Affirm (AFRM) breaking through the head and shoulders neckline today. Nvidia (NVDA) pullback to its trend-line, $230's becomes the next trend-line if it breaks. Otherwise, watch for a bounce. Snowflake (SNOW) breaking its rising trend-line. Adobe (ADBE) huge double top in place, yet tor confirm, but testing the major support level.

Will inflation hurt the stock market? In this video I provide my analysis with the FOMC Statement and what Jerome Powell will do with interest rates and accelerated tapering that will end in March of 2022. I also provide my $SPY technical analysis as well as $QQQ technical analysis, and $IWM technical analysis and where

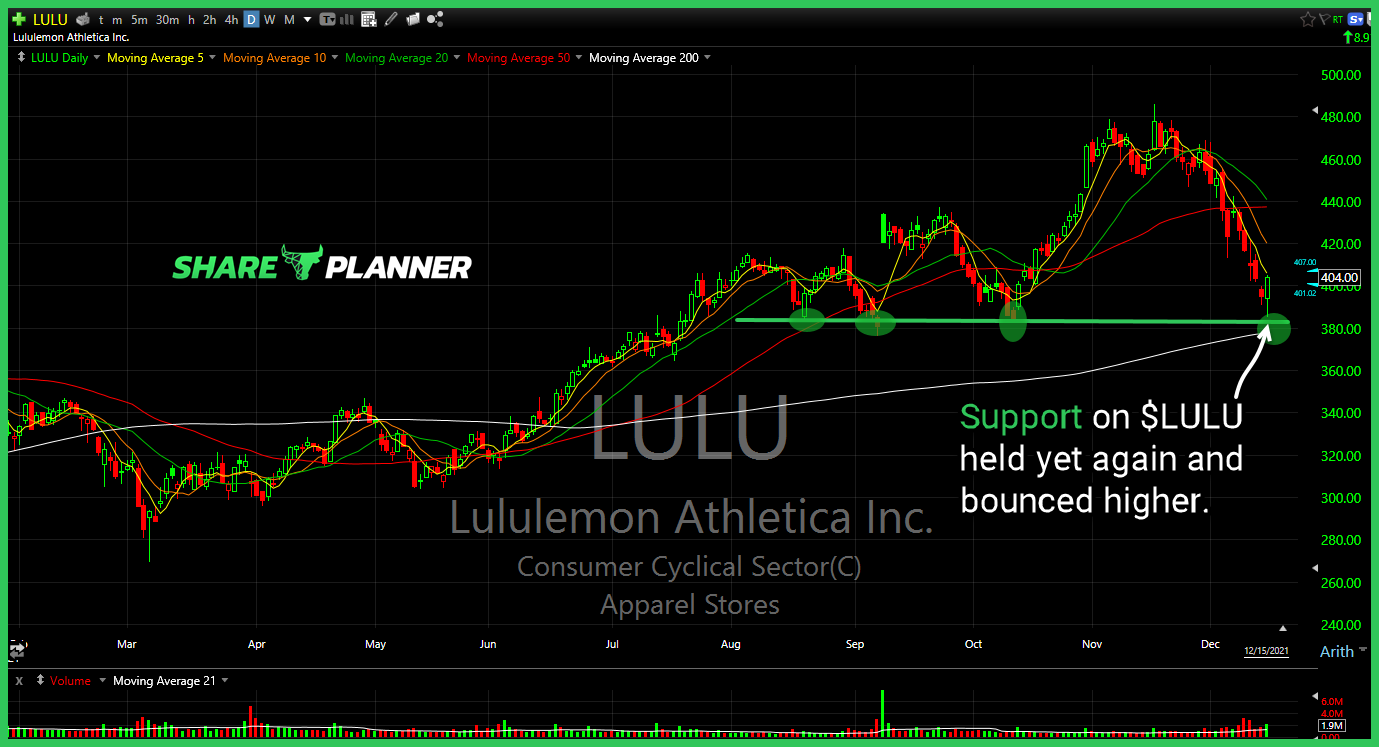

$LULU found support today.

$DOGE.X with a big move, but lacking the kind of momentum from earlier in the year that sent the stock skyrocketing.

