Episode Overview In this podcast episode Ryan covers the basics of building a swing trading watchlist for beginning traders. Also covered are the key elements that are necessary to ensuring that the watchlist is functional and capable of providing quality results for one's swing trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps

Energy $XLE has the potential to shine here if it can break out of this declining channel. Some much needed consolidation this week. . $XLB tight and well constructed bear flag in the materials sector and toying with a confirmation over the past couple of weeks. $ALB huge support going back to November, with bounces

Episode Overview This episode focuses on Ryan's sector analysis and what he's looking for when determining which sectors to trade from. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by setting the tone on managing complexity in trading, particularly around sector analysis. [1:13] Listener Question: Otis from

Episode Overview Step-step directions on how I use the Top Down Trading Strategy in my swing trading. This trading strategy guides my decisions and how I analyze stocks and choose which stocks to trade. In this strategy I connect the overall stock market direction with sector strength and industrial technical analysis to help find the

$AMD double top forming, and would confirm if it gets back into the gap. Still some ways to go before confirming, but worth keeping an eye on. Heavy layer of resistance for $AMC should it continue to push higher that has rejected price on four previous occasions. $XLB with a Decisive break of the declining

Episode Overview What's the differences, advantages and disadvantages of swing trading vs day trading vs position trading, and what does it mean to be either of them? Also in this episode, Ryan explores one trader's questions about trading index funds only and provides the bigger questions that this person should be asking himself. 🎧 Listen

Episode Overview One Instagram follower asks Ryan why he has relied so heavily on inverse ETFs in this Bear Market as opposed to individual stocks in his swing trading. PLUS, Ryan has one of the best bourbons he's ever had! 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Leveraging Inverse ETFs in

Episode Overview For working traders or those with a heavy family load, it can be difficult combing through hundreds if not thousands of stocks looking for that one quality swing trade setup. In this episode I talk about how one can trim down the stocks that they have to follow as well as trading off

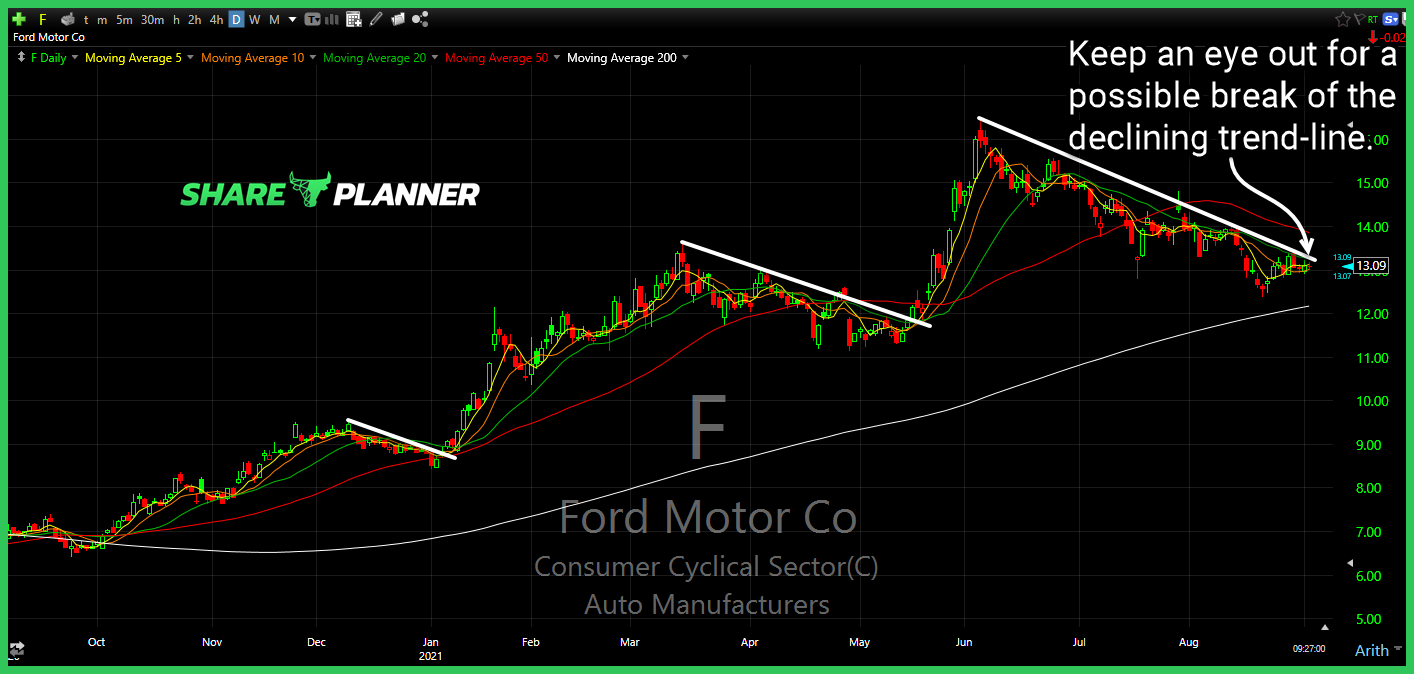

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

As a new feature to SharePlanner, I'm going to roll out, the SharePlanner Notebook, where I essentially "clear out my notebook" of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading