Current Long Positions (stop-losses in parentheses): PEP (70.10), STZ (22.20), FTR (8.57), CB (64.32), PCLN (502.75), KCI (57.69), SLV (33.36), PNW (44.78)

Current Short Positions (stop-losses in parentheses): None

BIAS: 60% Long

Economic Reports Due Out (Times are EST): Chicago Fed National Activity Index (8:30am)

My Observations and What to Expect:

- Futures are significantly lower heading into the open.

- Asia saw losses as much as 2.9% and Europe on average is trading 1.7% lower.

- Greece and Italy downgrades are weighing heavily on the markets.

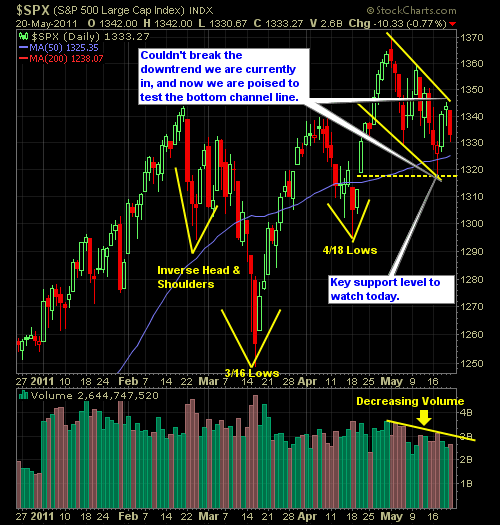

- We are setting up to open and challenge the lows from last week (recent lows) at 1318 on the S&P.

- Today’s open will put us below the 50-day moving average at 1325 and the long-term trend-line at 1330.

- The S&P continues to trade in a downward channel. with today’s negative open, the bottom channel could possibly be tested and would likely offer a potential bounce area for the market at 1311.

- Volume since the beginning of the month continues to taper off.

- My conclusion: It’s definitely a day where my focus will be damage control, and to keep losses on current long positions to a minimum. However, don’t expect me either to load the wagon with short positions either. After a move down like we are seeing this morning, isn’t the time to do so.

Here Are The Actions I Will Be Taking:

- Scalped SSO on Friday for a 1.5% gain

- Added SLV at $34.06 and PNW at $45.61 on Friday.

- No changes to the stop-losses today.

- Will look to limit damage in my long positions. May play SSO off of any extreme negative TICK readings.

- I will start tightening the duration of the trades that I make – I’ll look for most of my trades to last 1-2 days at the most, should the recent market weakness persist. .

- Follow me in the SharePlanner Chat-Room today for all my live trades and ideas (as well as everyone else’s).

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.