My Swing Trading Strategy

One new swing-trade was added yesterday to the portfolio, but didn’t increase my long exposure at all, as I was stopped out of one stock, and closed out another for performing so poorly. Neither loss was detrimental, but more about managing risk. I will look to add one additional long position today.

Indicators

- Volatility Index (VIX) – VIX was in a free-fall on Friday, dropping another 8% and closing at 15. Risk on mentality is permeating the market as VIX looks to make a move back towards the 11-12 area.

- T2108 (% of stocks trading above their 40-day moving average): Hardly any movement in the T2108, after giving up all of its gains Friday afternoon. However a very strong reading still.

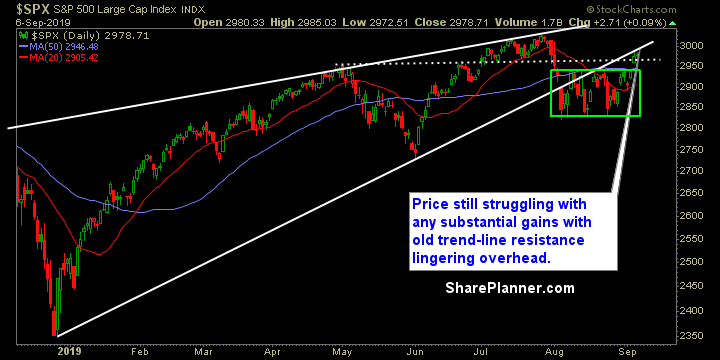

- Moving averages (SPX): Currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Telecom continues to run very hard and ready to break all-time highs that haven’t been seen since the year 2000! Staples are still in a similar rally mode right now as well. Energy showed itself again as an unreliable option going forward, while Technology also struggled though its chart still looks poised for a test of all-time highs. Healthcare looks like it has lost its way, as it continues to trade in a sideways range and an even bigger sideways trading range going back to February.

My Market Sentiment

Friday saw an afternoon sell-off, but showing resistance at the old broken trend-line. However, the box breakout did hold, and I still hold the expectation that price will re-test all-time highs.

Current Stock Trading Portfolio Balance

- 3 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.