This is absolutely the market that “couldn’t” It can’t go up… It can’t go down… It just trades side-to-side. Honestly, I don’t care whether the market is bullish or bearish, but the narrow range we have been trading in since March definitely makes you earn your keep as a trader. There still is opportunities out

The one thing that the bears can look to, to give them any hope whatsoever at this point is the sell-off that took place back on 4/4/14 after breaking through the 1883 level on the S&P 500. It was one massive head fake for the bulls and trapped a lot of longs. However, I don’t

We have seen this plenty of times in the past month where SPX breaks hard into the 1890’s only to give up the gains before the session close and finish the day instead below 1883. So far today that hasn’t happened. I came into today net short, but that was more out of managing

Finally seeing some action that appears sustainable to the downside…at least for today. I’m not sure how long this weakness can last but over the last few months any sell-off could typically last 2-3 days on average before the risk ran against your short trade. While it isn’t a lot time to make profits to

The same theme that plagued March and April, now looks to do the same with the month of May. The first two days of the month saw price rejections at 1883 and so far today the same is true. This has been the place where the downside reversals have occurred, and unless the market wants

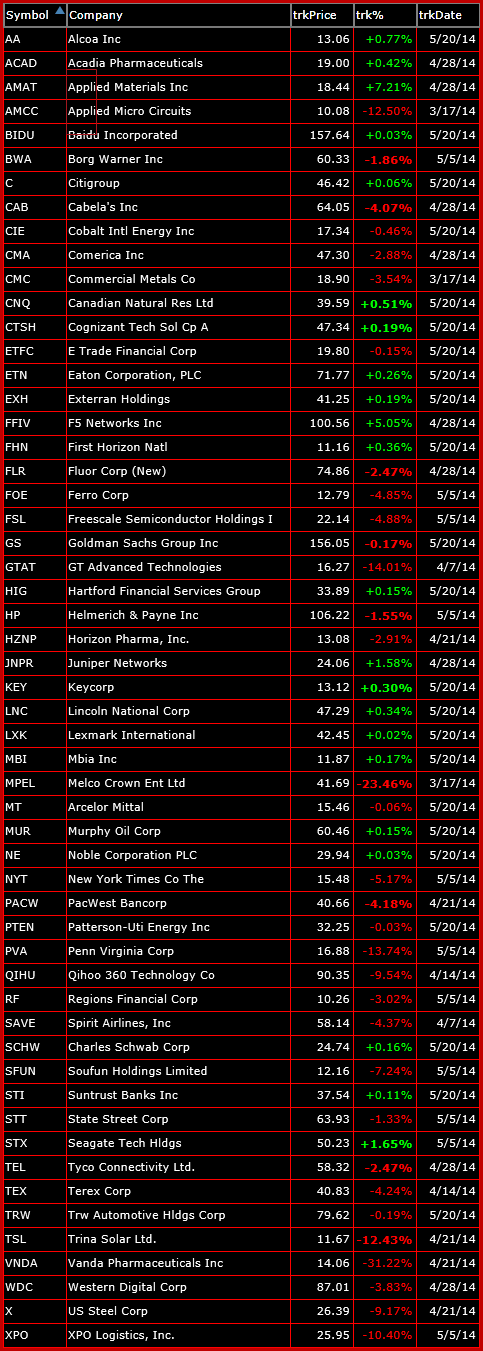

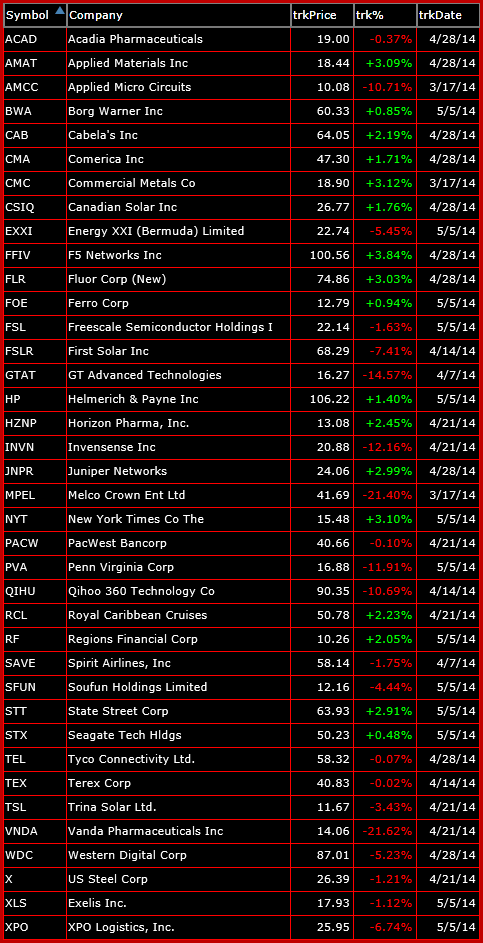

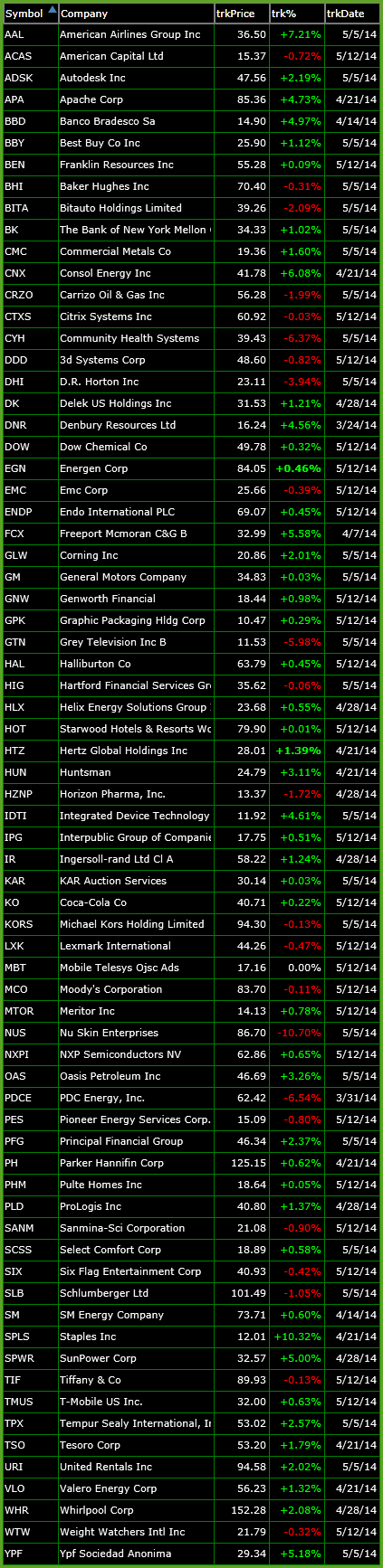

