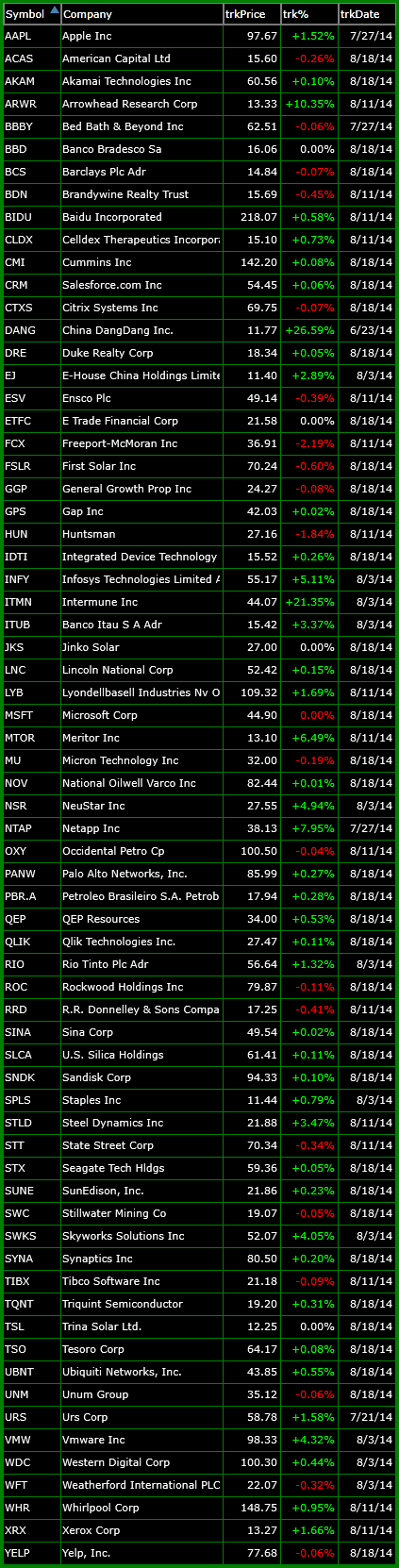

Apple (AAPL) is pulling back hard today and with it is trying to take the Nasdaq down as well. But the market has not reached a point where it is time to flip to the short side. You have to wait for price to confirm the sentiment no matter how strong that sentiment

