As a new feature to SharePlanner, I'm going to roll out, the SharePlanner Notebook, where I essentially "clear out my notebook" of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

As a new feature to SharePlanner, I’m going to roll out, the SharePlanner Notebook, where I essentially “clear out my notebook” of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

I don’t have any issues with any of the sectors right now except for Energy. Energy is seriously the most unpredictable and untradeable sector right now. Nothing holds to the upside, and just when you think a stock is breaking out, it reverses course and breaks down on you.

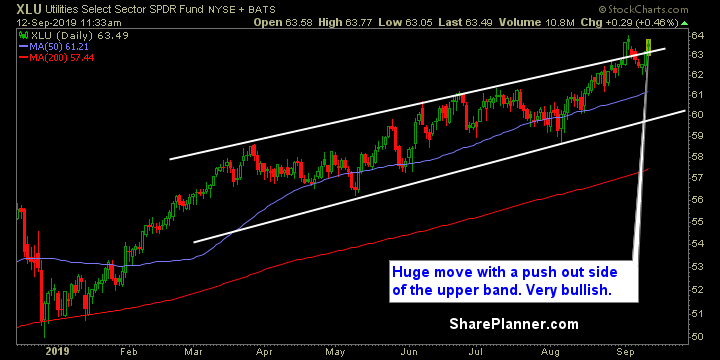

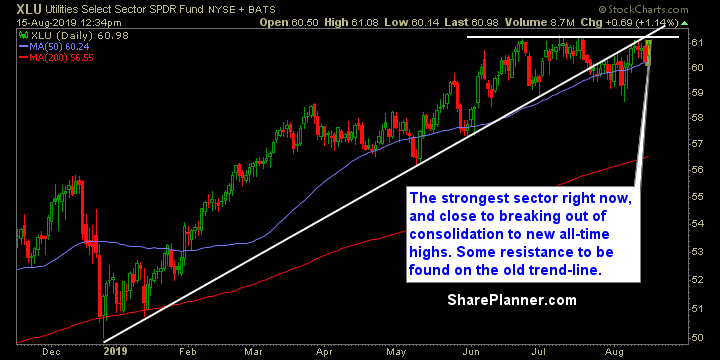

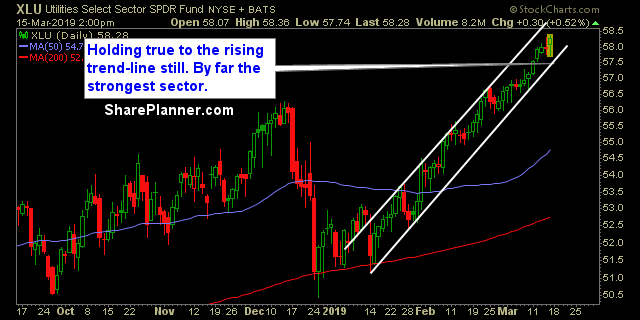

A lot of trend-lines breaks and topping patterns are forming The safe sectors is where big money is putting its capital. Utilities are practically on the brink of new all-time highs. I’d also like to add stocks supporting the military or have big dollars in the Pentagon defense budget are also holding up well and

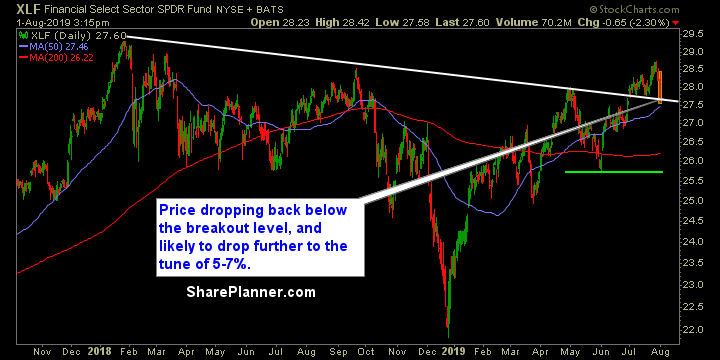

The market is shedding its bullish act, and taking on a much more bearish tone. Jerome Powell’s circus yesterday, coupled with Trump’s untimely Chinese tariffs tweets today, has instantly put this market into a tale-spin. Short -term support levels are being violated across the board, and traders are being whip-lashed all over the board. The

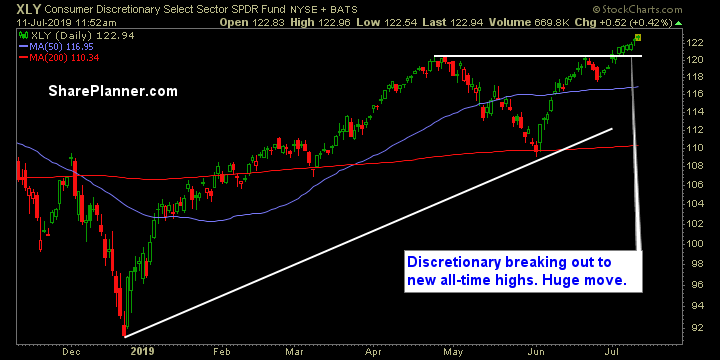

Very bullish look to the market. Maybe some pullbacks to existing trend-lines in order. I can’t find much to say that is negative about this market. Trade War headlines have died down and the Fed (for reasons beyond any reason) are still wanting to lower rates even though the market is at all time highs.

