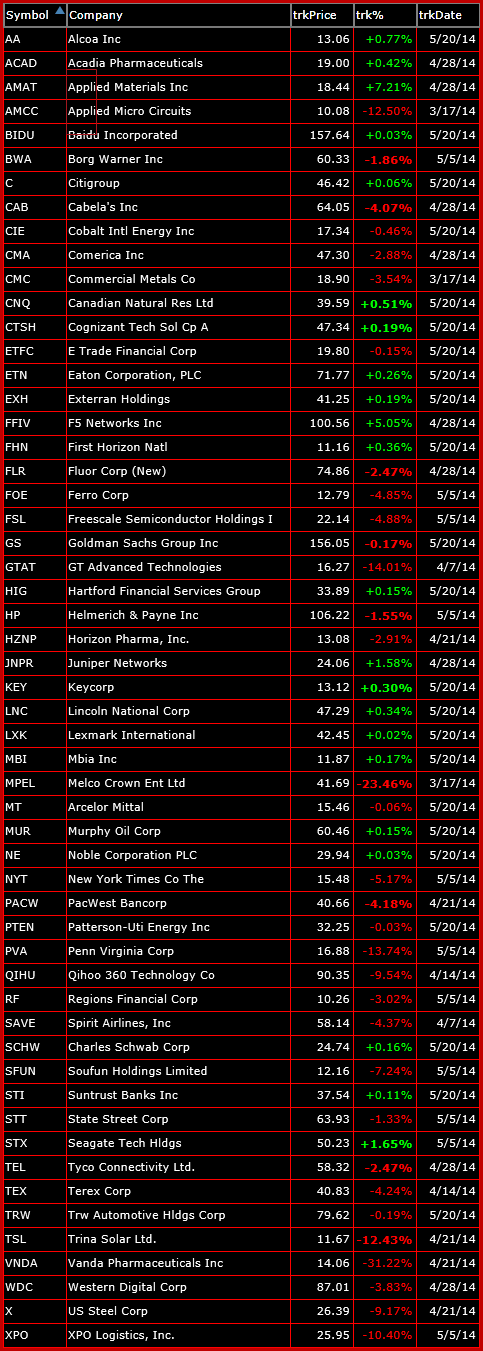

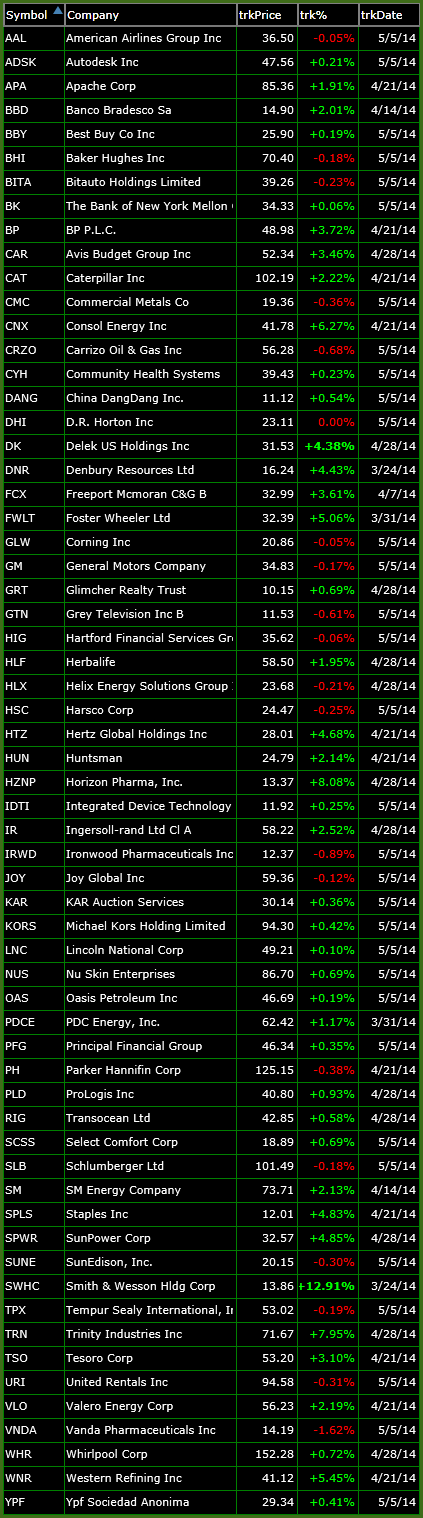

This is absolutely the market that “couldn’t” It can’t go up… It can’t go down… It just trades side-to-side. Honestly, I don’t care whether the market is bullish or bearish, but the narrow range we have been trading in since March definitely makes you earn your keep as a trader. There still is opportunities out

The one thing that the bears can look to, to give them any hope whatsoever at this point is the sell-off that took place back on 4/4/14 after breaking through the 1883 level on the S&P 500. It was one massive head fake for the bulls and trapped a lot of longs. However, I don’t

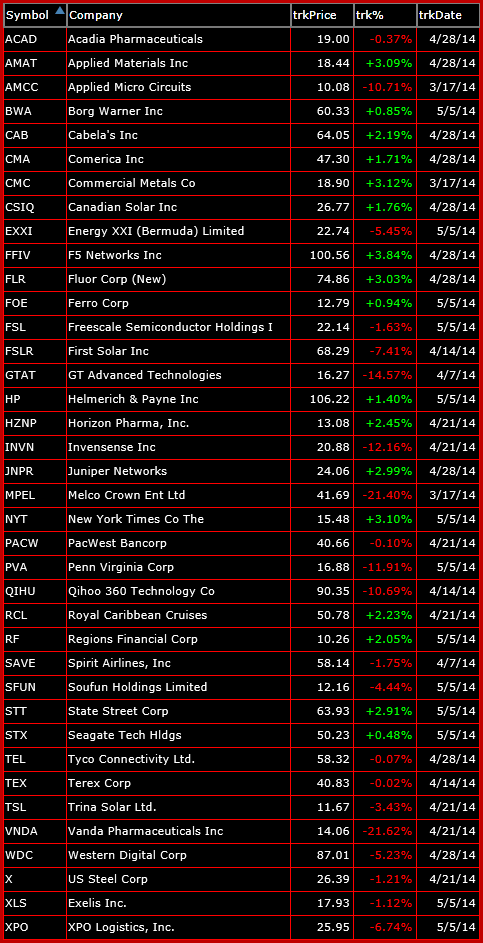

We have seen this plenty of times in the past month where SPX breaks hard into the 1890’s only to give up the gains before the session close and finish the day instead below 1883. So far today that hasn’t happened. I came into today net short, but that was more out of managing

Finally seeing some action that appears sustainable to the downside…at least for today. I’m not sure how long this weakness can last but over the last few months any sell-off could typically last 2-3 days on average before the risk ran against your short trade. While it isn’t a lot time to make profits to

The same theme that plagued March and April, now looks to do the same with the month of May. The first two days of the month saw price rejections at 1883 and so far today the same is true. This has been the place where the downside reversals have occurred, and unless the market wants

INVESTMENT SYSTEM PICKS Positions to Open/Buy at Open - None Positions to Close/Sell at Open - None Recent Positions Added - Quest Diagnostics (DGX) at 56.00 on 4/29/14 - State Street Corp (STT) at 65.06 on 4/16/14 - Lowe's Companies (LOW) at 46.97 on 4/16/14 SHAREPLANNER RISK PICKS (not autotraded) Positions to Open/Buy at Open - None Positions to Close/Sell at