My Swing Trading Strategy I was stopped out of Twitter (TWTR) for a +4% profit yesterday. I hate getting stopped out, but it does signify a solid, disciplined, and well-executed trade. I added one additional trade, and may add another today depending on how the market performs, and whether it wants to continue the selling

My Swing Trading Strategy One new swing-trade was added yesterday to the portfolio, but didn’t increase my long exposure at all, as I was stopped out of one stock, and closed out another for performing so poorly. Neither loss was detrimental, but more about managing risk. I will look to add one additional long

My Swing Trading Strategy I added one new trade to the portfolio yesterday, but in terms of adding more long exposure at this point, I may hold off, until I can see with a bit more certainty as to whether this market wants to challenge new all-time highs or not. For sure, I’ll be increasing

My Swing Trading Strategy I booked profits in SPXU yesterday for a 2.4% gain, and SQ for a 0.6% profit. I’ll look to add one or two new trades to the portfolio today. Indicators Volatility Index (VIX) – A very mellow 3.6% rise in the index on a day where the market was trying to

My Swing Trading Strategy I’m under the threat of a hurricane today, so that makes trading a little dicey for me today. Power could go out, internet/cell coverage could go down. As a result, my focus today will likely be to manage the existing positions and nothing else. Indicators Volatility Index (VIX) – A 6.2% pop

My Swing Trading Strategy Closed out my two short positions early yesterday, and flipped the script and added two long positions to my already existing long position. I may add one additional long position today, depending on how the market performs. Indicators Volatility Index (VIX) – It surprises me that the VIX isn’t dropping more than

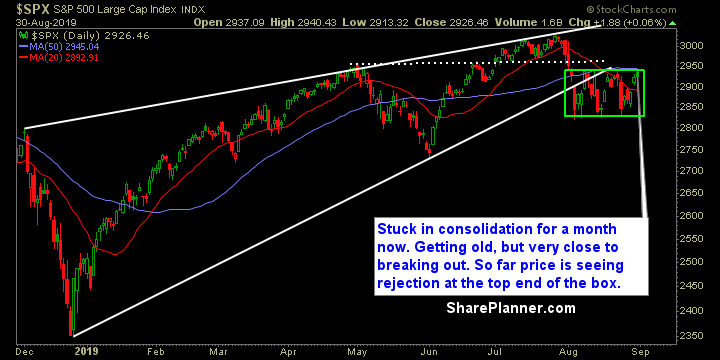

My Swing Trading Strategy I’m likely to be forced out of my two short positions, while riding my one long position higher. I am open to add one to two new long positions, but until we break out of this four week consolidation pattern, I am not going to put a lot of confidence in

My Swing Trading Strategy I added one additional short position yesterday to the portfolio, while keeping the existing portfolio and balance the same. I won’t look to add any additional short exposure here, until we get confirmation that the market wants to break down and out of the current trading range that price finds itself

My Swing Trading Strategy I closed out my position in QID for a +2% profit. Not thrilled about the ultimate outcome of that trade, especially considering how well the futs were performing Sunday night, but that is the stock market for you, what the current situation happens to be doesn’t denote its ultimate outcome. I