So far today, I am not adding any new positions to the portfolio. I am at a point here with this market, where I’m not willing to add any additional exposure to the portfolio (currently 30% long and 70% cash) from a long standpoint, until this 2111 on SPX is cleared. It is simply

6/2: Nearly three months of consolidated trading that it is starting to emerge out of. Once this happens, this is a risk reward setup that could return 3:1 for the amount risked. Continues to find support at the 50-day MA and looking to make an intial push towards $37 for starters. Once that is cleared,

It is the same story that we have seen since February: the bears, in the first ten minutes of trading, come out looking like they want to drive the S&P 500 down 40 points on the day. Then suddenly, you use the bathroom and you come back to find they are hanging on to the

The bulls are off to a slow start, but at this stage of the rally, give them the benefit of the doubt. I can justify shorting a stock, as long as it is to hedge some existing gains on current long positions. But to be net short right now on this market, as the bulls

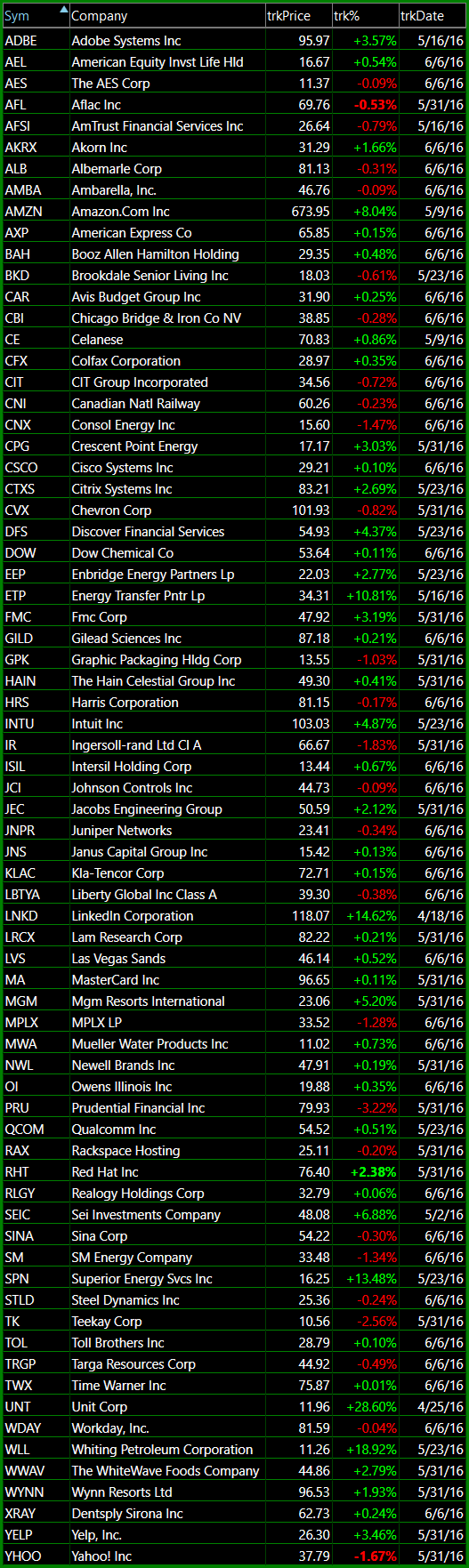

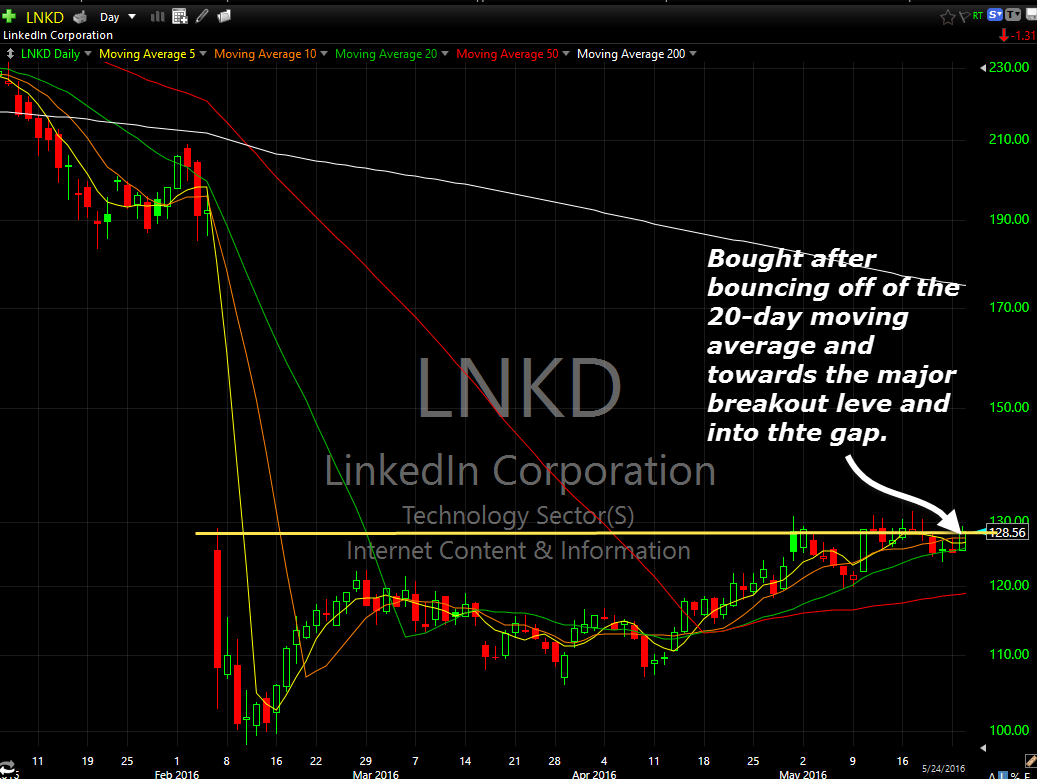

5/24: LNKD following their horrific sell-off after their February earnings report, has created a very nice base that it is now attempting to break out of and push into the gap. We day-traded th is stock earlier in the month and made a solid gain. I think here it is still a strong setup and

5/25: Nice bull flag tthat over the last two days it has fought to break through and establish new highs in. Broke today above the 5-day and 10-day moving average, with a nice series of higher highs and higher lows in place. I expect recent highs to be taken out very soon. It goes without

5/26: Short-term cup and handle. There is some resistance overhead with teh 200-day moving average, but also has some decent support underneath with the 5-day moving average.It is hard to get a good risk/rreward entry on $TSLA so, it can require being aggressive on the entry.

Microsoft (MSFT) has one of the more intriguing charts that you will find out there today. In fact it may be one that I end up buying before day’s end. You have a nice double bottom play, over the course of the past month, and followed by a breakout of the double bottom base

I feel like this post is entirely inappropriate considering the current state of the market today, where it happens to be rallying in a manner no one foresaw at the close yesterday. Even so, we’ve seen how many reversals this market has experienced the following day, and if tomorrow doesn’t follow through on today’s gains,

You get the feeling that today is going to be yet another one of those trading sessions that you say to yourself, “I wish I could get back those 6.5 hours of trading!” Since the early ramp Friday morning, the market has been insanely dull and boring and today is doing little to change that