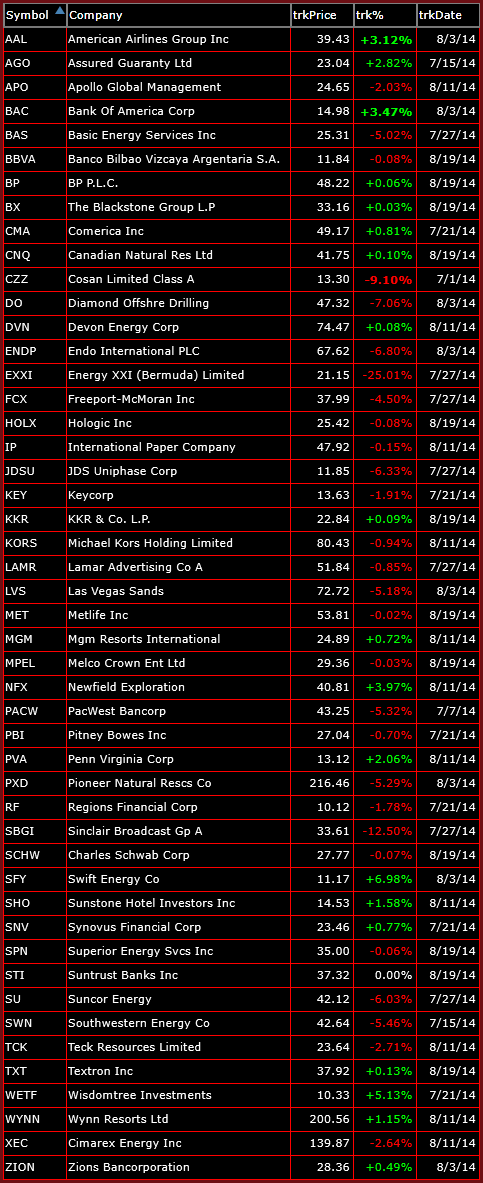

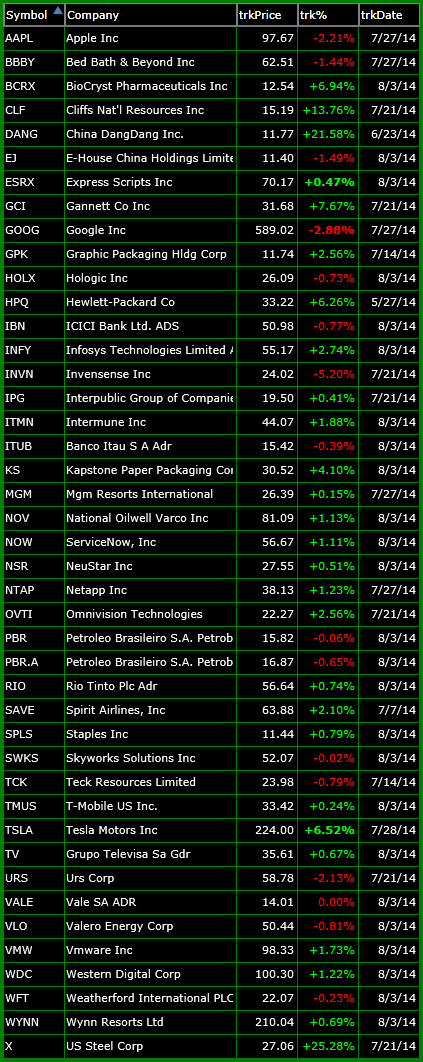

I’m a little later than usual in getting the bullish trade setups for the week out, but nonetheless, I present it before you. Essentially, there is some cause for concern about how much higher this market can ramp up without at least a small pullback of some kind. However, until that happens, trying to guess

