Stock market pullback back lasted for the past two days. Using technical analysis, is now the time to buy the dip, or wait for stocks to sell off even further before considering buying stocks?

The stock market ripped higher following the FOMC Statement issued by Jerome Powell. The stock market soared, and from a technical analysis standpoint, the outlook looks good for stocks going forward. In this video, I provide my analysis on the SPY, QQQ and IWM ETF, as well as my outlook on the VIX index.

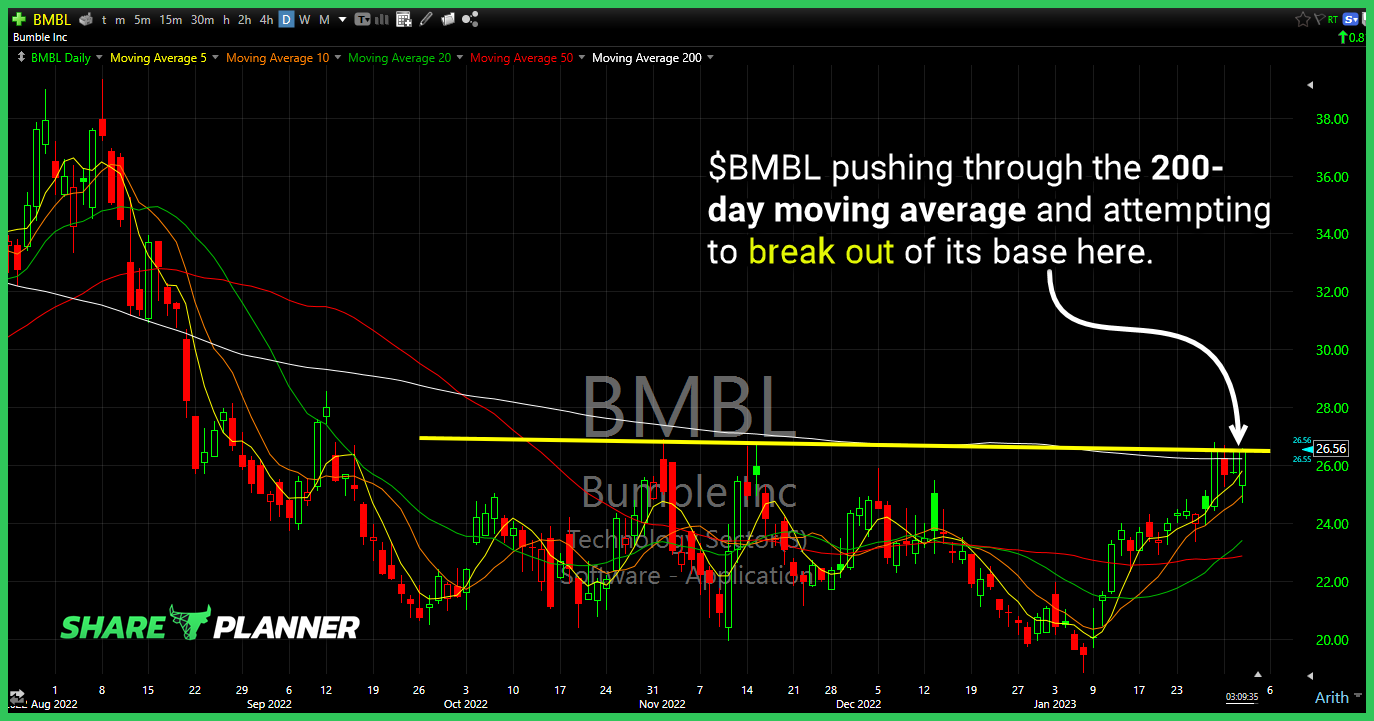

$BMBL pushing through the 200-day moving average and attempting to break out of its base here.

S&P 500 (SPY) and Nasdaq 100 (QQQ) both made major moves via technical analysis when broke through their declining trend lines on their respective charts. These trend-lines go back over a year, and this is the first time that these ETFs have managed to break through!

$SPY 5 min intraday pullback only a 23.6% retracement from Thursday lows to Monday highs. Needs $395-7 to make it a meaningful one.