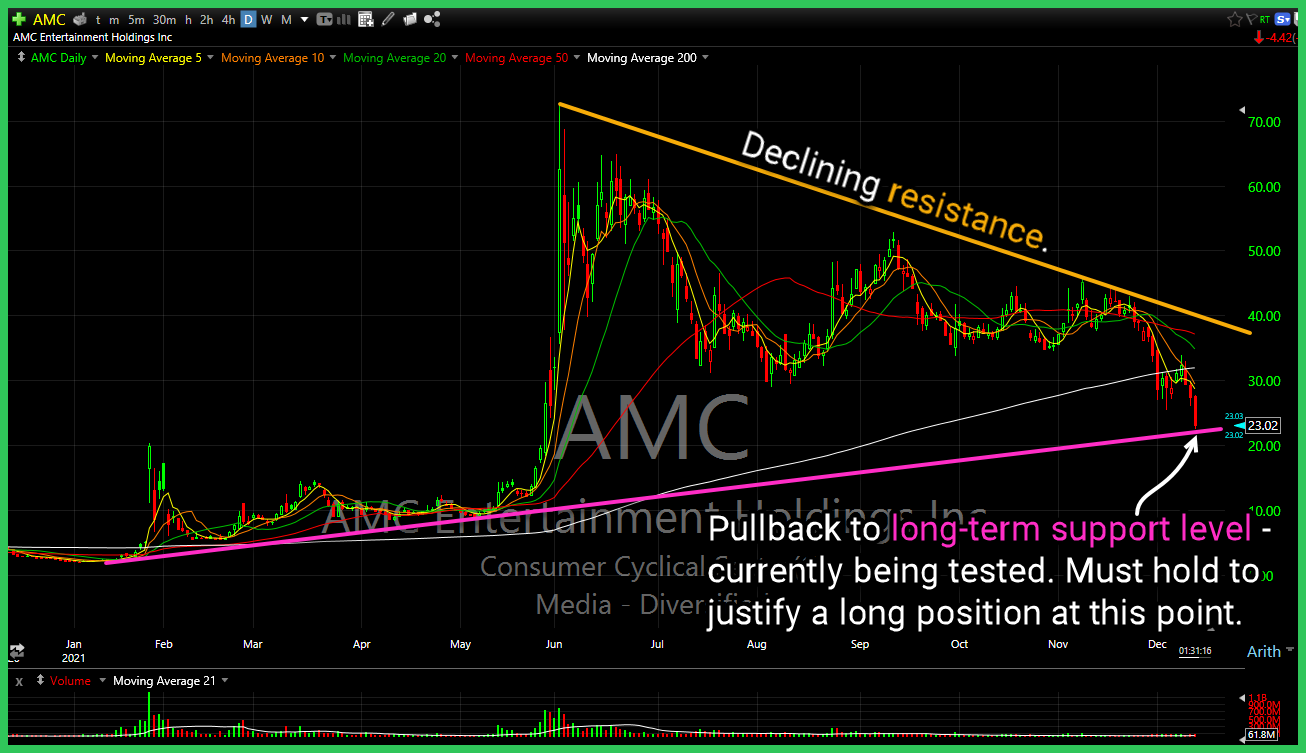

AMC Entertainment (AMC) pulling back to its long-term trend-line. Bulls are in a do-or-die moment here for the stock, as a move below $10 becomes much more likely, if the trend-line fails to hold. Discretionary ETF (XLY) with a double top trying to confirm. Target (TGT) Textbook double top forming, but shorting it here, could

Apple stock has been one of the strongest stocks in the stock market over the past couple months. Traders and investors continue to flock to $AAPL stock during every market sell off, but is now a good time to buy Apple stock, or is it better to wait for a pullback. What about AAPL price

Another week of selling in the stock market, sparking concern this is the start of a stock market crash comparable to that of the Dot-Com Bubble or the Great Recession. In this video, I provide my technical analysis on the charts for swing traders and investors, and providing SPY, QQQ and IWM Analysis. Most investors

$AMC broke down through the triangle pattern. Possible rising support in the low $20’s.

$CLF holding major support so far despite a huge head and shoulders pattern.

$LCID doing a good job of sustaining its momentum all month long. If the market can hold itself together, potential is for a move up to $60.