My Swing Trading Approach

Ahead of the FOMC Statement tomorrow, I suspect the price action to be contained and lacking conviction. I may add an additional position to the portfolio today, but will only do it under strong, bullish conditions. Otherwise, it is more important to focus on raising stops and protecting profits.

Indicators

- VIX – Trading higher, despite the stock market indices doing the same. Morning gaps higher continue to wane throughout the trading session. Resistance, currently, is at 12.60.

- T2108 (% of stocks trading below their 40-day moving average): Showing strength yesterday, with a 2.1% rise yesterday, taking stocks up to the 71% level, with continued higher-highs and higher-lows.

- Moving averages (SPX): Trading above all the major moving averages.

- RELATED: Patterns to Profits: Free Training Course

Industries to Watch Today

Energy, along with Staples, was yesterday’s big move, as the former has, and continues to struggle with the 20-day moving average. Financials continues to trade sideways, with the momentum slowly favoring the bulls heading into the FOMC tomorrow. Utilities continues to sell-off and could see a retest of the February lows – extremely oversold. Technology still hovering at the all-time highs.

My Market Sentiment

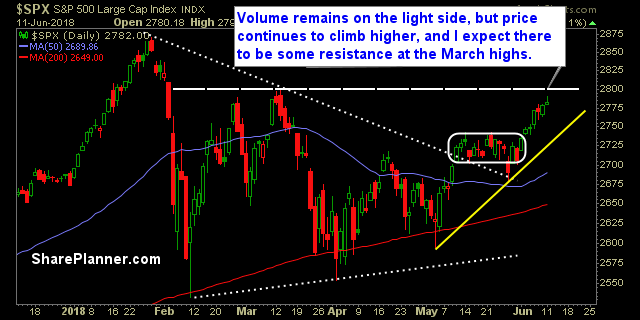

The volume continues to languish, but price continues to rise, as it has done in six of the last seven trading sessions. I suspect there may be some resistance at the March highs, and possibly a pullback to the existing trend-line off of the May lows.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 6 Long Positions