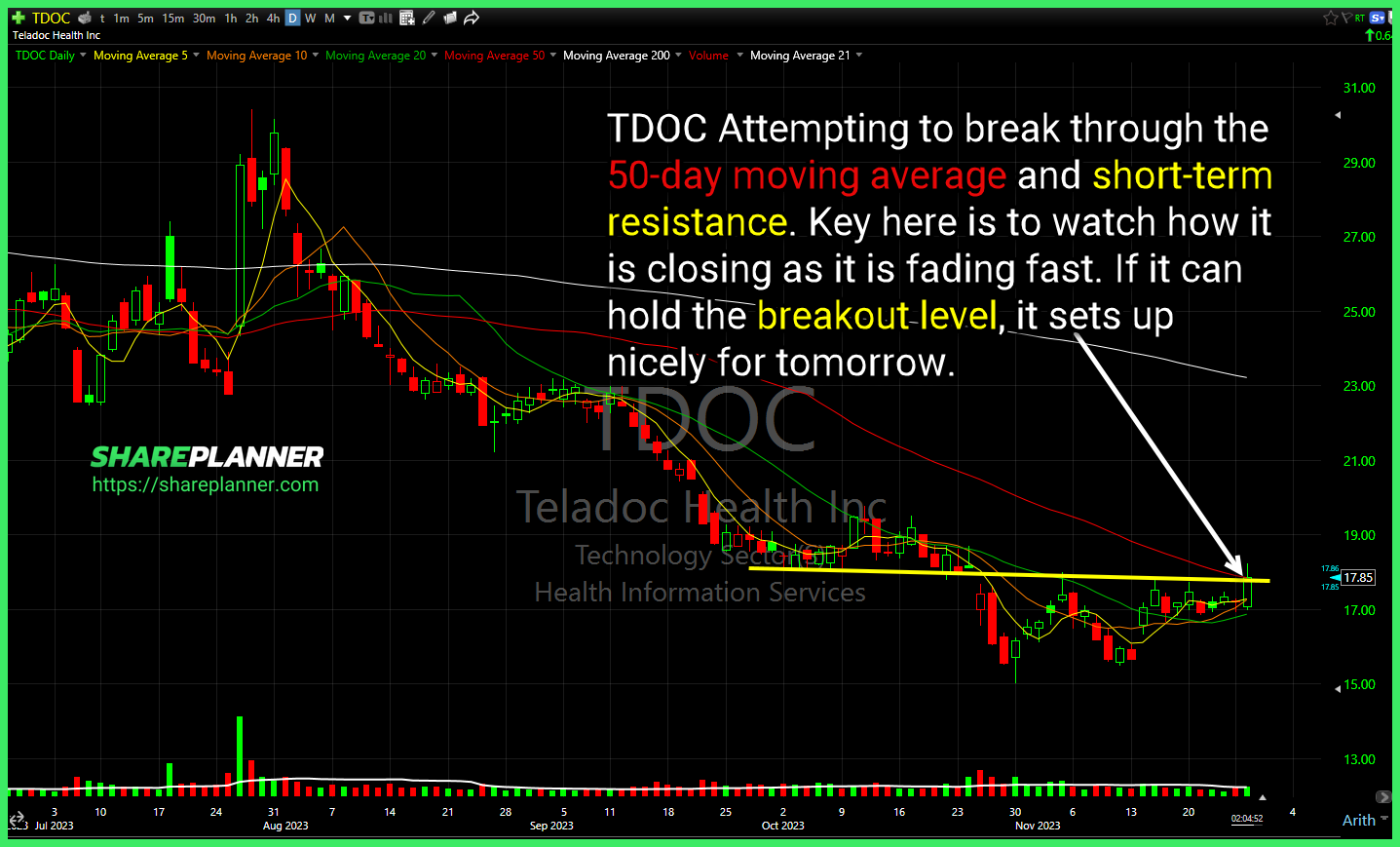

$TDOC Attempting to break through the 50-day moving average and short-term resistance. Key here is to watch how it is closing as it is fading fast. If it can hold the breakout level, it sets up nicely for tomorrow. Price on $SPY testing major resistance here. $GDX setting up for a test of the inverse

The S&P 500 and Nasdaq 100 has been on a 3 day rally and the Russell 2000 has been on a 5 day rally! But can it last? How much more room to rally does the stock market have to rally. Or are we simply looking at a bear market rally coming to an end

Stock have been in a steep sell-off of late and poised for a bounce here in the near term. Can we expect a dead cat bounce here? Or will the stock market crash continue for the foreseeable future. In this video, I provide my technical analysis for SPY, QQQ, IWM ETFs, as well as my

Stocks have rallied hard over the last five trading sessions, but can the rally continue going into Friday's Job's number?

