Well, back on October 27th, I thought it would be genius to add a short position in Best Buy (BBY).

And at the time it looked like a good idea as a hedge against my multiple long positions in the portfolio. SPX was in the middle of a two day pullback and things were looking like there could be a few more days of selling. It had already rallied over 200 points in the past four weeks. Some protection was needed.

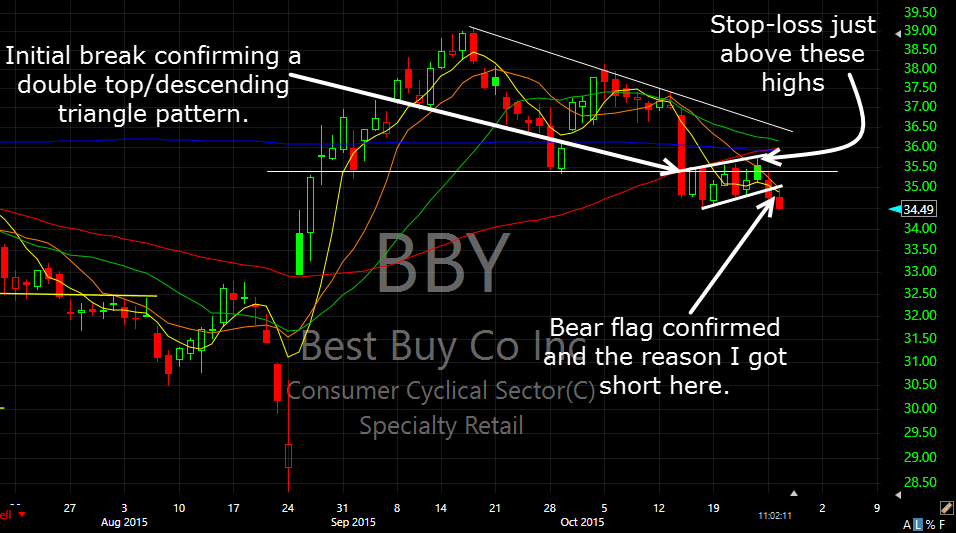

And the BBY chart was absolutely amazing… this is how I described it to fellow members of the SharePlanner Splash Zone:

Yeah, it was looking really good. This thing had bucked the entire October rally, it was consolidating some and working off the oversold conditions and coming out perfectly of a bear flag.

But then Friday happened, and it never looked back. Up until this point, the stock was doing fine for me, but when the market was down 10 points, this piece of garbage decided to rally nearly two percent on me. Then yesterday wasn’t any better, and this morning, before I let it hit my stop-loss of $35.80, I went ahead and closed out my position at $35.52 and saved a few extra bucks.

Perhaps I jinxed the trade (not that I believe in jinxing anything when it comes to trading) when I decided to order a Microsoft Surface Book from them and they weren’t even able to get the order right. I was punished further as I stood there in Customer service for two hours that evening waiting for the order to go through, and then it still didn’t and forget ordering online – that wasn’t working either…whatever.

But in all seriousness, the question after a trade like this is obviously, “Was it a bad trade”. From a setup point, I don’t think it was. It was sporting a classic breakdown pattern, it had bucked the market and all signs were pointing down.

The next question was, should I have been shorting a stock at this point. In hindsight the answer is obviously “No.” But when you are in the heat of the moment, the market was showing some signs of weakening, and considering the run up, putting a 100% faith in this market, would never be a wise decision. I could have chosen to curb my long exposure instead, but I liked my portfolio’s make up and I really saw the BBY trade setup as a gem.

So the trade didn’t work out. That’s ok. Bad trades aren’t defined by whether they are profitable or not. It is about how you manage them, and your reason for getting int them. In the long run I’ve always managed to be profitable in my trading. You can check out all my trades in the Splash Zone by clicking here. Hindsight always makes the trade inadvisable, but you have to work with what is right in front of you because in the heat of the moment, hindsight isn’t a luxury that is provided to traders.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan examines one swing trader's disaster of a trade in Robinhood (HOOD) and the problems that come with not managing the trade and managing the risk in every swing trade that one takes.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.