My Swing Trading Strategy

I took profits in Applied Materials (AMAT) for a +2.8% profit on Friday, while also adding one additional position to the portfolio. There are a lot of earnings reports coming out this week, like last, so avoiding any potential hazards will be extremely important.

Indicators

- Volatility Index (VIX) – Down 4% and more than anything else, simply stuck in choppy, sideways action for the entire month of April. I don’t have much in expectations for there being any major moves here in the near term.

- T2108 (% of stocks trading above their 40-day moving average): Sideways, like many indicators in the month of April. It rose 5.2% to stay in that 55-70% range for the month of April.

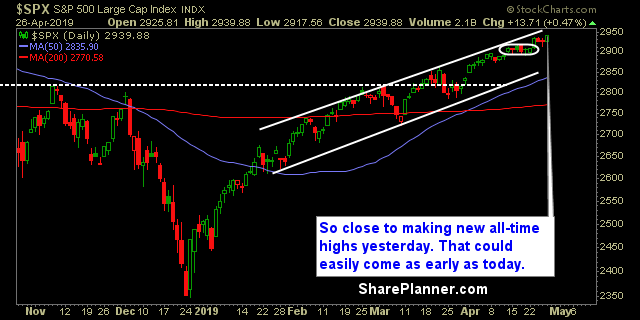

- Moving averages (SPX): Price is trading above all the major moving averages now.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Healthcare was last weeks big winner, and may look to recover by putting an end to the double top pattern, this week. Materials may be setting up for a bounce here – despite last week’s sell-off, it is still in a solid uptrend. Financials broke out of consolidation. Utilities with weaker price action than the rest, but still remains in a well defined bull flag.

My Market Sentiment

All-time highs are on the radar today and with that, the bulls will have effectively wiped away all the losses from the 2018 sell-off that began back in October of last year. But that doesn’t mean that traders should relax – always, always protect profits by moving up those stops.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.