$AKAM gapped above the inverse head and shoulders neckline, but I think it's better to wait for a pullback to the neckline before considering a new long position at this point. $UNG held the breakout level into the close. Worth watching going forward. Serious puking underway on $SPY ahead of tomorrow's CPI Report. $UNH in

If $AMD breaks short-term support, I would be looking for the next leg lower to start on the stock. $SPY is trading in the gap now. Nice pullback for $BYD to the lower channel band, but my big concern here is the fact that it has now made to consecutive lower-highs following a bounce. $DWAC

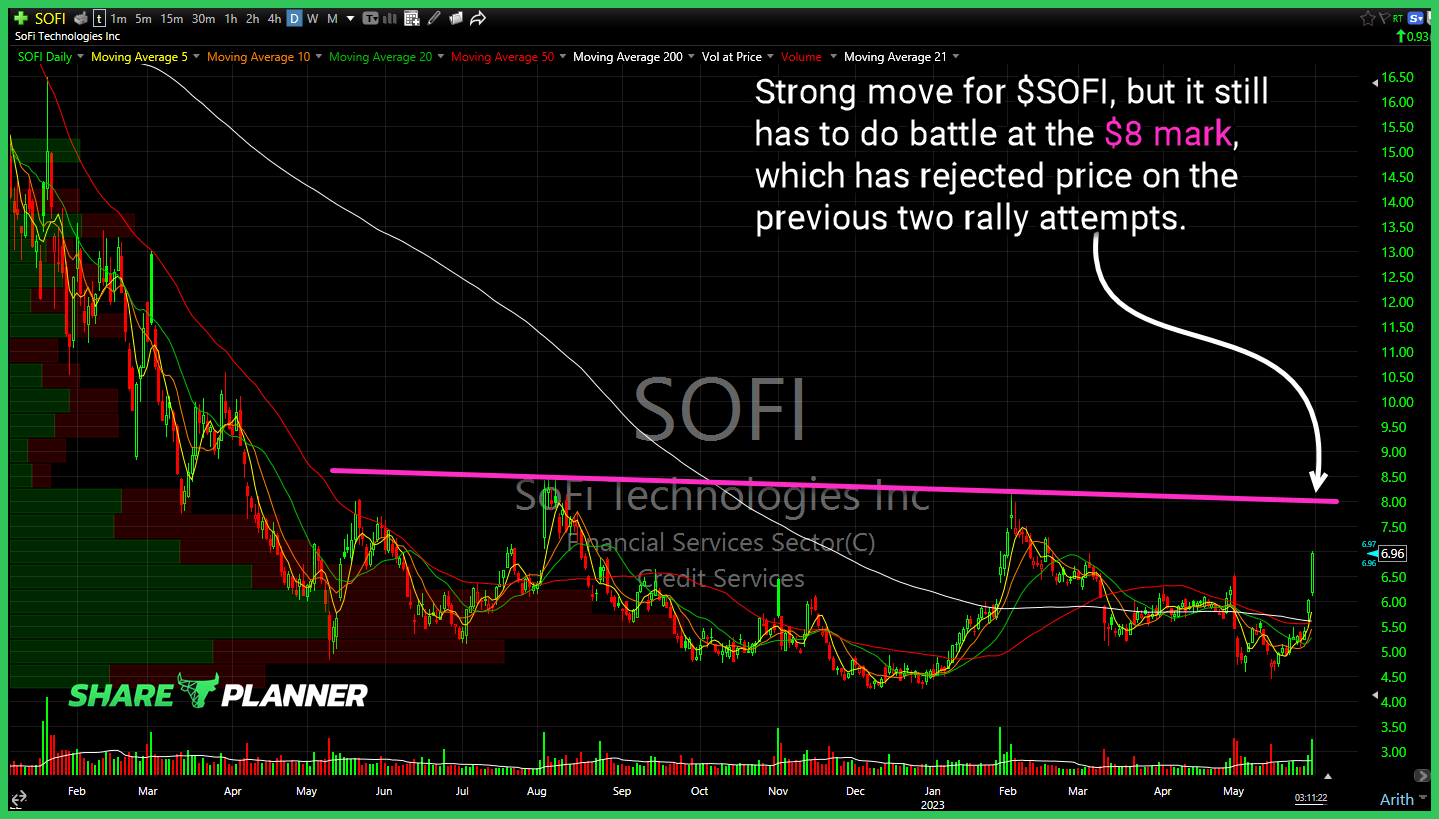

Strong move for $SOFI, but it still has to do battle at the $8 mark, which has rejected price on the previous two rally attempts. $NVDA gap closed, but the effort to bounce it after that failed. Watch for an attempt at filling the second gap. $UNH price action still a struggle, but if it

