My Swing Trading Approach

I haven’t added any new positions to the portfolio since Monday, mainly because it was obvious this market was due for a pullback and adding new positions here made zero sense. Use the pullback to find some good trade setups that will naturally bounce should the market eventually resume the trend higher.

Indicators

- Volatility Index (VIX) – Closed below 20 for the first time since 12/3 after having been above 36 just over two weeks ago. Good chance to see a strong reflex bounce here.

- T2108 (% of stocks trading above their 40-day moving average): Another 23% move. Amazing moves, but unsustainable – even in a dead cat bounce. Currently at 46% and ready for a pullback here.

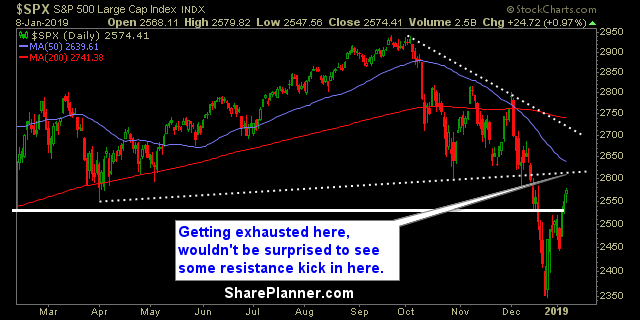

- Moving averages (SPX): No major changes on this front yesterday. Still looking for a possible test of the 50-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Good chance Utilities will garner some interest today. All of your other sectors have run hot over the last two weeks, and are in desperate need to cool off here. Even Energy is extremely overbought. They all are.

My Market Sentiment

Starting to see some profit taking in the AM. The bulls are going to have a hard time keeping things going here without a simple pullback first. Preserve capital. Support shown in the chart below must hold.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% long.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.