Another Monday, another rally, albeit a small one this time. The inverse correlation between the Nasdaq and Russell 2000 persists, with the latter only rallying hard when it needs to cover for the former and vice versa.

The pump and dump is a classic scheme in the world of penny stocks, that has found itself into the mainstream trading will large companies going up by incredible amounts, sucking in retail traders, and then leaving them as bag holders long term. In this podcast episode, I will cover how to handle a market

Rally Stocks Now and Forever More Honestly, I hate this market, as I am sure plenty of of others do too. It isn’t that I have something against bullish markets, but I do have something against markets that have been completely taken over by a federal government trying to win re-election and re-appointment, and investors

Episode Overview Another tale of life on the Robinhood app. This time I'm coming at you with a good story of a trader on the Robinhood App, looking to learn with realistic expectations and a healthy respect for the market. Listen to how "Larry" is taking on the stock market while managing a full time

Stock Market and swing trading update of the major earnings beat of Apple (AAPL) and the stock split as well as Amazon (AMZN), plus the latest technical analysis of the SP 500, Nasdaq, Russell 2000, and Dow Jones Industrial Average. I also provide my warnings of what could ultimately be another stock market crash if

Continuing to answer your most pressing questions, I took the time to answer one trader's email that touched on experience, learning and developing watch-lists. Swing-Trading the Stock Market · Experience-Learning-Watchlists

The Stock Market Crash 2020 might seem long forgotten, as Tesla stock is now all the rage, but with a major earnings week coming up, and the FOMC Statement as well, there is the potential for a resumption of the stock market crash if all does not go well. You already see a lot of

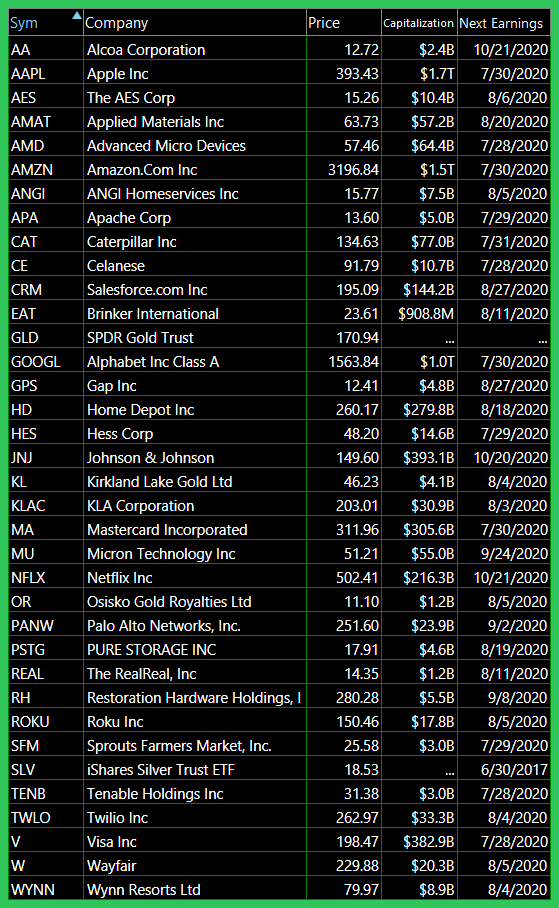

We got the ceremonial Monday rally. Now it is just a matter of whether the stock market craps all over itself the rest of the week. I took Silver (SLV) off the watch-list and I'll probably get a bunch of "you're an idiot" emails because some of you out there don't realize what risk and

Episode Overview There is an influx of new traders in the stock market since the Covid-19 lows were struck. But instead of trading, it is more like gambling on the Las Vegas Strip. Hoping to strike it big, the lose it all, all under the guise of believing what they are doing is investing. No

Oh what a mess this Federal Reserve has put the stock market in! Oh I know, S&P 500 and the Nasdaq are both positive on the year, and the latter is raging at new all-time highs, day after day practically. But what happens when the Fed balance sheet goes back to “normal”?