Technical Analysis:

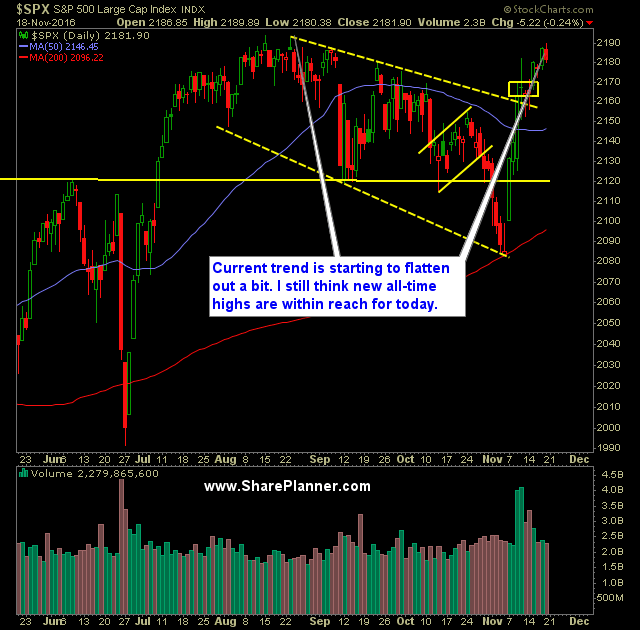

- Inside day (candle body contained inside the previous trading day’s body) of trading yesterday on S&P 500 (SPX) yesterday, that kept the current uptrend intact.

- The 5-day moving average held strong on Friday.

- Volume on the SPDRs S&P 500 (SPY) increased for a second straight day, but still remained below recent averages. Enthusiasm on the current rally is not nearly as strong as it was during election week, but the price action is still solid for the bulls.

- 3-day winning streak on the Nasdaq (QQQ) broke on Friday and closed exactly on its 50-day moving average. Still the index that is lagging all other indices, showed signs of strengthening over the past week.

- Small caps (IWM) continue to exhibit a lot of strength, though I would caution on loading up on the small caps at this point. It is currently up ten out of the last eleven days.

- CBOE Market Volatility Index (VIX) diverged from Friday’s market direction, by dropping another 3.8% and down to 12.85. This officially breaks the rising uptrend off of the August lows for the first time (bullish for equities).

- SPX 30-minute chart continues to consolidate at recent highs and now showing any notable weaknesses at this point.

- Today marks a shortened holiday week, where the market is only open 3.5 days. This tends to be one of the most bullish market weeks of the year from a historical standpoint.

- Expect volume to get very light as the week moves closer to the Thanksgiving holiday.

- Price is still less than 1% of all-time highs, and expect that to be tested at some point this week.

My Trades:

- Added one new swing-trade to the portfolio yesterday.

- Covered my short in XOM at 85.09 for a 1.2% profit.

- Sold NKE at $51.04 for a 0.4% loss.

- Will look to add 1-2 new swing-trades to my portfolio today.

- I am currently 40% Long / 60% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.