Current Long Positions (stop-losses in parentheses): PEP (70.10), STZ (22.20), FTR (8.57), CB (64.32), PCLN (502.75), KCI (57.69), SLV (33.36), PNW (44.78) Current Short Positions (stop-losses in parentheses): None BIAS: 60% Long Economic Reports Due Out (Times are EST): Chicago Fed National Activity Index (8:30am) My Observations and What to Expect: Futures are

I went long Silver (SLV) at $34.06, and though it’s not Linkdeln (LNKD), it does have a lot of volaility, and if you followed my chart that I posted earlier this week, you’ll remember that I highlighted the potential for us to see a nice pop out of this commodity. Well, now it is

If you’re like me, you probably expected the NYSE Reversal Indicator to be pointing straight down. Instead, it is the exact opposite. So what does this all mean? Well, let me give you a few observations that come to mind 1) Bears only managed to push the market down last week, by a smidgen, which

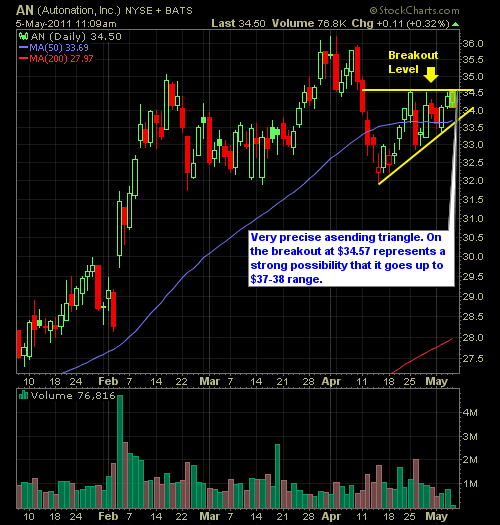

Current Long Positions (stop-losses in parentheses): GOOG (529.00), NFLX June 270 Calls, AAPL (343.95), SSO (53.99), AN (33.67), SLV (32.99), NTAP (50.98) Current Short Positions (stop-losses in parentheses): None BIAS: 42% Long Economic Reports Due Out (Times are EST): None My Observations and What to Expect: Futures are slightly higher heading

All I know is that I shorted silver on Monday, ZSL. I heard all kinds talk about silver and commodities freaking everyone out from CNBC to the blogosphere and twitter. Now, first of all, let me be perfectly clear in that the proceeds from ZSL countered the total error of buying GLUU at absolute tops.

So far the market is rebounding well today, and will look to lighten up some of my positions as well, particularly in SSO where I have a huge chunk of my capital in (40%). I’ll probably sell 3/4 of that position today and take the nice profits in hand. Also, the Silver (SLV) play

Current Long Positions (stop-losses in parentheses): GOOG (524.00), NFLX June 270 Calls, AAPL (343.95), SSO (53.99), STZ (22.39), AN (33.67), SLV (32.99) Current Short Positions (stop-losses in parentheses): None BIAS: 66% Long Economic Reports Due Out (Times are EST): Employment Situation (8:30am), Consumer Credit (3pm) My Observations and What to Expect: Futures are significantly higher after

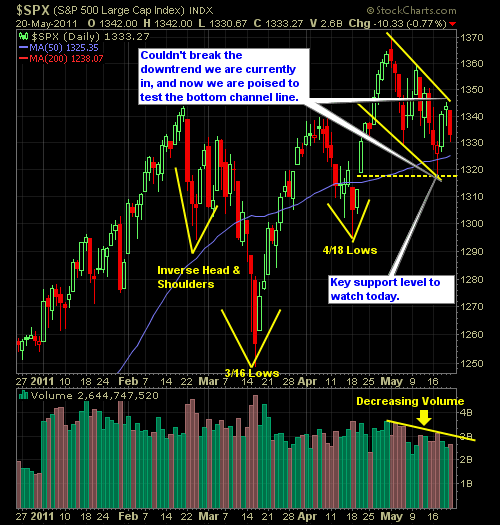

Market is getting hammered yet again today and commodities, in particular Silver (SLV) far worse – down over 28% from its highs. The main thing is that we are trading below 1340 which was a key support level for this market – it’ll be important for the S&P to recover that level by the

Current Long Positions (stop-losses in parentheses): DISCK (36.79), RAX (43.46), HRB (17.39), GOOG (517.00) Current Short Positions (stop-losses in parentheses): None BIAS: 40% Long Economic Reports Due Out (Times are EST): FOMC Meeting Begins, ICSC-Goldman Store Sales (7:45am), Redbook (8:55am), S&P Case-Shiller HPI (9am), Consumer Confidence (10am), State Street Investor Confidence Index (10am)

If yesterday’s two-point decline in the S&P got you excited, then you’ll really love the fact that heading into the open we are currently in the red. That’s right, the bulls are suddenly not so optimistic in their usual way. What does all this mean? It probably means we drop 5% right at the open,