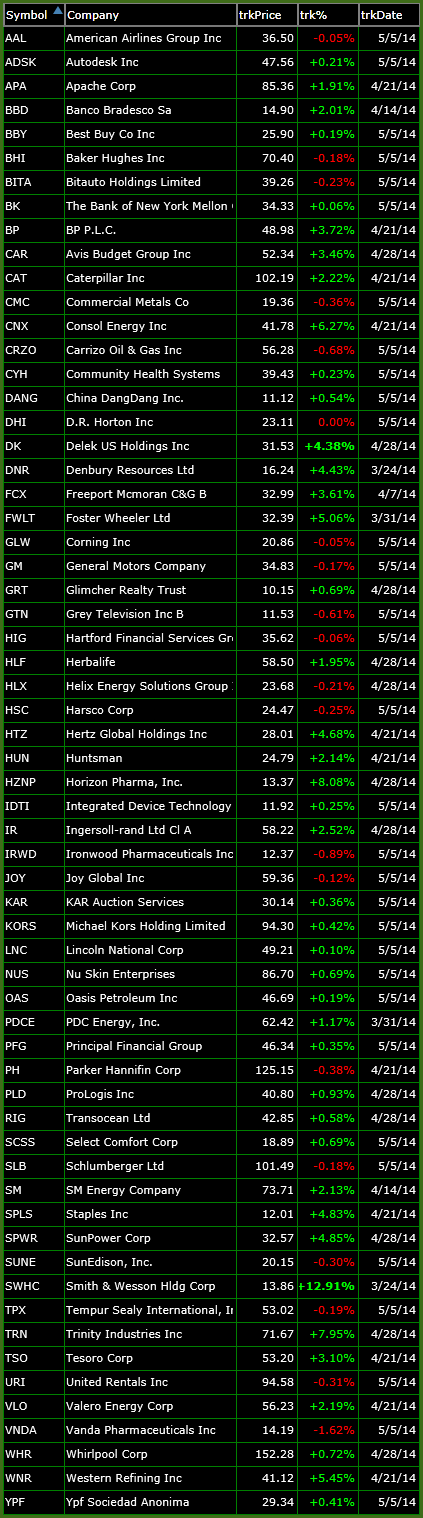

INVESTMENT SYSTEM PICKS Positions to Open/Buy at Open - None Positions to Close/Sell at Open - None Recent Positions Added - Quest Diagnostics (DGX) at 56.00 on 4/29/14 - State Street Corp (STT) at 65.06 on 4/16/14 - Lowe's Companies (LOW) at 46.97 on 4/16/14 SHAREPLANNER RISK PICKS (not autotraded) Positions to Open/Buy at Open - None Positions to Close/Sell at

The bears, despite some respectable efforts up until yesterday afternoon, finds themselves at a breaking point with S&P 500 determined to take another crack at 1883. With every attempt, it becomes that more likely that it will break and there are plenty of news events this week, from the FOMC Statement, GDP and Employment, to

It started off solid for the bulls this morning but quickly faded as the bears took control and added to Friday’s downside. I don’t see any reason to buy any stocks at this moment, but as we’ve seen in recent past, the bulls have no problem buying the dip. But wait for them to

For the past two months the market has been trading sideways. If you look beyond the S&P 500, and look at the Nasdaq and Russell, the market has been drifting lower. Now we are seeing six straight days of positive gains, assuming today ends higher. That breaks the four day win streak from earlier

At this juncture, with the S&P 500 butting up against heavy resistance at 1873, whether we go higher from here or reverse course like last time we tested this level, is anyone’s guess. I’m going to let the market confirm which direction I should be bias towards. If we break 1873, then it will obviously