SPY ETF was saw price get rejected at its key declining trend line. The S&P 500 could not continue the rally with year long resistance overhead. In this video I provide my latest technical analysis on the SPY ETF and S&P 500.

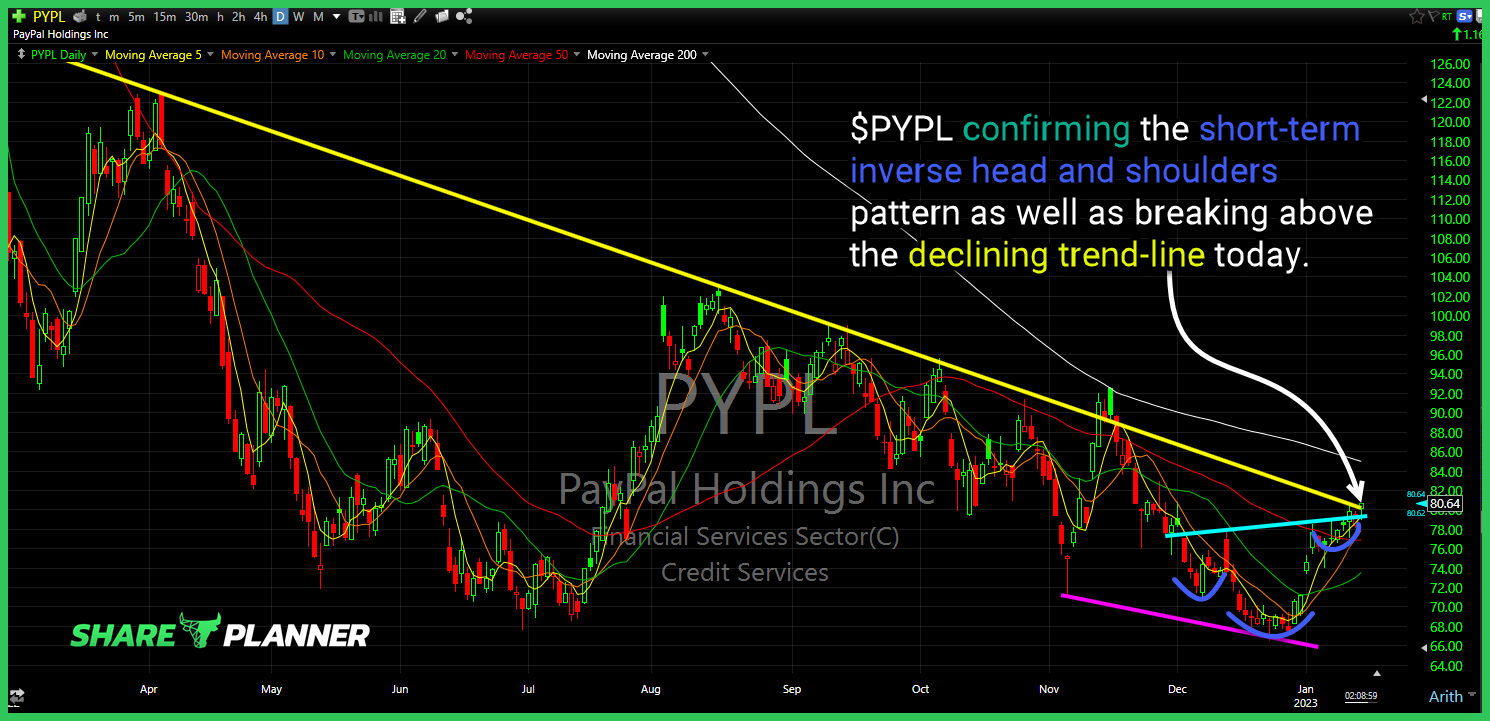

$PYPL confirming the short-term inverse head and shoulders pattern as well as breaking above the declining trend-line today.

SPY has rallied over 5% in the past week! A lot of traders are hoping this is finally the moment it can break through declining resistance and just start a bull market for the stock market. I'm providing my technical analysis on SPY and what you can expect as it does battle with major resistance.

The stock market saw a breakout with SPY after being stuck in a trading range for 13 straight days. But the follow through was less than impressive leaving traders wondering whether the rally of late was nothing more than a short lived bounce. In this video, you will get SPY technical analysis on a daily