I guess until the Fed and central banks world-wide decide to stop interfering with the market, the normal ebb and flow of price action will cease to exist. That is why you have the VIX flirting with 10, and any sell-off cannot be sustained for any meaningful length of time. I mean, look at

This market knows no bounds. There is a million reasons why this market should be much, much lower, but the central banks don’t want that, and until they take their foot off the gas pedal, I don’t expect much to change. At least not ahead of the US election in November. The world clearly doesn’t

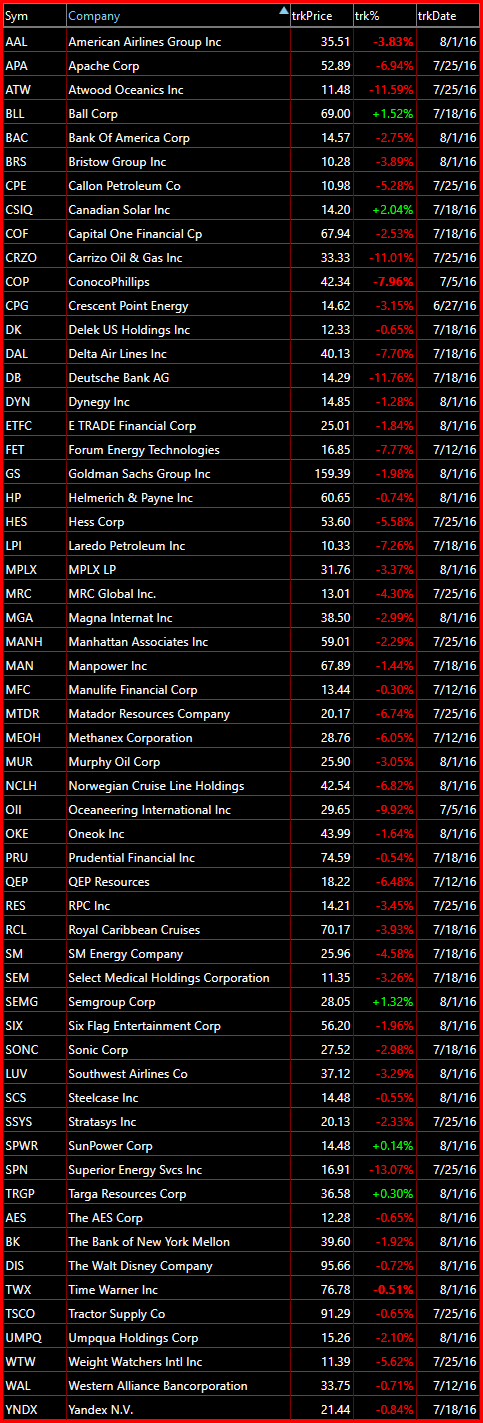

Stocks are selling off in dramatic fashion… well… comparatively speaking. The market has been stuck in a 13 day range and as I stated in the trading plan this morning, broke 2155, which creates a strong potential for more downside. But this move seems too easy, and while technically it makes sense to get short

It is a new month and the market behavior today is acting as if it wants nothing to do with the gains seen last month. That wouldn’t be surprising either considering that August is the worst month of the year, historically, for the Dow and S&P 500. As a result, I don’t have huge levels

