Tesla (TSLA) stock should be sold here – No reason to hold it at this point

It was just last month I was long on Tesla (TSLA). And it was’t a great trade for me either as I eventually took a 2.9% loss on my Tesla shares. Not one of my finer trades on the month (though it was a good trading month). Nontheless, today’s sell-off does not endear me to want to try and buy TSLA again.

But that doesn’t mean you go out and find some shares of TSLA to short either. I think that this company is one of those that can really burn the bears with random press releases, and even has the potential to be bought out by a Silicon Vally company – think Apple (AAPL).

I just think that Tesla’s stock should not be bought here. For some, that will be a tough trade to pass up, as the Tesla share price has provided few opportunities of late to buy on the dip, and TSLA in itself, have been a stock, over the past eight months that has rarely provided traders with dip to buy. But I have my reasons for wanting to stay away from it – and it all revolves around the technical side. And let me tell you what they are.

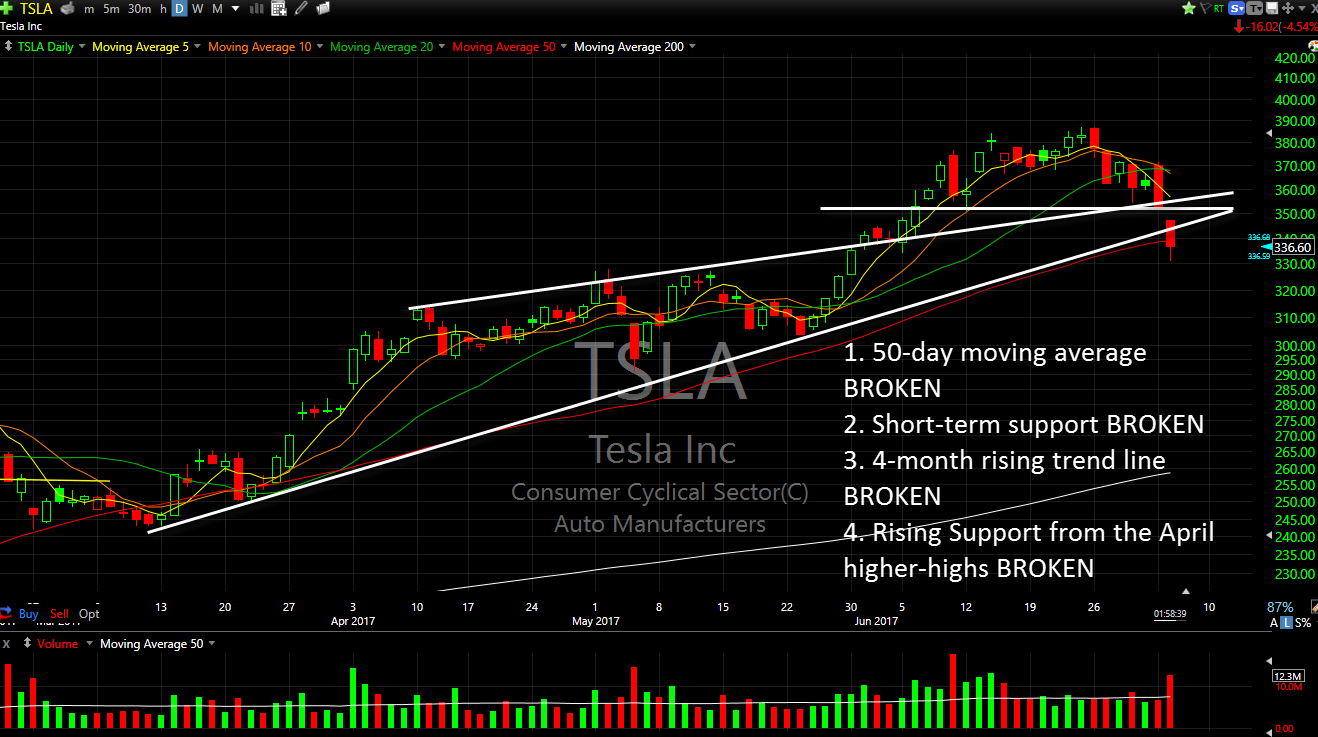

My reasons for why Tesla Stock should be sold:

- TSLA’s 50-day moving average that has previously provided support has been BROKEN

- Short term support for Tesla in the 350’s has been BROKEN

- 4-month rising trend line off of the March lows has been BROKEN

- Rising Support from the April higher-highs have been BROKEN

I’ve went ahead and mapped out all these technical breaches on the Tesla chart so that you can see for your self why I think the stock should be sold

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode Ryan talks about not allocating all of your capital to one single trade. He covers why it is dangerous to your trading and the sustainability of that strategy long-term. Also covered is how much should you dedicate to long-term vs short-term trading, and whether you should ditch one approach for the other.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.