Pre-market update: Asian markets traded 1.3% lower. European markets are trading 0.3% lower. US futures are trading 0..9% higher ahead of the market open. Economic reports due out (all times are eastern): Empire State Manufacturing Survey (8:30), Industrial Production (9:15), Housing Market Index (10) Technical Outlook (SPX): Massive gap up this morning on SPX in

The bears are back in full swing today, though the level of confidence that traders have in them to close out a day at its lows remains highly questionable. The action that we are getting out of today is about the best action we have seen all month long. Until today we have spent the

The bulls are taking some hits but they are not giving up. At least not yet. We saw that most clearly today when the market stopped me out of 3 positions, only to see an inverse head and shoulders pattern form at the lows of the day and confirm the pattern shortly thereafter. It was

Even with today’s rally there is reason to be skeptical towards this market There isn’t a collective rallying mindset among stocks even with you have a double digit rally on SPX like there is today. However, now isn’t the time to get net short. However, I don’t disapprove of adding some short hedges to

Shaky start to the traditional Santa Rally. But remember, we haven’t seen a December finish in the red since 2007. That means despite all of volatility in 2008, SPX still managed to find its way into the green. That doesn’t mean I am going to stay blindly bullish here, but it does mean that

The bears haven’t seen day-light in a long time, and I doubt it is going to change for them this week as Thanksgiving is upon us and the volume will only get more light and the interest by the big money be less interested in what this market has to offer us. While, I have

Traditionally this is a bullish week for stocks. But this is also one of the slowest weeks in terms of volume for stocks as most of Wall Street get in their fancy cars and head off to the Hamptons for the week. Very rarely do you see volatility enter this market though I have seen

The bulls are riding the fence here and attempting to come off of it today. The past week the market has been forming those indecisive doji candles, but never once did it close below the 5-day moving average. Had SPX been able to push below 2030, I might have started one short position as

It’s a new week, but indecision by the market seems to be prevailing. Despite the stocks still remaining at or near its all-time highs, I am still concerned that stock prices may start eroding well before the indices start to show that weakness. We saw that happen in September where prices were falling apart, particularly

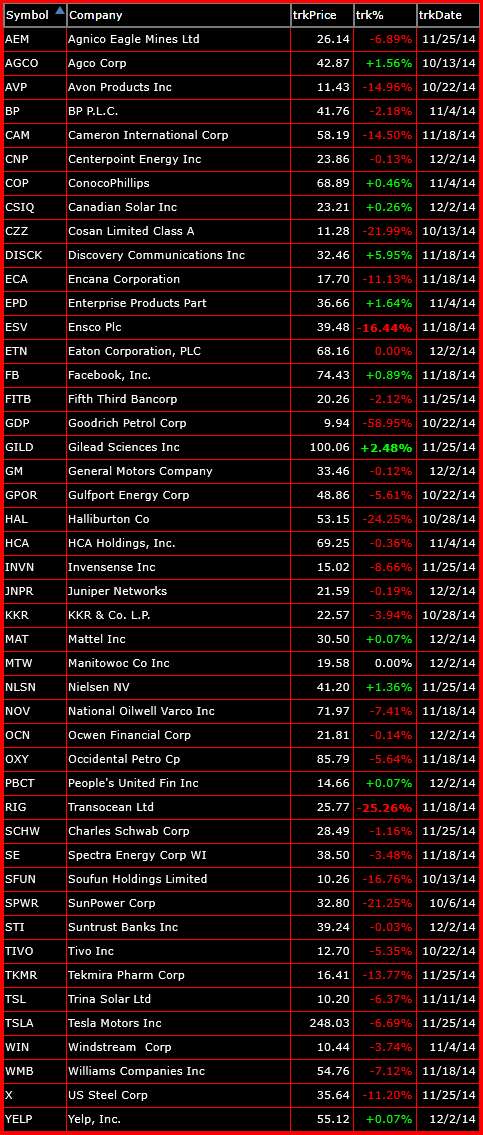

So far the markets are giving back just a smidgen today. But that definitely isn’t enough to justify getting short on this market. In fact, I see very little reason to even trim long exposure until, at the very least, the 5-day moving average is breached on SPX. With that said below is the