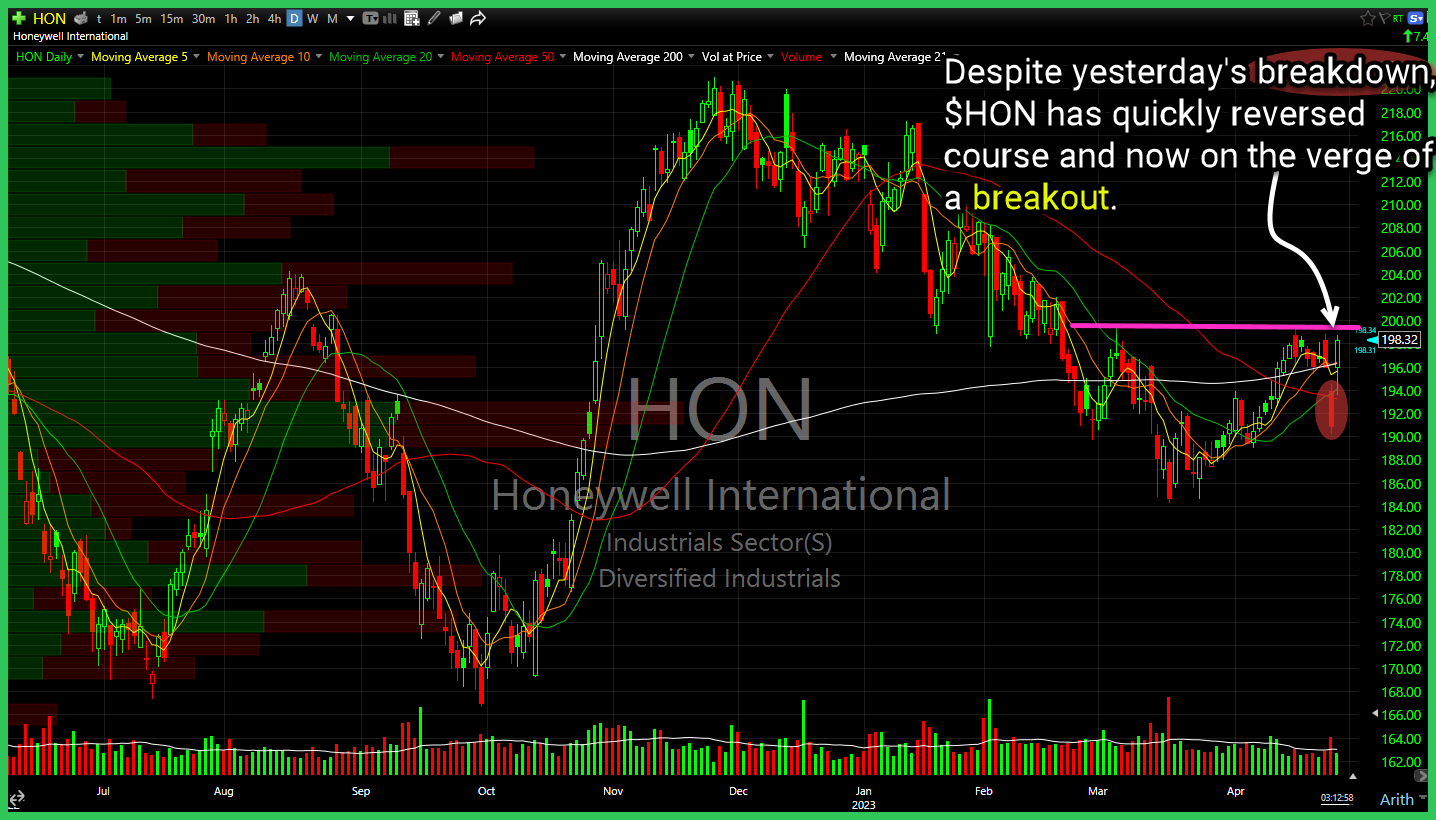

Despite yesterday's breakdown, Honeywell (HON) has quickly reversed course and now on the verge of a breakout. Quite the clown market we are in. Caterpillar (CAT) intraday breakdown of support has now seen a sharp intraday rebound. Watch declining resistance above. Communications Sector (XLC) ripping higher on Meta Platforms (META) earnings, but closing

