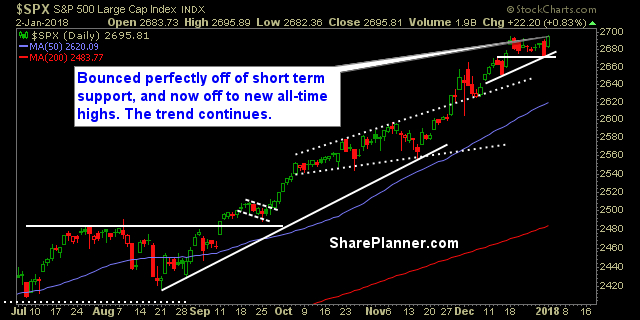

My Swing Trading Approach There are some nice swing trade setups to be had, but I am concerned about adding additional long positions to the portfolio today. Tightening the stops will be in order. Indicators

My Swing Trading Approach Right now, the risk-reward on trade setups are unfavorable when taking in the overall state of the market. At this point, I am looking to ride my current positions higher, while raising the stops. Indicators

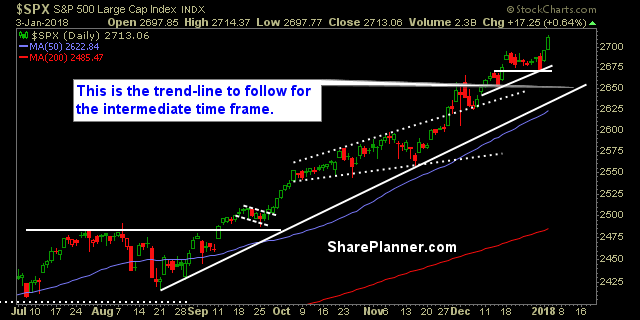

My Swing Trading Approach With the market gapping up, I will be increasing my stops, but I am less inclined to add new positions at this juncture of the rally. Indicators

My Swing Trading Approach First, I’ll manage the profits in my existing positions, primarily by raising the stop-losses. Then I will look to add additional long exposure as the market permits. Indicators

My Swing Trading Approach I’ll be looking to add 1-2 new long positions, should the bullish sentiment hold strong today. Indicators

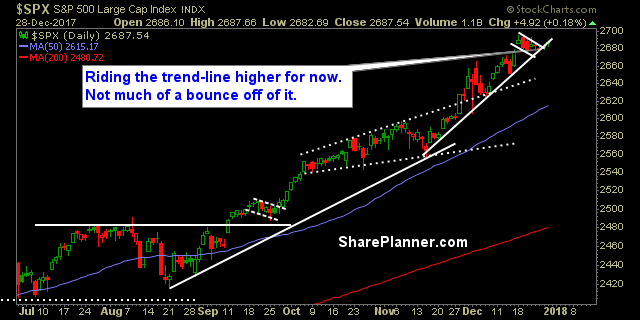

My Swing Trading Approach I expect to be conservative in my trading approach today, booking gains where it makes sense, and finishing out the year strong. Indicators

My Swing Trading Approach I will likely take a conservative approach to the trading day ahead. Manage profits in existing trades, and at most, add one new position to the portfolio today. Indicators

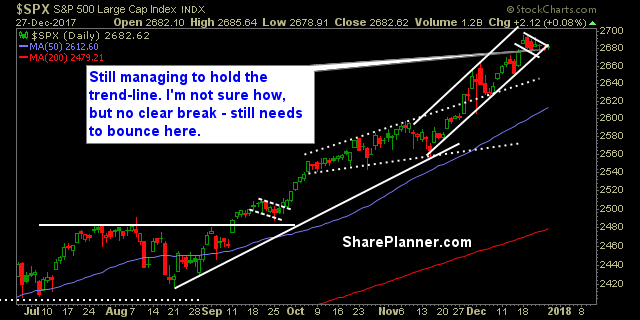

My Swing Trading Approach Low volume market today and for the remainder of the week. I am not looking to add much to the portfolio this week. Indicators

My Swing Trading Approach Not looking to force anything during this last trading week of the year. Light volume will limit new opportunities. Indicators

My Swing Trading Approach My first priority will be to manage my current positions. I may add an additional long position to the portfolio if the market cooperates, but likely, I will simply stay put. Indicators