$BTC.X Bitcoin double top forming, though it will be a difficult one to confirm.

Recession for stock and the stock market as a whole is looming large, as $SPX dropped significantly this past week amid the war in Ukraine with Russia, rising oil prices, and soaring gold, wheat and commodity prices. In this video I provide my technical analysis and outlook for the stock market. Now it is time

$KR rally – is this a product of them increasing earnings, revenue, or both? If the former, then they are capitalizing on inflation rather than adjusting to inflation, right? Perhaps more are eating at home and less eating out?

$NIO testing critical support. If it can hold there is the potential for a triple bottom, but if it doesn’t, there’s little support underneath.

$CRM with a declining trend-line in play. $UPST looks impressive here with that basing pattern and inverse head and shoulders pattern. $AFL bouncing at two significant levels of support.

The price for a barrel of oil is over $100 a barrel and keeps going higher. Will oil prices keep going up or are we do for oil prices to go down.

Unlike $SLV, the $GLD breakout has been well underway.

Yet there are people out there buying the dip on $RSX

Massive stock market rally saw S&P500 ($SPY) rally 270 points. But is the sell off over? Will we rally back to the highs? I'll highlight the bullish and bearish scenario following news that Russa is banned from Swift.

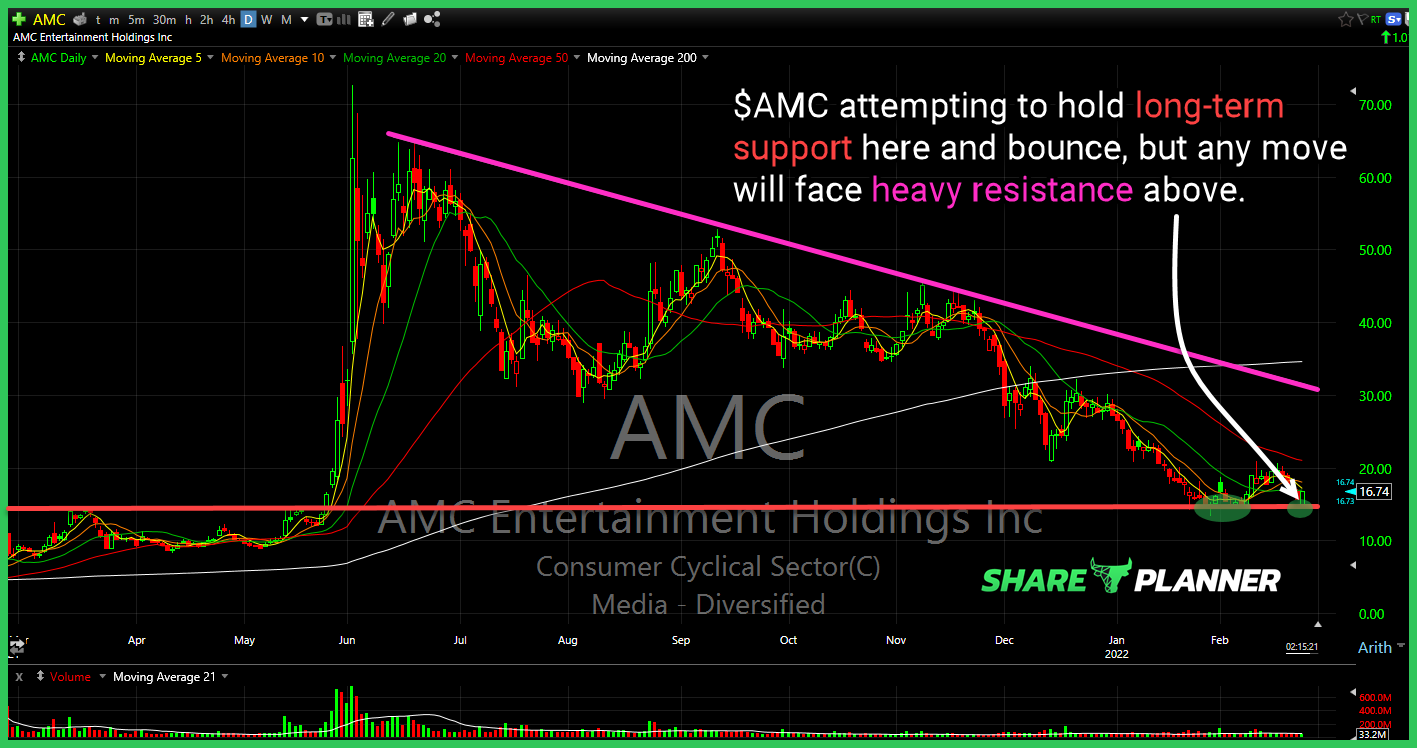

$AMC testing major support here.