Here's tonight's watch-list: Long Web.com Group (WWWW) Long Keycorp (KEY) Long Gray Television (GTN) Long Itau Unibanco (ITUB) Long Leucadia National (LUK)

February has been an awesome month for my swing-trading and I’m looking to close out the last two day’s of the month on a positive note. Here’s a look at the stocks that I’ve closed out so far this month – and if you like what you see, then be sure to sign up for

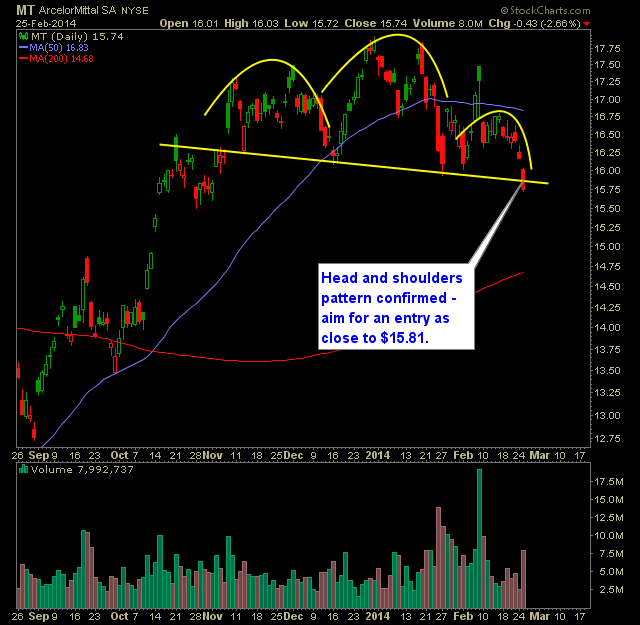

Here’s tonight’s watch-list for tomorrow’s market: If you’d like to subscribe to the SharePlanner Splash Zone and get my Real-Time Swing-Trades and Oscar’s Day-Trade alerts and access to our vibrant chat-room, then sign up for the Free 7-Day Trial by clicking here. Long ArcelorMittal (MT)

I have to say, the afternoon action today created some concern for me. We spent most of the day above previous all-time highs, only to give it all back and create one massive head fake for those playing the market breakout. While I am still bullish on the market, that doesn’t mean that I don’t

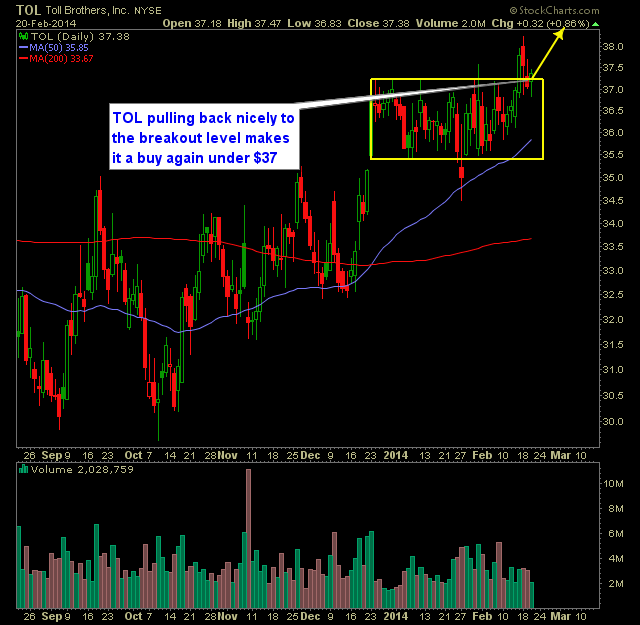

Here’s tonight’s trade setups for tomorrow’s market: Long Toll Brothers (TOL)

I thought it has been long overdue to provide an all-short watch-list. Today’s action and tonight’s subsequent weakness in the futures suggests that this watch-list just might come in handy. I even added an extra setup there for you. Here are the trade setups: Short Fulton Financial (FULT)

I booked gains in CLR today at $116.88 for a 4% gain. I probably could have been more patient with it into the close, but at the end of the day, I make it a habit not to worry about leaving a percentage or two on the table. I judge whether I should continue to

Here’s tonight’s trade setups for tomorrow’s market: Long Best Buy (BBY)

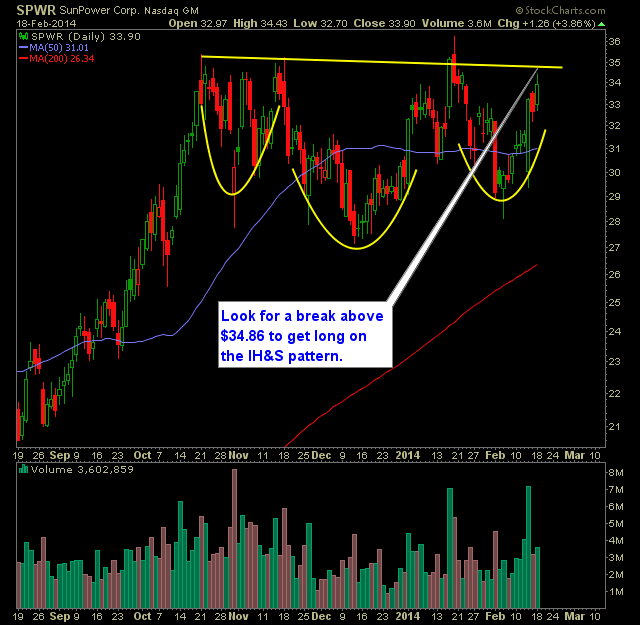

Here’s tonight’s trade setups for tomorrow’s market: Long SunEdison (SUNE)