My Swing Trades

I didn’t take any trades today, but managed to scalp a little $ROKU on the way up in the morning, but that was about it. Still holding one long and one short position as swing-trades. At this point, any new long position in a growth stock is a high risk trade, because the upside reward at this stage of the rally will be limited in comparison to its downside risk.

Indicators

- Volatility Index (VIX) – A very promising start for the index today, but as is always the case (literally for the last 15 trading sessions) the index sells off hard from its highs of the day. Today was no different. Yes, a lot of people short the VIX pops, and yes, a lot of people will ultimately get burned by this practice.

- T2108 (% of stocks trading above their 40-day moving average): Breadth really sucked for the market yet again today. Fewer and fewer stocks are participating in this rally, and you are seeing a lot more people putting money into the higher beta stocks to get bigger returns. Current reading of T2108 is 58%, after falling 4% today.

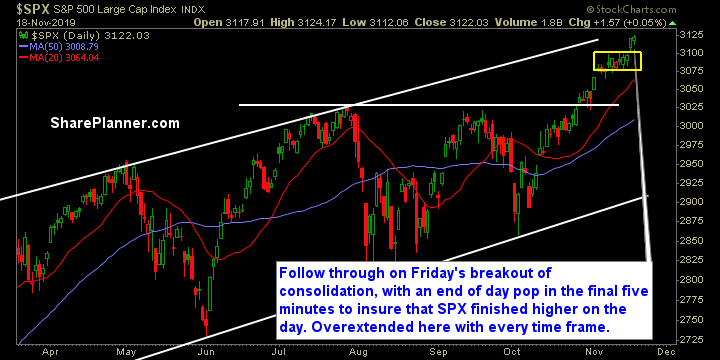

- Moving averages (SPX): Trading above all major moving averages for the 21st straight day (including 5-day MA).

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

This was quite odd, in my opinion, where 8 of the 11 sectors traded lower today, yet every index except for the Russell managed to squeak out a gain. Even more interesting is that two of the three indices were defensive sectors where traders go to find safety in stocks.

My Market Sentiment

Moving in on almost 200 points in less than 2 months in parabolic fashion on SPX, retail investors are piling in at all time highs, I do think it is better to wait for a pullback, even if minor, before getting aggressively long again.

- 1 Long Position, 1 Short Position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.