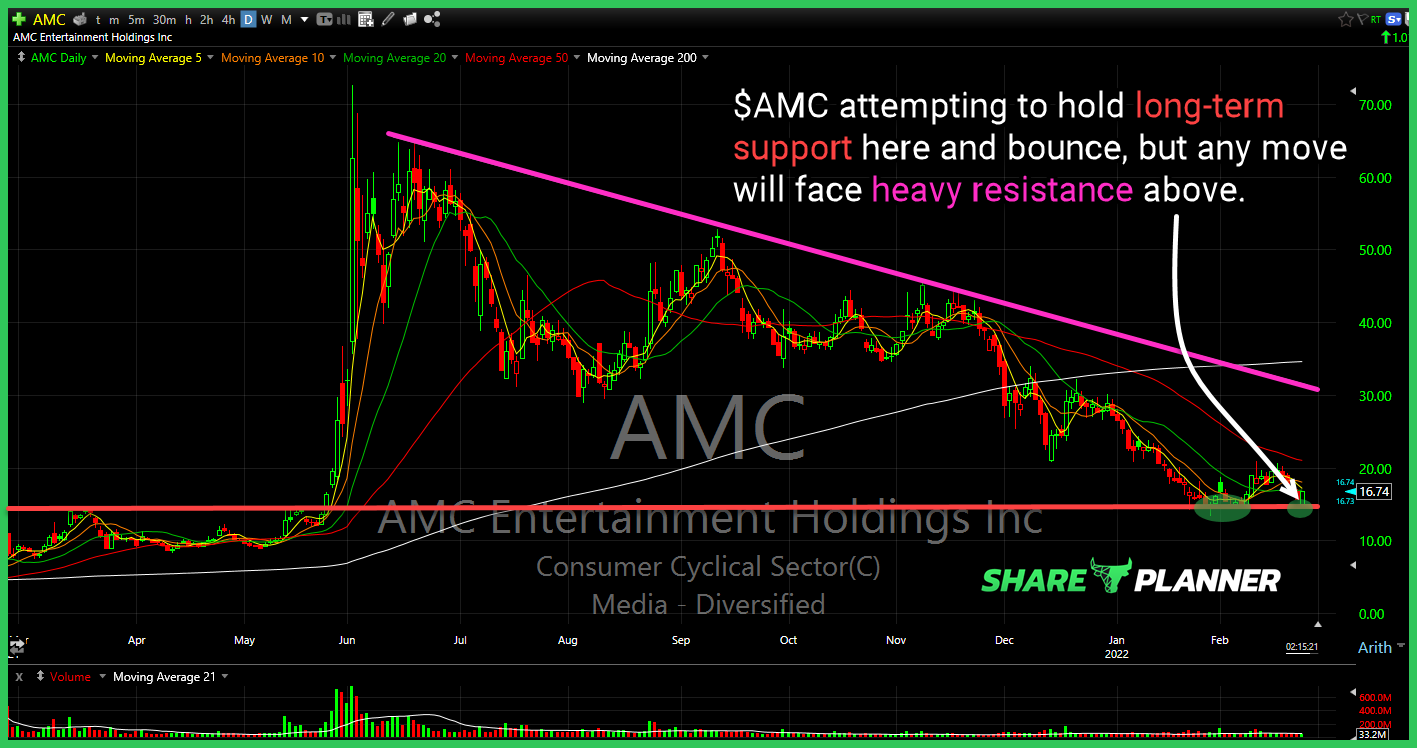

$AMC testing major support here.

$SOFI trying to find some support here at their all-time lows. Any bounce means very little until it can break the downtrend above.

The Nasdaq 100 ($QQQ ETF) dropped 1.6% this past week. And has confirmed a major head and shoulders pattern that is very bearish for the entire stock market. I provide my technical analysis on multiple charting time frames for swing traders to see how much of a stock market crash could result from the Nasdaq

