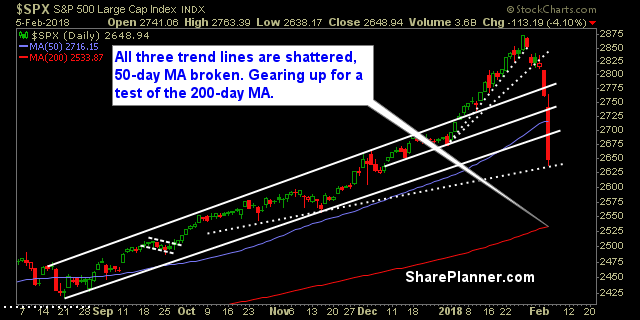

My Swing Trading Approach I am 100% cash right now. I am willing to play the bounce, but will likely only add a couple of positions in the early going. Watch for a possible market fade of the early gains ahead of the weekend, just as we saw last week. Indicators

My Swing Trading Approach I’m not looking to add new positions to the portfolio unless this market can show itself capable of sustaining a bounce. Indicators

Thursday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Murphy Oil (MUR)

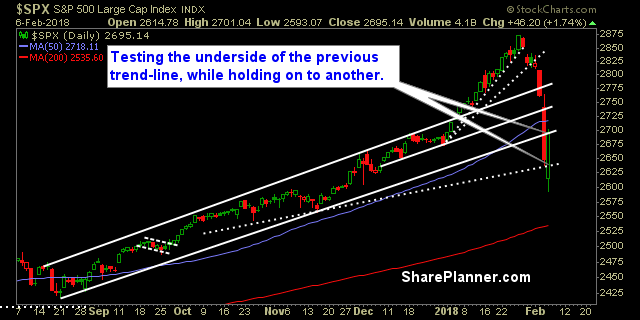

We’ve entered that phase in the market bounce, where everyone is wondering whether this is a “Dead-Cat Bounce” or not. My experience with market bounces following a huge sell-off, is that they usually last 3-4 days, enough to where people feel comfortable with the notion that the worst is behind them, only then to have

My Swing Trading Approach Wait and see if the market wants to continue with the bounce off of the morning lows. If not, it will be a time to sit on my hands and watch. Indicators

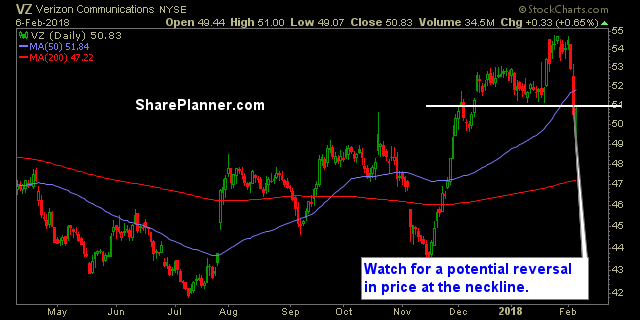

Wednesday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Accenture (ACN)

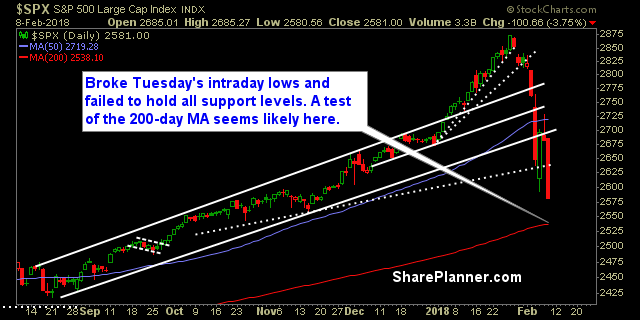

My Swing Trading Approach There will be a substantial bounce to play at some point in the future. I will sit on the sidelines until that time is unveiled. Indicators

My Swing Trading Approach I expect us to see a rally come forth at some point this week that will be hard and fast. However, while playing it is okay, committing too much capital to it is a bad thing. Be careful as it may not take place exactly when you expect. Stay nimble and

Monday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Cypress Semiconductor

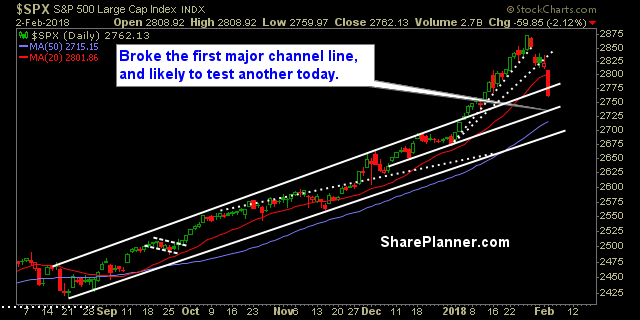

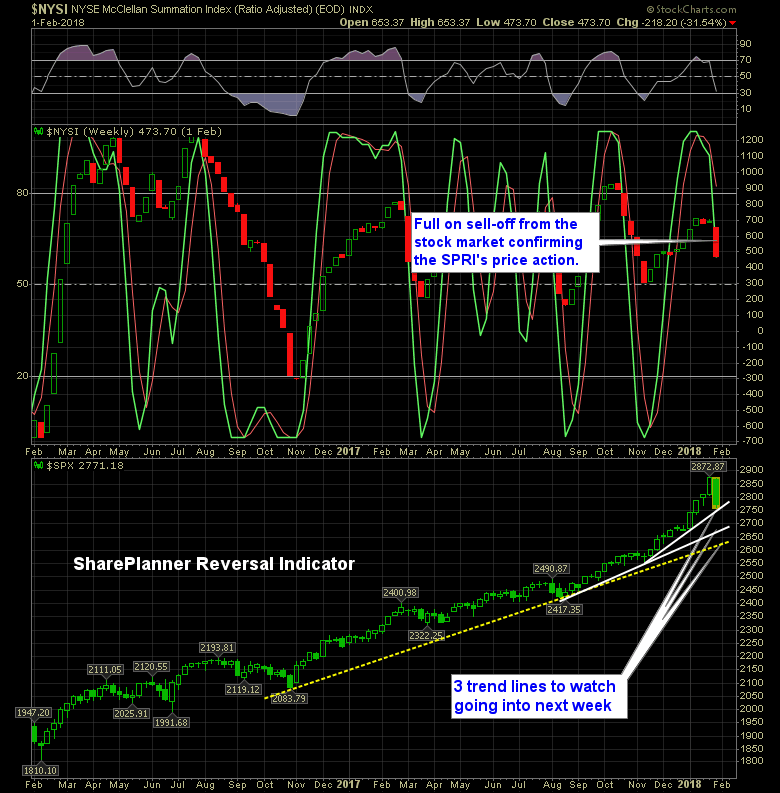

Over the past couple of weeks, I’ve tried to remain some what cautious about getting overly long on this market. I stayed away from maxing out the portfolio and kept plenty of cash handy. And I am glad I did!