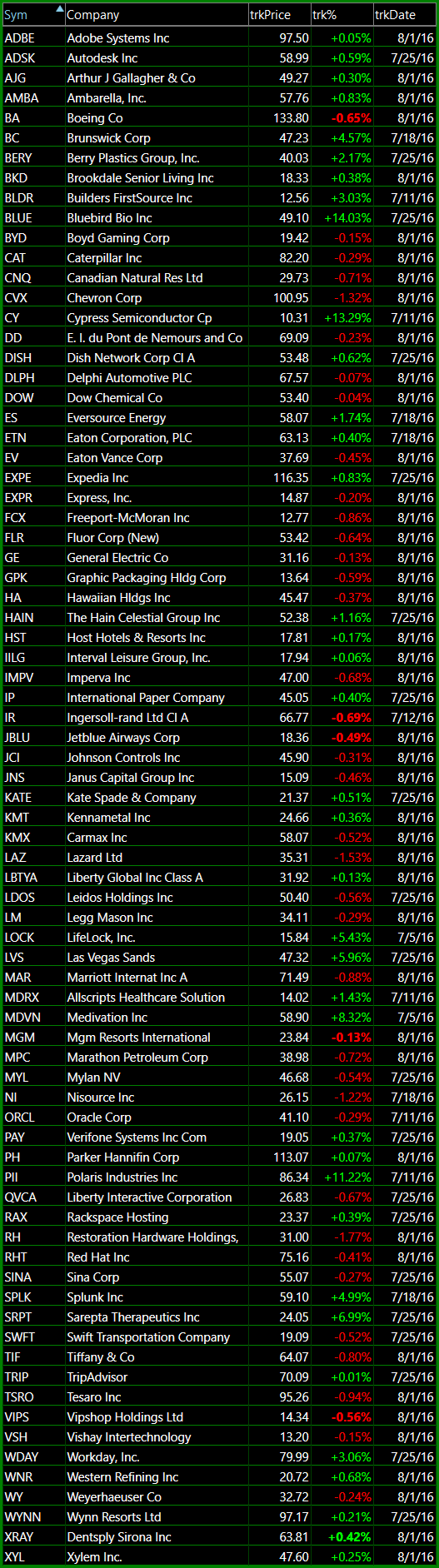

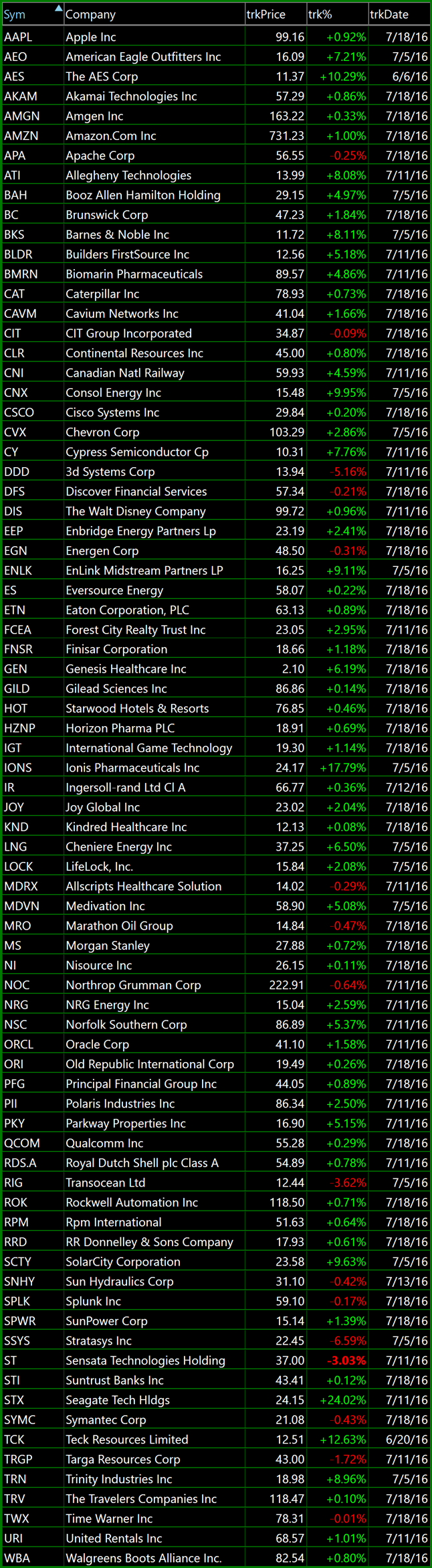

There is a lot that could go bad this week. Apple (AAPL) earnings are after the bell, then you have Amazon (AMZN) later in the week. Not to mention the slew of economic news from the Fed tomorrow at 2pm eastern when they release their FOMC Statement and then again with the GDP to

This week is going to be a challenge for traders – there is no doubt about it. Regardless of whether the market finishes higher or lower on the week, you have the biggest weak of earnings where tons of big names are reporting their results, followed by the Fed’s FOMC Statement on Wednesday, and GDP

The market is trading sideways the past couple of days. I don’t see that being bearish at this point. Especially when you consider the ramp the market has been on since the Brexit sell-off. The can change in the favor of the bears, but first some technical damage needs to be done and when looking

