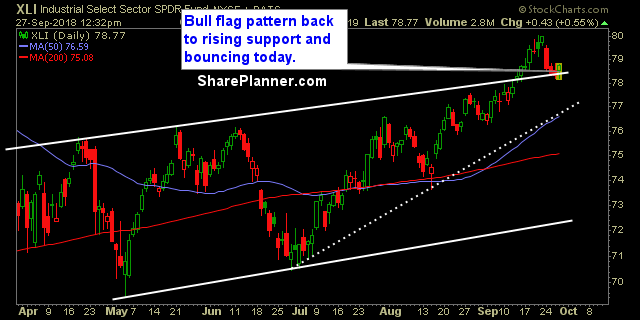

Industrial sector continues to be one of the best sectors to trade in. That is namely because Boeing (BA) is soaring through the stratosphere and they are and remain the best stock in the industrial sector. The best time to be buying into it is on any test of the 10-day moving average as it has

Sectors showing a lot of weakness still, and only a few that are holding up. The bulls can’t hold on to their gains at all, and each day is being met with a conviction to sell not matter how high the bulls run it up in the meantime. A lot of it is headline

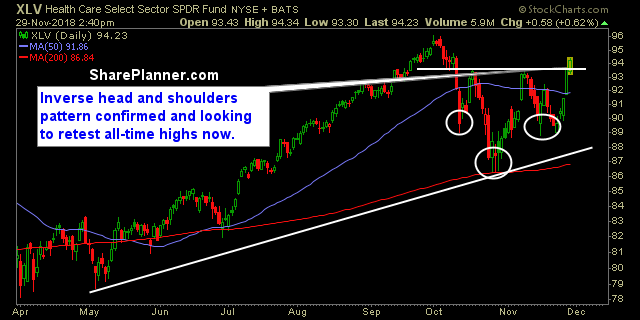

A lot of improvement this week in the sectors, but can it last? Considering the last sector update was on November 15th, things are much improved overall, but the market and related sectors as a whole are by no means out of the woods here. Stocks could certainly lose the current momentum next week

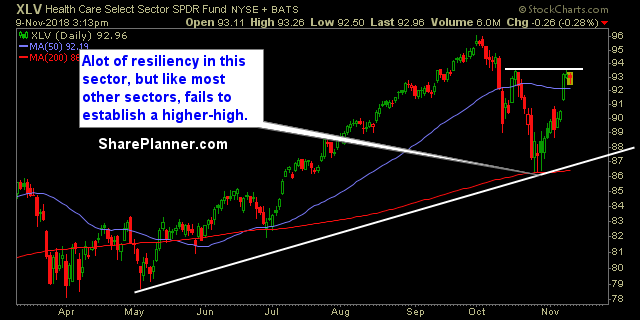

Sectors overall in rough shape, but promising charts emerge. Today the market made a dramatic turnaround off of its lows of the day. It was a much needed boost for the market which had yet to produce a green day even once in the previous five trading sessions. However, I’m concerned that it could be

Old and broken trend lines trying to stall out the current market rally. The market is trying to sell off, though since the 2:30 turn, the bulls have been on an ungodly buying spree, wiping out half of the day's losses, and inspiring the bulls that the worst may be behind it. Where this market

