Here’s my other long position that I took today – UnitedHealth Group (UNH), where I took a long position at $50.21 (as I said talked about doing in my previous post). Here’s the chart on UNH.

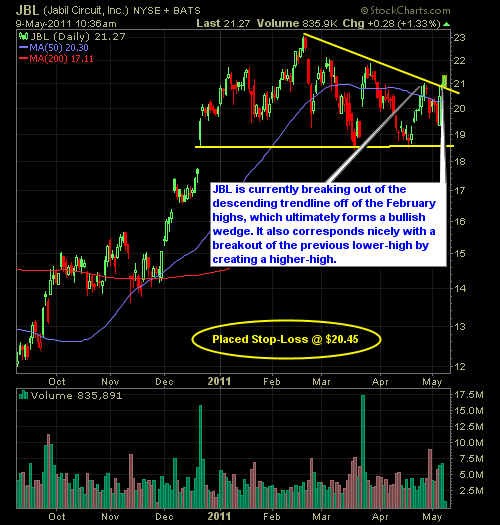

Two new trades this morning with the possibility of another two should Hatteras Financial (HTS) trigger at $28.69 and United Healthcare (UNH) at $50.21. The two that I got in this morning are doing well so far, despite little movement out of the broader markets at this point. The first one is Jabil Circuit

So far the market is rebounding well today, and will look to lighten up some of my positions as well, particularly in SSO where I have a huge chunk of my capital in (40%). I’ll probably sell 3/4 of that position today and take the nice profits in hand. Also, the Silver (SLV) play

Market is weak today, which if you read my trading plan this morning, comes at a bit of a surprise, because I was leaning toward seeing a bounce today – and who knows maybe we will. But for now, the mission of the bulls, has to be to plug the hole in the dam and

Here’s another trade that I just made in CVS Caremark (CVS) on top of the Apple (AAPL) trade that I made this morning at $348.73. CVS is positioning itself for a great breakout, assuming the the market cooperates in the coming days. If so, the stock could make a push for $38-39 without much

The selling that we have seen in this market so far is not at all worrisome, in fact it is more welcomed then anything, allowing for stocks to get a breather and provide an opportunity to get in stocks a little cheaper than previously. My one and only trade so far this morning, Apple

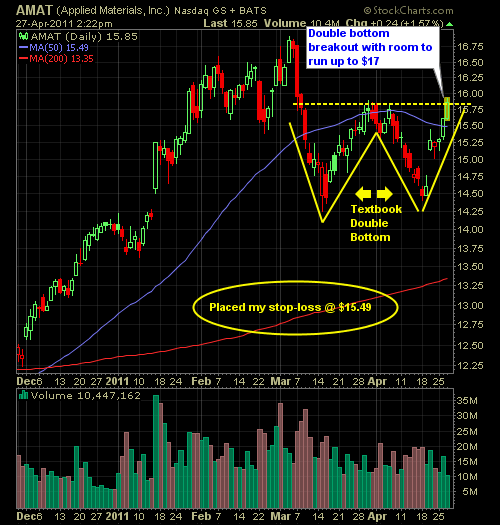

One more long position for today, and this will likely do it for me in terms of new positions. But the double bottom in Applied Materials (AMAT), coupled with a clean breakout opportunity, sucked me right into this trade here. The technology sector continues to perform well, and that is another “plus” going

I’ve jumped in The Jones Group (JNY) this morning at $14.73. The official breakout level to this stock is $14.85, so the closer you can get to that market, the better. I am also a big fan of the short setup below, but its not worth getting into quite yet. You’ll want to wait for

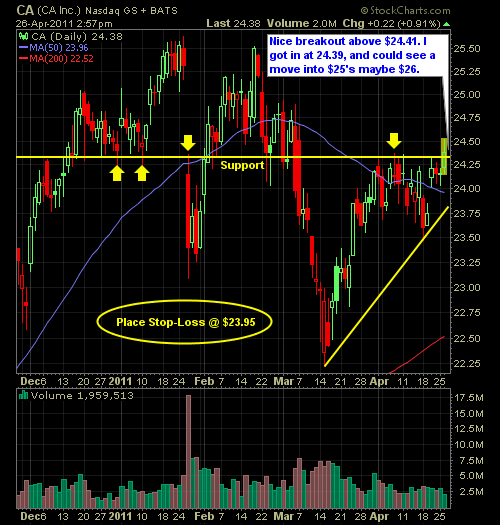

Another two tech plays added to the portfolio (continue to hold RAX and GOOG), in Analog Devices (ADI) at $39.74 and CA Inc. (CA) at $24.36. I’ll be looking to close out my position in Discovery Communications (DISCK) by the market close today. LONG: CA Inc. (CA)

Only one trade so far today, and I have yet to bail out of any of my existing trades. We’ll see how far this rally today wants to take us and then re-evaluate from there. As for my trade, I jumped into Atmel Corp (ATML) at $13.85 on a cup and handle breakout. Looks pretty