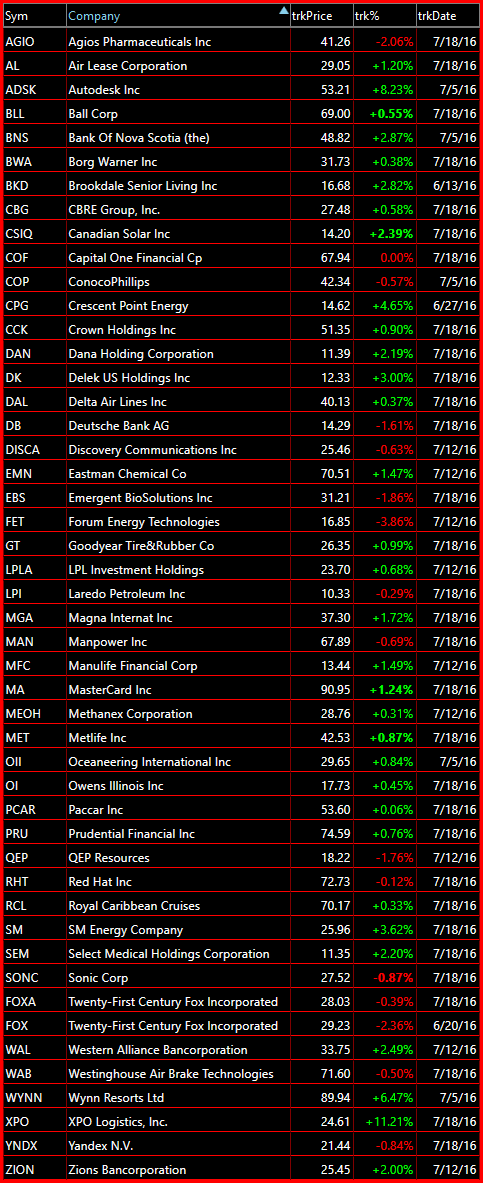

The bulls are trying to start the week off right, with more upside. This is despite the failed coup attempt in Turkey over the weekend and more law enforcement officers being killed domestically. The latter hasn’t mattered much to the market, nor has terrorist attacks within and outside US borders. I’m not stating an opinion

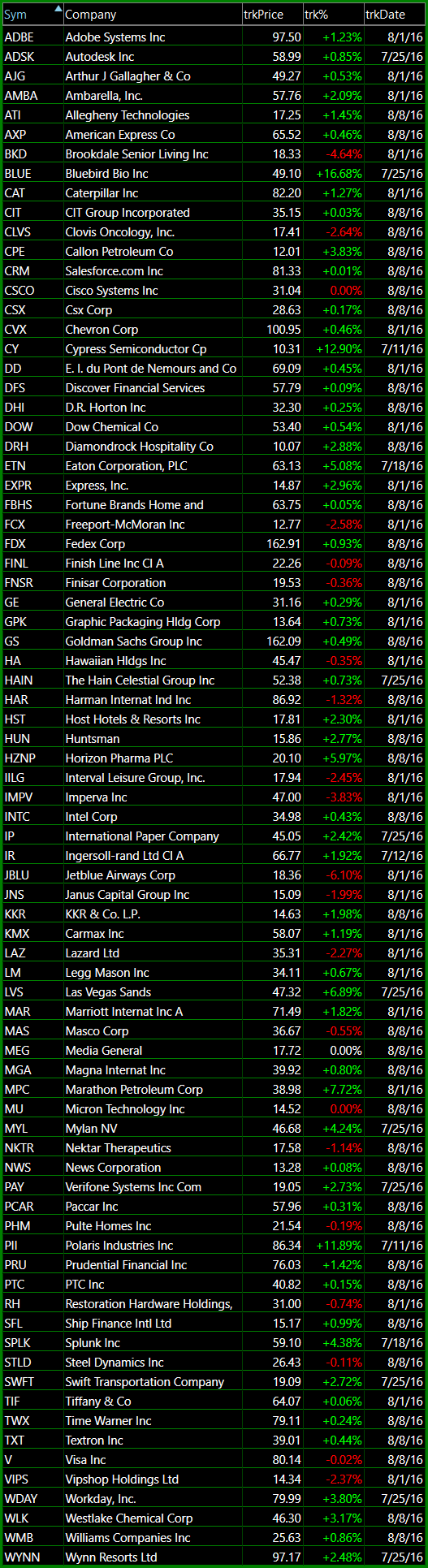

I provide short setups – because it is in my nature to always have a list of them handy regardless of the market conditions. Now that we have broken out of that two year range that the market has been in since 2014, I don’t see a reason to be net-short on this market.

The bulls have it – barring an end of day sell-off, that takes price back below 2034 or worse, 2030, the bulls will have closed as new all-time highs (as long as it is above 2030, it is above all-time closing highs). To be shorting this market at this level, I don’t see why you