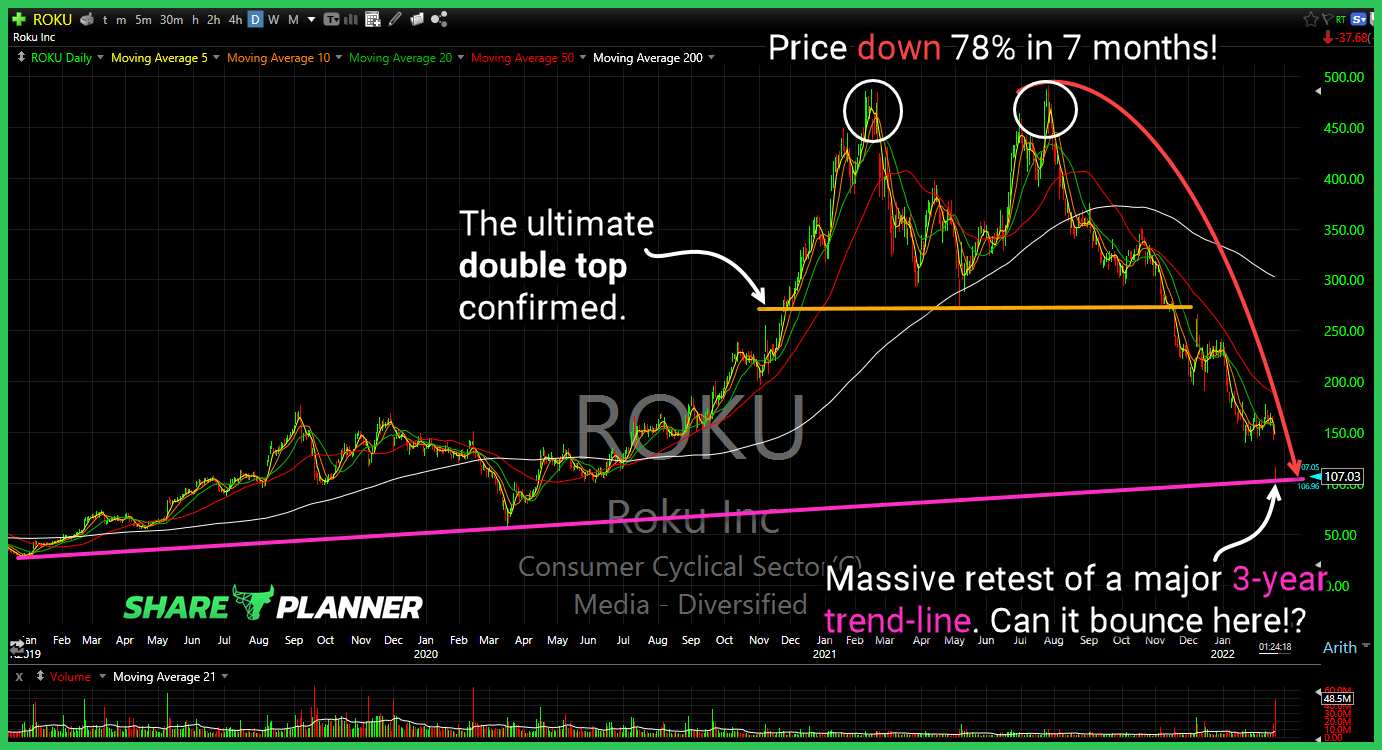

$ROKU has pulled back to a major trend-line from 3 years ago. Not worth catching the falling knife right now, but if it can start to form a base around support, it could provide a opportunity to get long in the next few weeks.

$MO breaking out of a multi-year inverse head and shoulders pattern with a 7.15% divi. One of the few long-term plays out there.

$PAAS holding up well today and could finally breakout of the declining trend-line

$ARKK bear flag and declining trend-line still causing trouble for investors… and Cathie Woods is the most overrated trader of my lifetime.

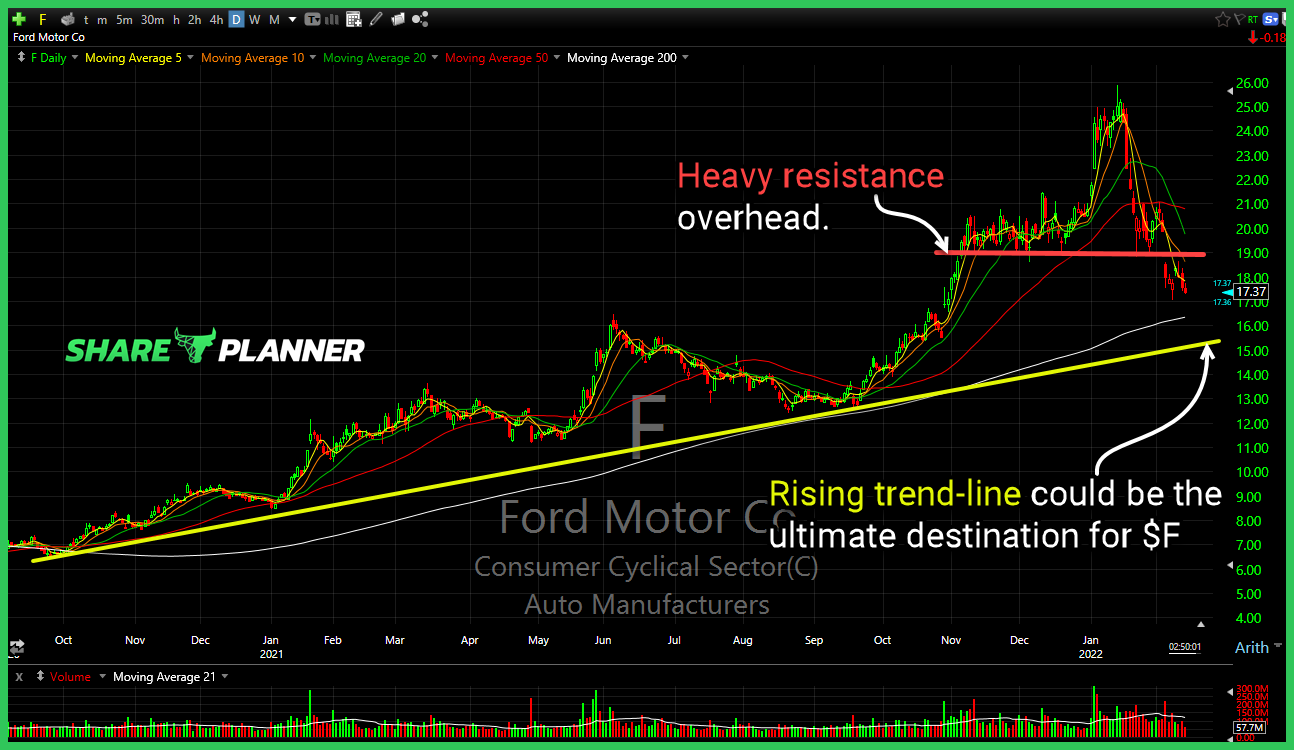

$F has room to fall before any substantial support kicks in.

Will the stock market crash again? With war between Russia, Ukraine and NATO, the Federal Reserve considering an emergency rate hike, oil spiking and causing further inflation, the risks in the stock market couldn't be more extreme.

$AMD taking its talents to $100