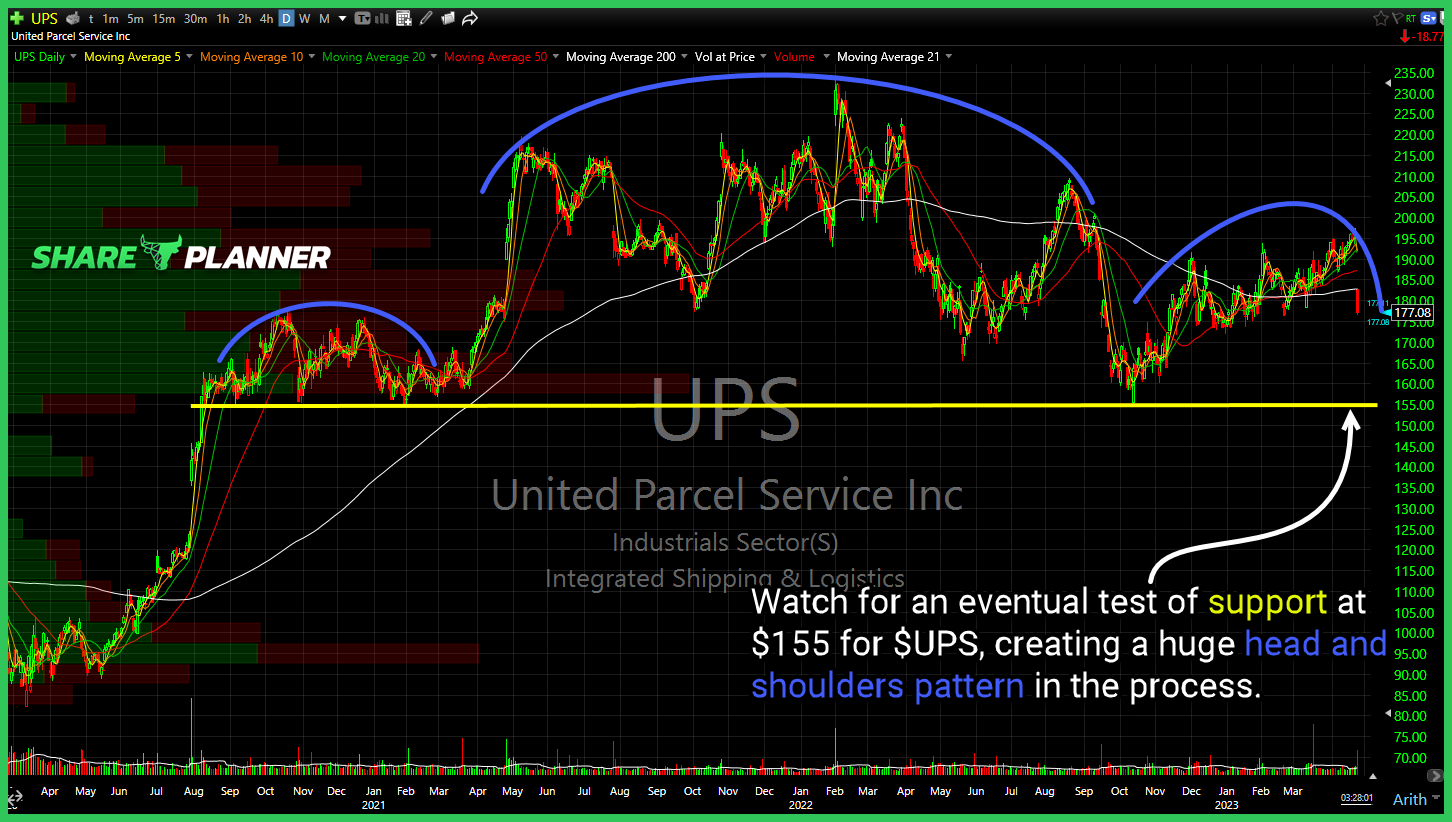

Watch for an eventual test of support at $155 for $UPS, creating a huge head and shoulders pattern in the process.

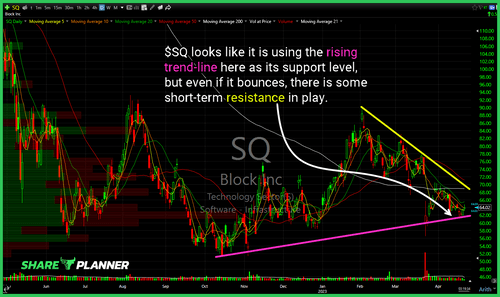

$SQ looks like it is using the rising trend-line here as its support level, but even if it bounces, there is some short-term resistance in play.

ARK Next Generation Internet ETF (ARKW) continues to see heavy rejection at the declining resistance level going back to last May. A lot of people chasing Amazon (AMZN) despite the fact it is trading on the underside of multi-year declining resistance. Better to wait for that resistance to clear first. Semiconductor ETF (SMH)

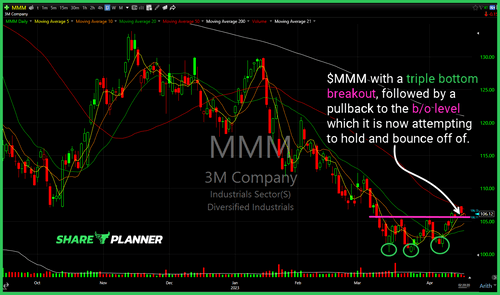

$MMM with a triple bottom breakout, followed by a pullback to the b/o level which it is now attempting to hold and bounce off of.

$UNH rejection at the broken trend-line, waiting for a pullback to key support.

China Large Cap ETF (FXI) broke its declining trend-line and then simultaneously tested its short-term rising trend-line and broken resistance. While both held, it hasn't been able to get much detachment from the trend-line. Poland ETF (EPOL) very similar to the US market in that it has been basing/trading sideways for the past 11 months.

Another breakout for $GOOGL looking really strong here against this tape today.

Heavy sell-off yesterday in $NFLX has price completely reversed and attempting to break out of the bull flag pattern.

$WW looks like a double top on its way to continued trek towards $0. lol