July 16, 2008

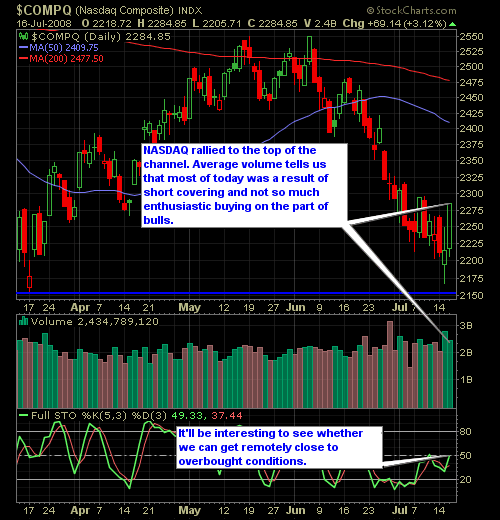

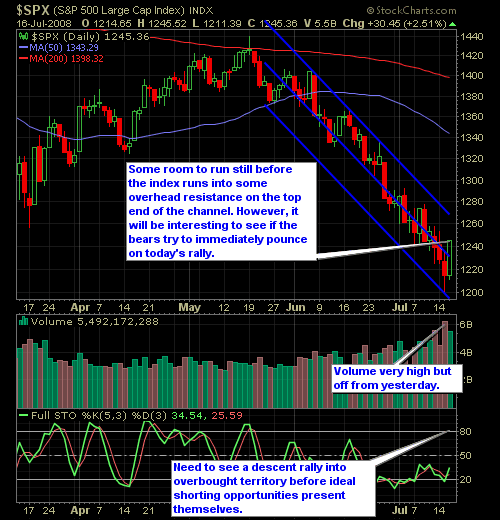

From the very start, with Wells Fargo posting a solid earnings report, and oil slumping – the two areas that have driven the markets to two-year lows, made it near certainty we would get a huge day from the markets. However, despite today’s solid gains, we still to tread carefully. Mr. Market could easily give back all of today’s gains should the bears decide to immediately pounce on the gains made today. However, while that’s a possibility, that is not a tactic we wish employ.

Instead, we will wait for this market to run a little further, before we attempt to short anything. While today will be argued by the so-called market experts that we may or may not have reached a bottom in this market, we are more than willing to state that we have no clue – and frankly we don’t care. We will continue to follow the road that the markets put before us. One thing is certain however, the bears will jump on this market again and try to drive it lower. When it does, it will be imperative for the bulls to not give back all of its gains. If it does then nothing has really changed about the overall climate that has pervaded this market for some time now.

A word to the beginning investor and trader…

One of the reasons why we became nervous about holding our short positions earlier this week, was because first, the market was reaching ridiculously low levels of being oversold. The other important factor was that, there was two many government entities (i.e. Congress, White House, Fed, etc.) trying to actively manage the day-to-day markets. While their efforts may prove futile down the road, we knew it couldn’t be long before the market bounced hard and fast. That’s what we got today, and that’s why we went long on Goldman Sachs (GS) at $156/share.

Here’s the NASDAQ and S&P Charts…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.