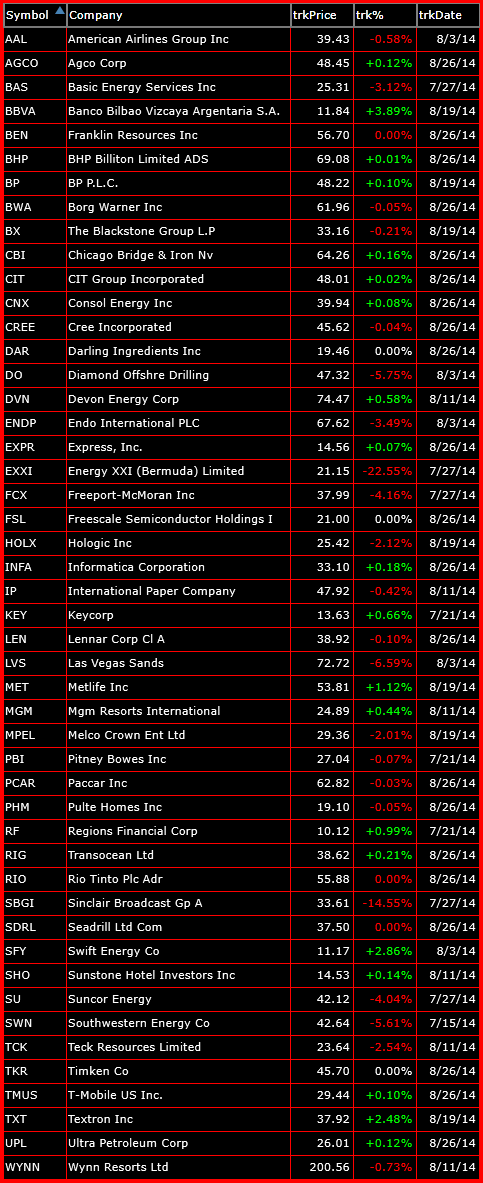

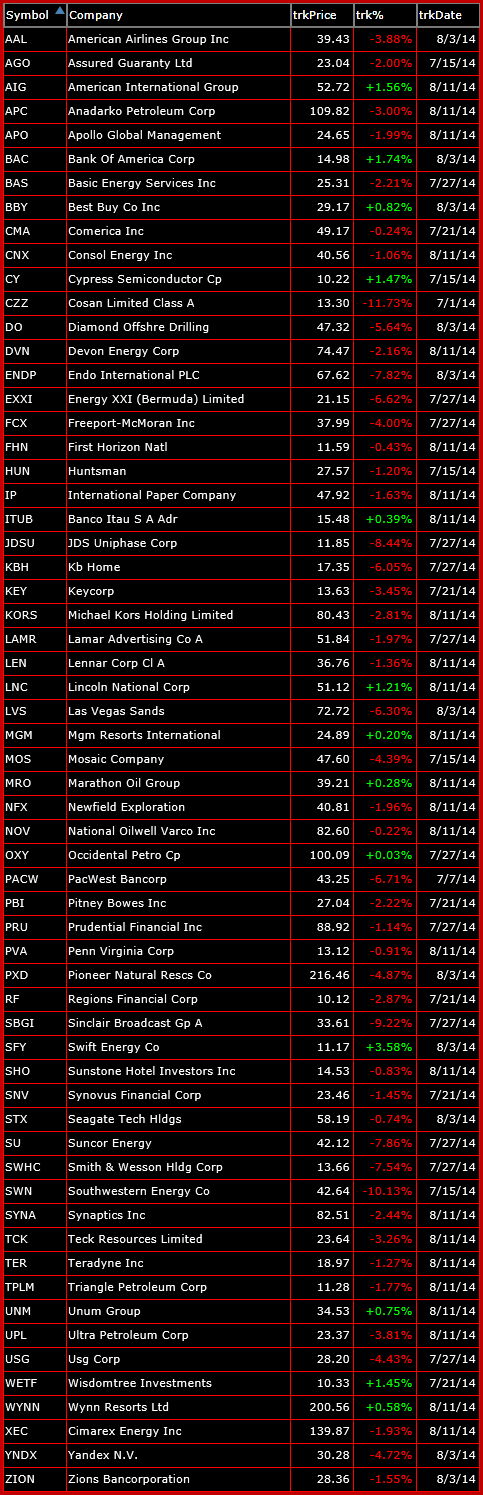

The list of bearish trade setups have diminished again some this week as a result of a massive bull rally for most of August. While I am still a bit uncertain of this market at these levels and how much more it can really rally, experience has taught me to always expect the unexpected from

Stocks keep pouring on the gains and my list of bullish long setups have been a huge help to traders. At this point stocks have rallied in short order from 1904 to 2001 – a total of 97 points in just a few weeks – that is huge! The bears have tapped out. While the

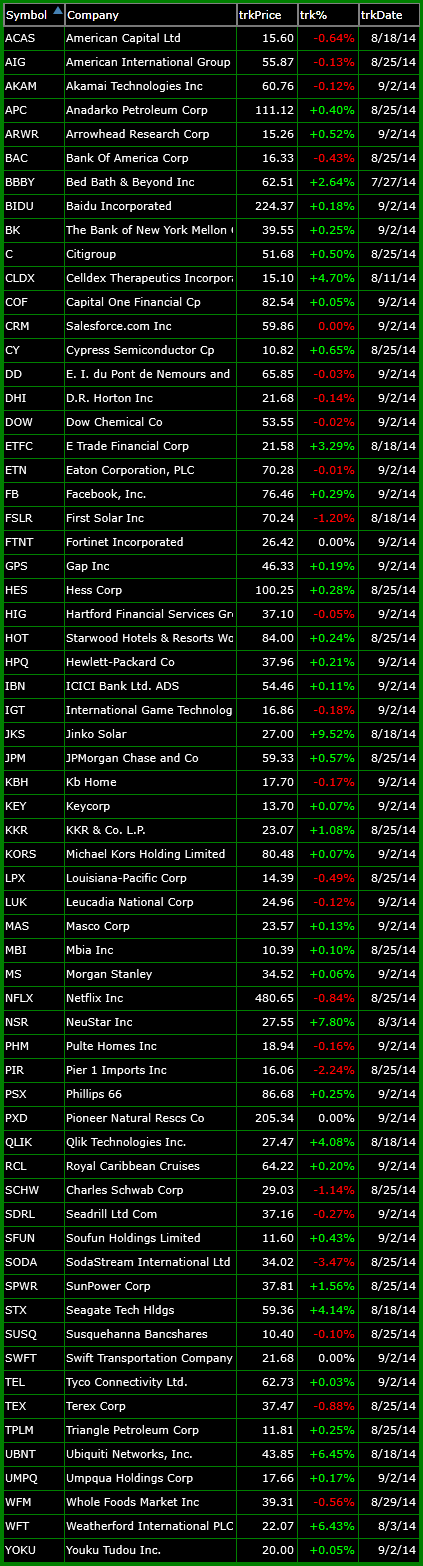

Not the market you want to really be shorting right now. The window of opportunity for the bears to short this market lower passed, when SPX moved out of the 1950’s yesterday. Now it has to be presumed that this market bounce is much more than just a simple dead cat bounce, but

What a way to start the week for the bulls. After pushing through the the 1950’s on SPX, the reality quickly became one that was much more than a dead cat bounce. And likely we have seen time and time again over the last five years, the bulls use the extreme oversold conditions

Bears are down but not out. In the grand scheme of things, this could just be another exaggerated dead-cat bounce that could see this market drop at any given moment. The likely driver of whether that happens or not is headline risk – meaning the news – whether it be Russia, Iraq or

The start this week hasn’t been as inspiring as the end of last week. Nonetheless, even with today’s uncertainty, it is hard to dismiss the fact that the dip buyers could very well come back in full force, and squeeze the bears out of their positions. If that happens, a lot of the stocks that

It has been a while since this has happened, but there are more readily available bearish trade setups out there than bullish trade setups. One of the reasons that I haven’t gotten short on this market in the last week with the sudden market weakness that shook traders up on Thursday is because, the sell-off

Conditions are prime for a bounce. If the dip buyers have proven anything over the last five years it is that they are resilient and that they have yet to find a dip that wasn’t ‘buy-worthy”. As a result of last week’s sell-off, there are tons of damaged stocks, and while there are still a