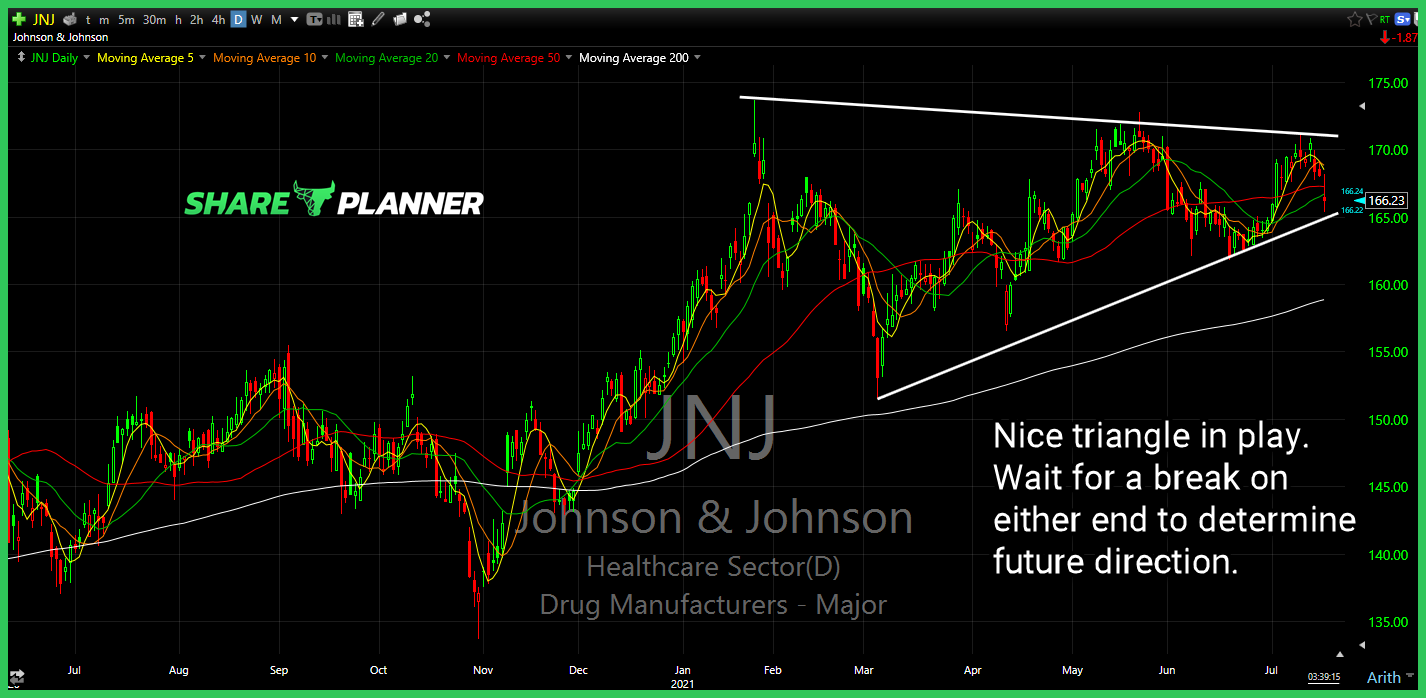

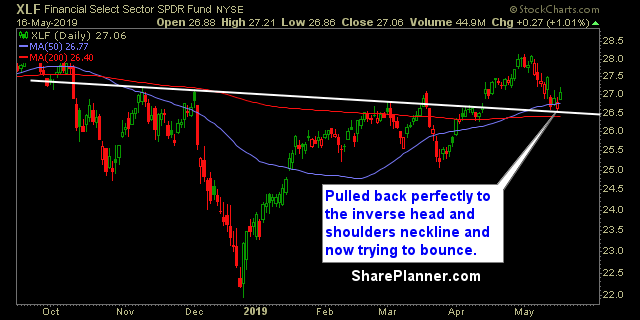

A lot of varying patterns among the sectors, but mostly bullish May was not kind for the market. June has been much better for the bulls, and last week’s bounce put SPX back to about 2% below all-time highs. There are triangle patterns (healthcare), head and shoulders patterns (energy), bull flags (technology), and downtrend

A number of head and shoulders patterns trying to form. Technology is not currently in the top three, but it is certainly the fourth best sector which places it right in the middle of the pack for now. The market has had a couple of weeks of late that has not been very easy for

Some sectors not looking as healthy as they once were In fact it is one of the first times in quite some time where I am seeing tons of divergences across the different sectors. You have utilities that are topping, and then healthcare that is crashing. Technology is surging, while Energy is simply creeping higher.

Resistance being tested in nearly every sector. Unless you are utilities, you have some resistance sitting just above your current price. Though overall, the market needs to break through it all at every level if it has any desire to keep this market rally going. The good thing is, that once it breaks, it should