My Swing Trading Approach I have three positions currently in the portfolio. All profitable, but will need a pullback to justify adding a new position here. The market is certainly stretched and prime for some profit taking. Playing the dip is the best option here. Indicators Volatility Index (VIX) - VIX has bounced the last two

My Swing Trading Approach I didn't add any new positions yesterday, and as long as the market is able to hold things together, despite pre-market weakness, I'll probably use today's weakness to add another long position. Indicators Volatility Index (VIX) - Finally a bullish candle on the VIX yesterday, with a pop of 2.4%, despite the

My Swing Trading Approach I closed out my Short Inverse ETF in SPXU for a loss yesterday, but early on, added Amazon (AMZN) and Square (SQ) to the portfolio. Not sure if I'll be adding anything else today, the market will have to jump back into rally mode for me to do so. Indicators Volatility

My Swing Trading Approach I added an inverse ETF on the S&P 500 yesterday (SPXU). Slightly underwater, but looking for this market to give back some of these steep gains from the past two weeks. I may add to my position by shorting additional ETFs should a market pullback take hold. Otherwise, I'll close out

My Swing Trading Approach I haven't added any new positions to the portfolio since Monday, mainly because it was obvious this market was due for a pullback and adding new positions here made zero sense. Use the pullback to find some good trade setups that will naturally bounce should the market eventually resume the trend

My Swing Trading Approach I didn't add any new positions yesterday, and that may be the case again today, until I can see what this market wants to do with overbought conditions (a rarity these days), and whether the market can consolidate some first. Indicators Volatility Index (VIX) - Not falling like it was last week.

My Swing Trading Approach I added one additional long position to the portfolio. At this point, I don't want force any new trades, and will have to wait for just the right opportunity to add anything new, as the bounce in equities is starting to mature some. Indicators Volatility Index (VIX) - Finished the day surprisingly

My Swing Trading Approach I added two new trades on Friday, and will look to add another 1-2 more today should the market show signs it wants to add to the gains. Never trust this market. Volatility swings are wild, and you should expect a change of direction at any moment. Indicators Volatility Index (VIX) -

My Swing Trading Approach I'm not liking the news out of Apple (AAPL) this morning and the impact that it has and will likely have throughout the trading day. With Apple warning you have a new issue for this market to worry and fear, and that is the prospect of a disappointing earnings season. Guard

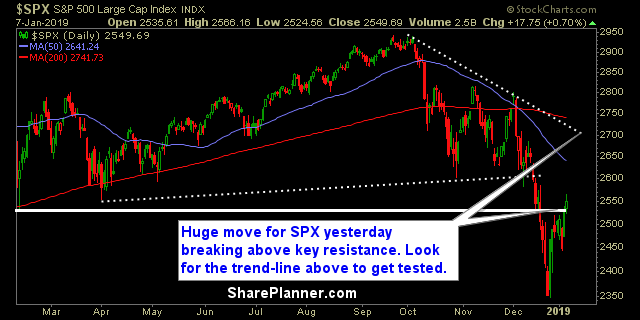

My Swing Trading Approach It is a new year, and I am 100% cash coming into it. I closed my only two positions out on Friday for a +1.5% profit in AMZN and a +1% profit in AAPL. I don't want to get short right out of the gate, because the risk/reward won't be favorable but will instead