Market is continuing to buy every dip it can get its hands on. With a bad inflation number the market initially sold off, but it didn’t take much time for that dip to get quickly bought up. So below, I’ve given you the charts on the three setups I like the best this morning, along

A rare long position for me these days. But I’ve been watching Taseko Mines (TGB) for a few weeks now, and it has finally reached my desired entry of $6.09, not to mention it was one of my three breakout plays that I posted earlier this morning. Here’s the Chart on TGB.

No surprise with the markets today, as the slightest of sell-offs yesterday has resulted in a march to new recovery highs today. Below I’ve put together the three best setups for taking on this market, and being able to profit from it in the short-term. LONG: Taseko Mines (TGB)

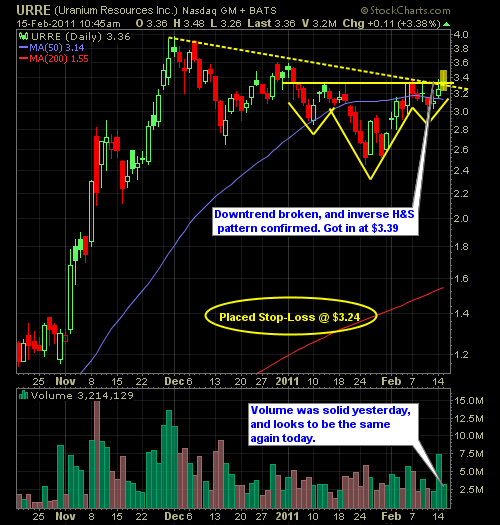

I jumped in this morning on URRE for a day-trade after it broke the neckline of the inverse head and shoulders pattern, and broke the downtrend that is currently in place. My stop-loss is at $3.24. Here is my chart analysis on URRE.

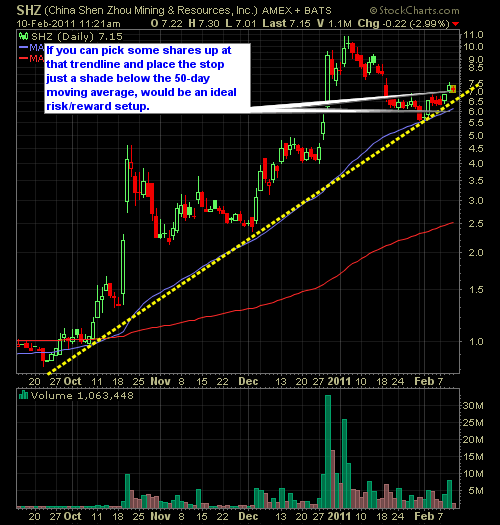

Looking through some low-dollar stocks this morning, I found three in particular that looked prime for the trade. I’m going to warn you though, these stocks move fast and furious, so you want to pay close attention to them, and use tight stop-losses. LONG: China Shen Zhou Mining & Resources (SHZ)

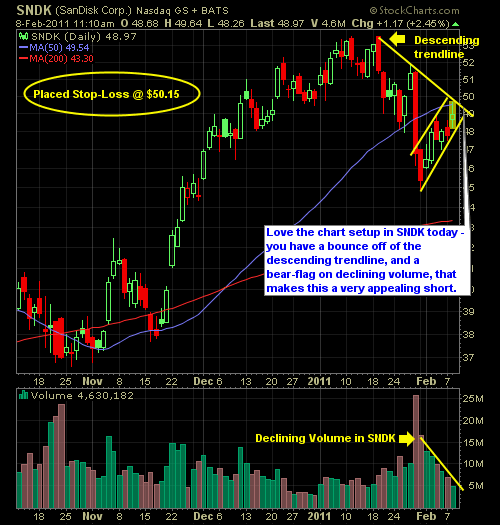

Added a new position with Sandisk (SNDK) which was upgraded this morning by Sterne Agee. The stock continues to rally on declining volume, and managed to find some resistance right at the descending trendline. Optimal risk and reward here as my stop is very tight going into the trade. Not to mention of course, that

If the market is going to continue going up next week (which I am betting against it doing, but who knows, the S&P could see 180,000 before there is a real pullback), the six stocks below are some of the best setups to have on your radar for profiting from further market gains. If we

Added SHZ this morning at $6.09 with a stop-loss at $5.71. Not the type of stock that I typically like to trade, but the pullback to the 50-day moving average and long-term trendline, followed by, what appears to be, an orderly pullback. This swing-trade could morph into a day-trade, should there be substantial gains

Friday’s sell-off has the bulls walking on pins and needles right now, even though they managed to bounce the market back up in a very respectable fashion (as of this post). But there are a lot of folks out there sensing that the bears are looming heavily on this market right now, and will look

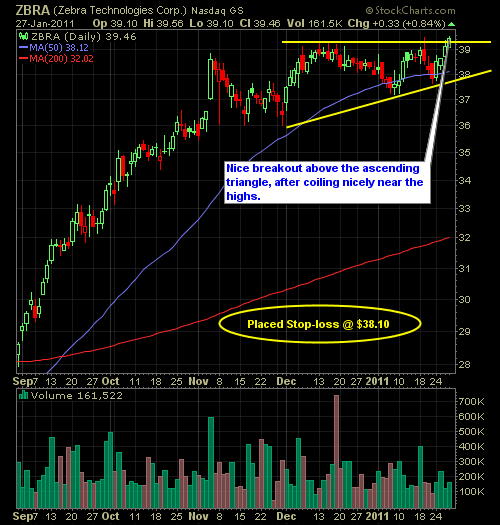

This was one of my trades from late yesterday, but still valid today, after having covered all of my short positions. It has an ideal chart pattern with the ascending triangle and is now breaking out above resistance. Stop-loss is tight at $38.10. Here is the chart analysis for ZBRA.