My Swing Trading Strategy

I tried to day-trade the bounce yesterday, but there was little juice in the market ahead of the three day weekend. I added one additional swing-trade that I held over the weekend, and will look to add 1-2 more today if this market can hold up for the bulls.

Indicators

- Volatility Index (VIX) – Dropped 6.3% on Friday, but managed to keep itself inside of the trading range of the last seven sessions. Market volume hasn’t been all the overwhelmingly strong during the sell-off in May, which has probably led to the VIX staying suppressed during that time.

- T2108 (% of stocks trading above their 40-day moving average): A 7% pop but still in the mid-30’s and no technical improvements from the bearish downtrend that still remains in place.

- Moving averages (SPX): Rejected on Friday at the 5 and 10-day moving averages. The latter continues to be a thorn in the side of SPX price action, as it cannot sustain a move above it for the better part of a month.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Financials led the market on Friday, and trying to establish a basing pattern to launch from. Materials rallied as well, but the overall price action is extremely dismal. Energy has been torn apart of late and should be avoided for now. Technology has to bounce here or risk breaking a significant support level.

My Market Sentiment

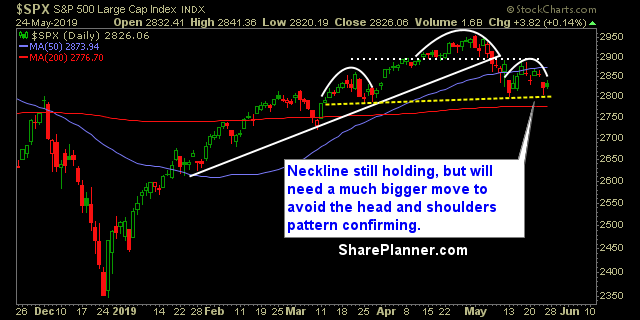

Strong open for the market on Friday, but could not hold it into the close, giving up much of the day’s gains. The only bright spot for the bulls, was that the market didn’t finish lower, but nearly all of its gains were wiped out. Still holding key support as shown in the chart below, and that will again be the key area for the market going forward. I suspect we will see an end of month bounce, to pair some of the losses.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% Long

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I go over the major reasons why traders fail and the biggest obstacles to finding success as swing traders in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.