Q&A session going over the stock market price action over the past week, and the impact that 0DTE traders are having on the overall market.

Into the gap GameStop (GME) goes. Never trust this stock. S&P 500 (SPY) gave up all the day's gains and broke yesterday's lows. Bad omen for this market. Netflix (NFLX) price resistance here worth keeping a close eye on. Pimco Total Return ETF (BOND) nearing resistance from July '22 for a potential breakout.

Watch how Nike (NKE) responds to a potential test of its rising trend-line in the coming days. SPX with a 103 point sell-off, those chasing the initial bullish reaction got fleeced today! Somewhat muted SPY response so far following FOMC Statement. Semiconductors ETF (SMH) testing resistance going back to May of last year.

Panic selling on the $TICK

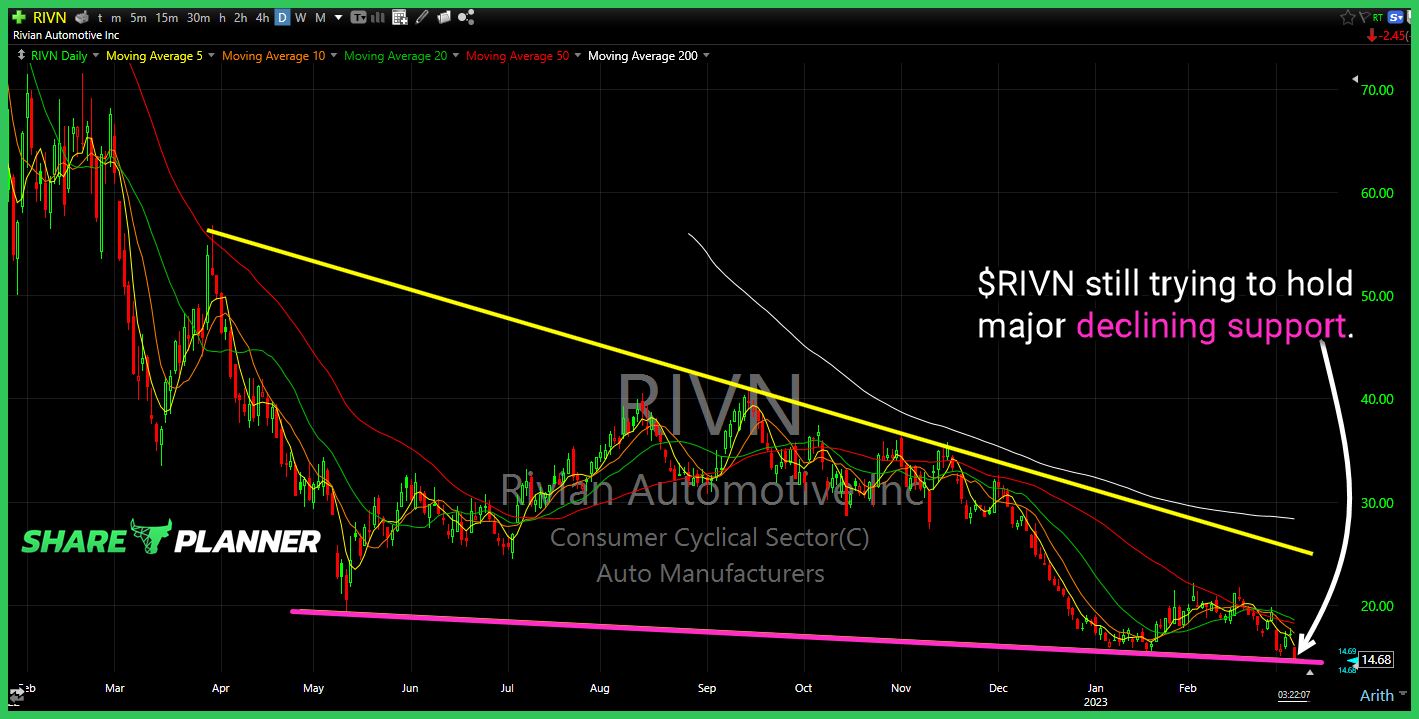

$RIVN still trying to hold major declining support.

$SPY afternoon sell-off was a nasty one that saw price close at the lows of the day.

0DTE Traders, which stands for "Zero days to expiration" are wrecking havoc on the stock market ODTE trading is creating constant market reversals and wild swings. Is this a new phenomenon that could lead to a major crash in the stock market?

After an epic rally in January and much of February, the last three days has seen stocks reverse the gains and trade in negative territory. In this video I'm going to provide my technical analysis on whether this is just a short-term pullback, or the continuation of the stock market crash that started last year.

$VIX back below key support, after falling off a cliff, post CPI.