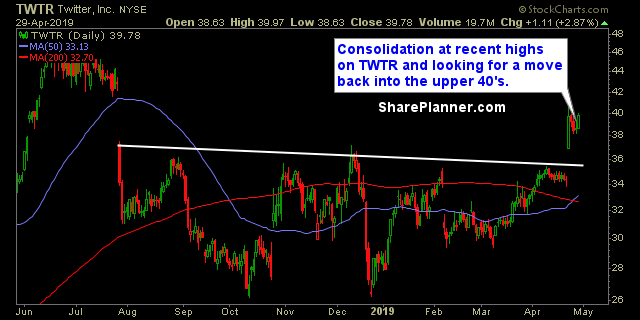

Tuesday’s Swing-Trades: $SWCH $TWTR $NUE Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Switch (SWCH)

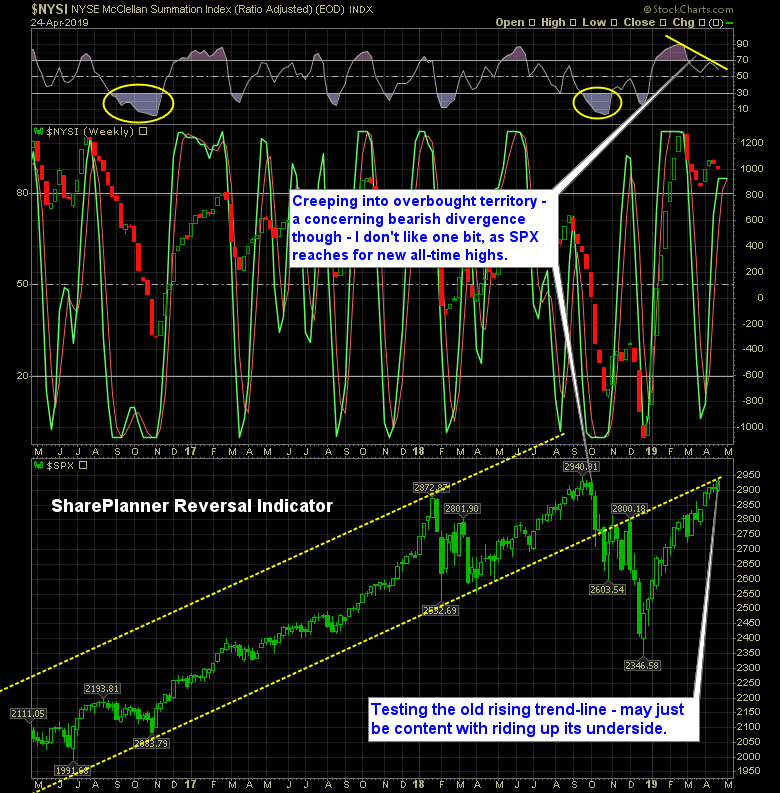

The All-Time Highs for the first time since September 2018 Honestly, I feel like this market is stuck on the Chumbawamba, I Get Knocked Down song on loop. This market simply shrugs off everything in its path. You have to wonder at what point, if this market continues marching higher that the Fed won’t revisit

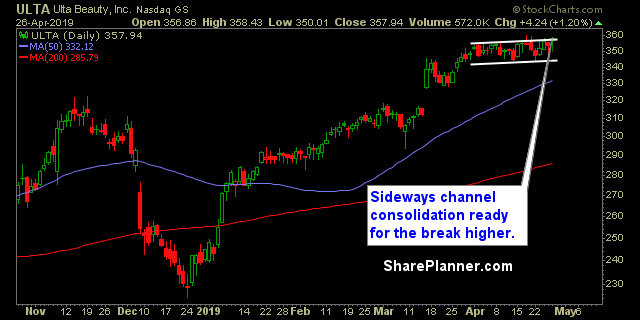

Monday’s Swing-Trades: $ULTA $BHF $RTN Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Ulta Beauty (ULTA)

My Swing Trading Strategy I took profits in Applied Materials (AMAT) for a +2.8% profit on Friday, while also adding one additional position to the portfolio. There are a lot of earnings reports coming out this week, like last, so avoiding any potential hazards will be extremely important. Indicators Volatility Index (VIX) – Down 4%

Earnings season is the toughest and most difficult time in the stock market for traders and investors alike. There are so many companies reporting earnings, and so many of them that miss analyst estimates or cut guidance that it creates a huge loss for the trader holding the stock. In my video, I am going

My Swing Trading Strategy I sold Jacobs Engineering (JEC) for a +3% profit yesterday but also took a -1.5% loss in Ralph Lauren (RL). The reward/risk was textbook between the two of 2:1. I added one new swing-trade yesterday to my portfolio and won’t rule out another today. However, my confidence in that happening is low,

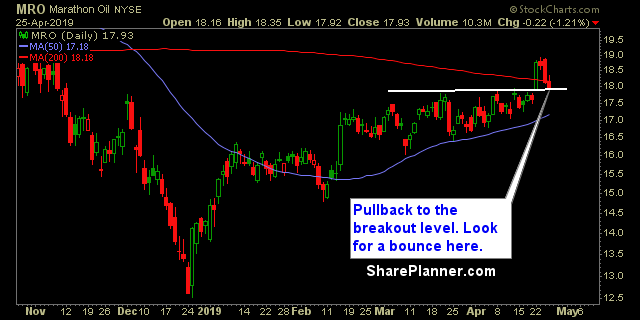

Friday’s Swing-Trades: $MRO $COUP $BHC Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Marathon Oil (MRO)

The Reversal Indicator could break lower, as a major divergence pops up. Notice that RSI divergence at the top of the chart? Not the best look for this market that is struggling to sustain momentum. I still think you still have to remain bullish on this market, but a hedge wouldn’t hurt here, for sure.

My Swing Trading Strategy I did not add any new positions yesterday as the market’s price action simply didn’t warrant it. Instead I raised my stops where I could. I will be open to adding another long position today, but won’t hold out hope for it, if the market decides to fade tech strength today.

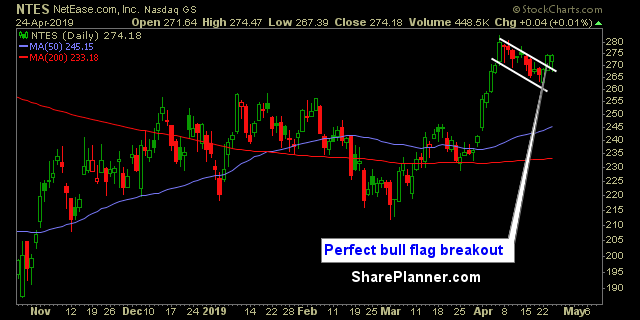

Wednesday’s Swing-Trades: $NTES $NCLH $IP Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long NetEase (NTES)