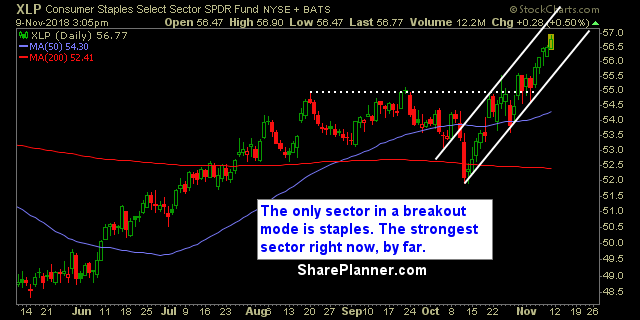

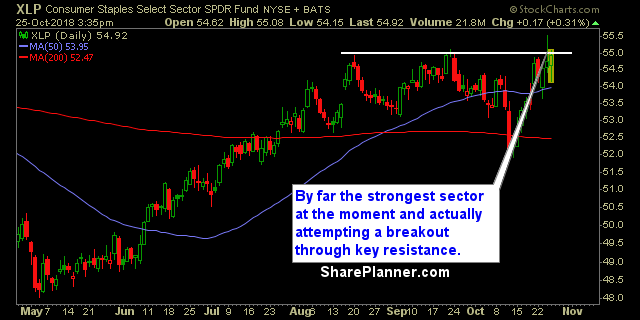

Technicals are pretty much a disaster for all the sectors. Except for Staples and Utilities, which are actually on the up and up, but that is to be expected when the street is looking for safe havens for its capital. The bulls have suffered for five weeks strong, and it is showing on the charts

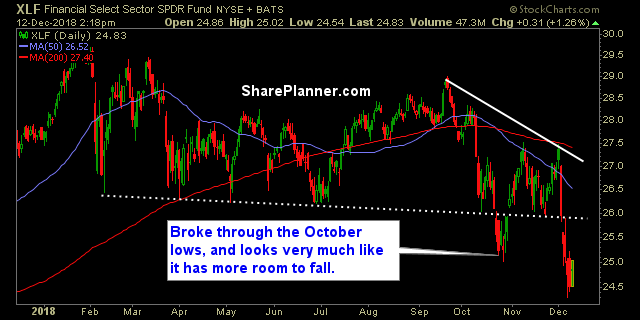

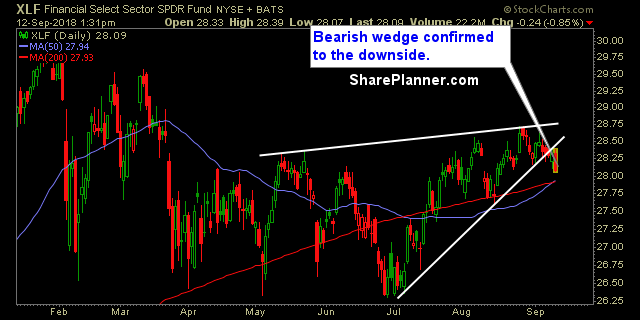

Sectors bullish as a whole, but still with some notable laggards. Financials suck, I’ve played them sporadically throughout the year, and every time, the gains have meager. Energy I have been incredibly skeptical of, though I have played them with much more success, I have stood by on its current rally because the sector itself

Sectors as a whole remain bullish, despite recent market pullback. The two sectors that I like the least are the financials and the materials. Both of them look problematic, and the financials are showing more weakness today, despite already being oversold.

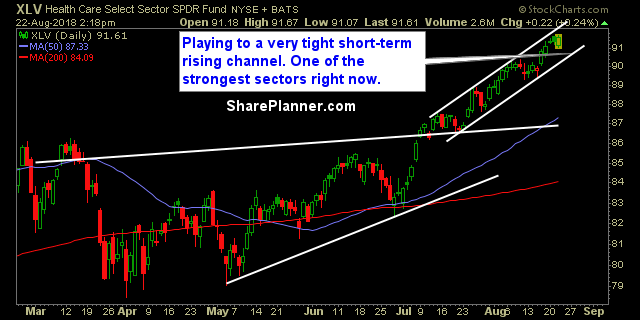

Sectors as a whole support the market’s move to new all-time highs. Outside of Energy and Materials, the sectors as a whole have shown some solid trend-lines and a willingness to push higher going forward.

Most of the sectors are showing sideways trading patterns. The market isn't entirely untradeable but it is getting pretty darn close to it. I'm finding the breakout plays to be more difficult than most, and instead focusing on the stocks that are forming a base and coming out of that base, following a sell-off. Most