My Swing Trading Approach The bulls have to show me that they can overcome yesterday’s bearish engulfing candle pattern. I won’t add further long exposure to the portfolio, unless price stabilizes right here, and I will be tightening my stops in a big way on my positions in order to secure profits. Indicators

Wednesday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Splunk (SPLK)

Looks like the S&P 500 is on track for its first negative return since March of 2017 Sure, we could rip off another monster rally tomorrow, but the odds are not favorable for finishing in the green.

My Swing Trading Approach I’m not opposed to adding a new position in this rally, but stocks are in overbought territory, and may see some profit taking. I’m taking a “wait-and-see” to this market. Indicators

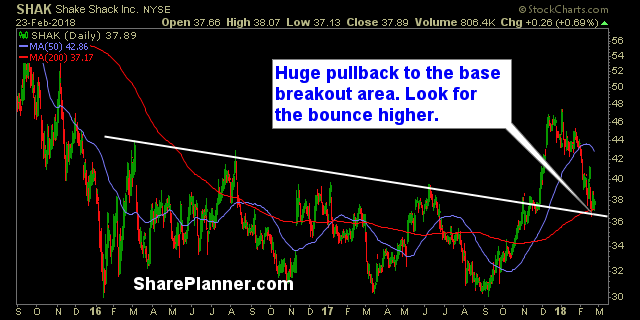

Monday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Shake Shack (SHAK)

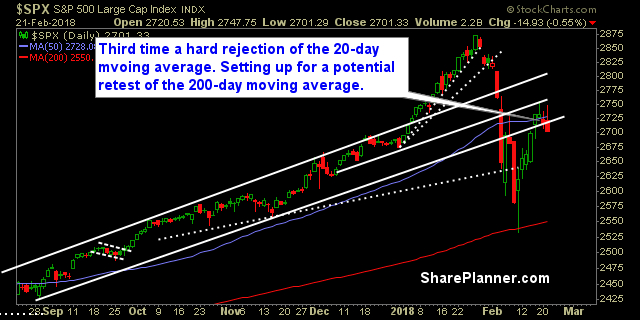

My Swing Trading Approach I still think this market could easily roll over at this point. That has yet to happen, but price action of late raises a lot of concerns. If the bulls can breakout here today, I will close the short position and keep the current long positions running. Indicators

Friday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long XL Capital (XL)

My Swing Trading Approach I am positioned to take advantage of this market for whatever direction it decides to go today. Bulls are showing difficulty with maintaining intraday profits and very much susceptible to end of day sell-offs. Indicators

Thursday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Square (SQ)

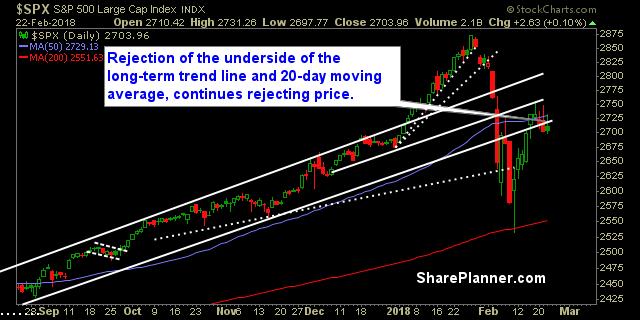

The bulls are trying to bounce today, and they absolutely had to, if they were going to keep this market bounce going. However, the 20-day moving average is still providing resistance, as of this post. Should that MA clear, I think the bulls have a clear path back to the highs gain. The price action