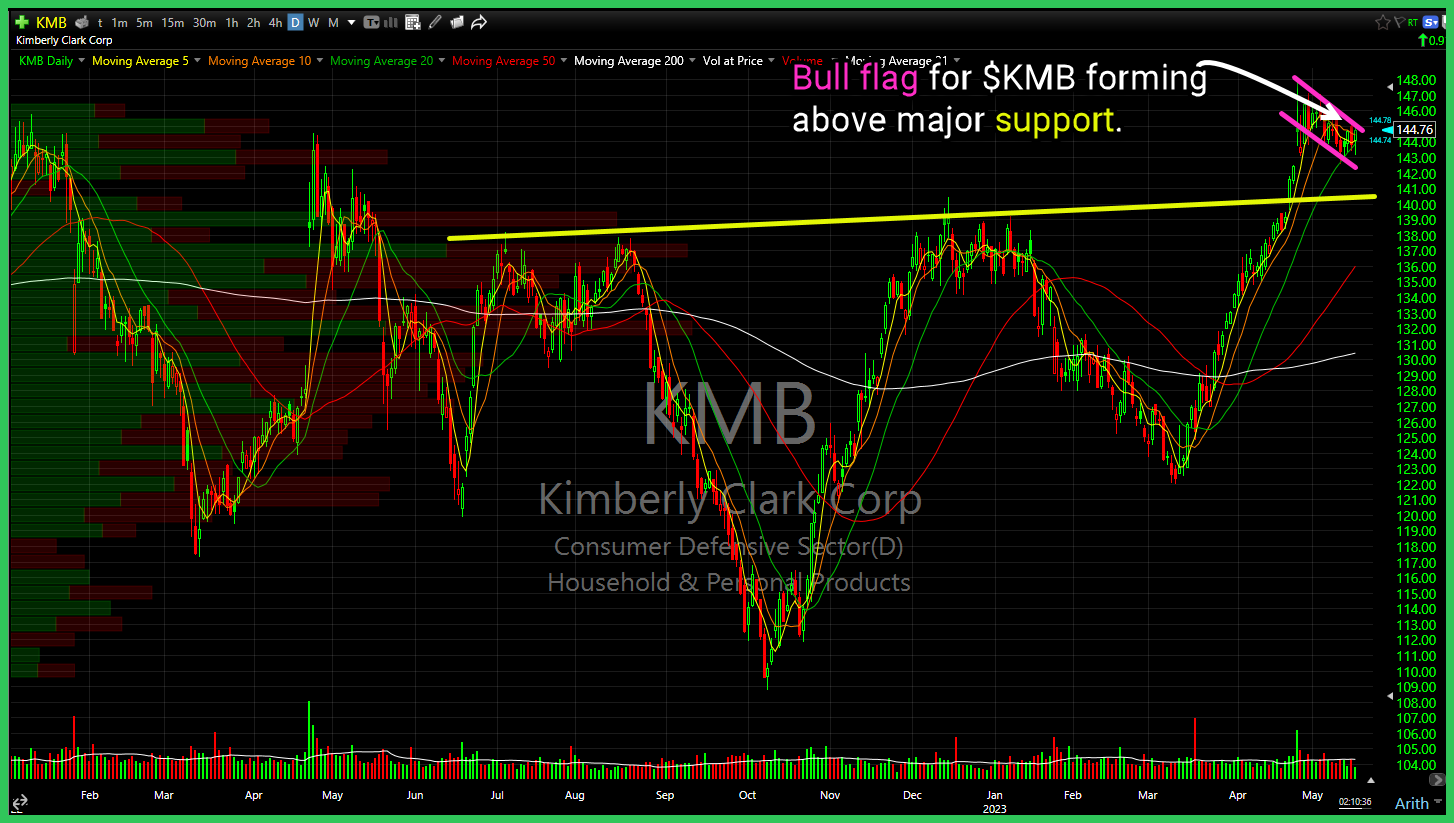

Bull flag for $KMB forming above major support.

$XLK price level resistance and upper channel resistance pushing back on the $XLK move back to last August highs.

$WW looks like a double top on its way to continued trek towards $0. lol