My Swing Trading Strategy One new position added yesterday, and considering another new position as well today. But the market needs to show that it can hold its gains into the close, something that has eluded it in each of the last six trading sessions. Indicators Volatility Index (VIX) – Gave up its session gains, but

My Swing Trading Strategy No new positions on Friday, as I am hesitant about any more exposure until the market breaks out of the current five day consolidation and low volume pattern. Indicators Volatility Index (VIX) – $VIX dropped 3.4% on Friday and sits just above its 50-day moving average, which is has been unable to

My Swing Trading Strategy I added a healthcare stock yesterday to the portfolio which is off to a great start so far. I may add another position today, but will need to see this market breakout of its bull flag pattern to the upside. Indicators Volatility Index (VIX) – VIX dropped for the third time in

My Swing Trading Strategy I didn’t add any new positions yesterday as the market didn’t show much willingness to make any meaningful move. I will look to add one or two new positions today. Indicators Volatility Index (VIX) – Less than a 1% drop yesterday, and continued consolidation over the last five trading sessions. The 50-day

My Swing Trading Strategy The last two trading sessions have seen the bulls slip in holding their intraday gains, so at this point, I am not willing to add more positions to the portfolio until the uptrend shows signs of wanting to resume moving higher. Indicators Volatility Index (VIX) – Finished higher by a smidge yesterday,

My Swing Trading Strategy I have been away for the past week due to the passing of my mother. This will be my first day back at the helm, and ready to get after it. I am still holding two postions in the portfolio, that has benefited greatly from the market bounce last week and

My Swing Trading Strategy This has been by far the most difficult month of trading that I have ever seen. I mean, when you have a Twitter account that can bring ruin to the financial markets, it makes predictability a lot more difficult. The month of May started with a tweet fanning the flames of

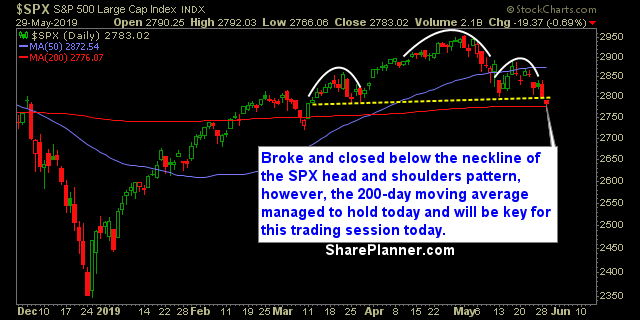

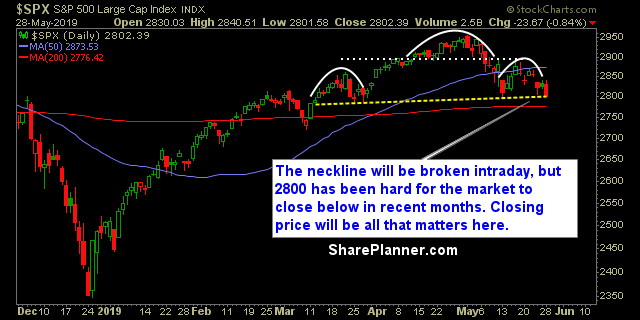

My Swing Trading Strategy Expecting further downside in this market as the head and shoulders pattern on the daily chart confirmed. May see a bounce first, but overall, the volume increased yesterday and it suggests that more traders are becoming concerned and liquidating their positions. Indicators Volatility Index (VIX) – VIX only finished 2.3% higher, and

My Swing Trading Strategy I increased my long exposure yesterday by one position, however, the market wasn’t able to hold on to its early morning gains. The market could be setting up for a hard reversal higher following the morning gap down, which tends to be the more traditional bounce scenario. Indicators Volatility Index (VIX) –

My Swing Trading Strategy I tried to day-trade the bounce yesterday, but there was little juice in the market ahead of the three day weekend. I added one additional swing-trade that I held over the weekend, and will look to add 1-2 more today if this market can hold up for the bulls. Indicators Volatility