Technical Analysis: Futures taking a notable dip this morning, though it has recovered about 2/3’s of its losses, as the S&P 500 and Nasdaq had actually limited down during the election coverage last night. With Donald Trump as the President-Elect, I highly expect the Fed to raise rates in December, since Yellen isn’t beholden

Technical Outlook: S&P 500 (SPX) continued its sell-off yesterday for the seventh straight day, and the nineth time in the last ten days. More importantly, SPX broke key psychological support at 2100 yesterday. Considering SPX is down seven straight days, it is extremely light that the market is only down -2.5% during that time. Considering the

Technical Outlook: Major reversal on Friday’s price action when the market went from being firmly in the green, to instantly into negative territory on news that Hillary Clinton’s email investigation was being re-opened. This creates some fresh volatility for the market as it had seemed, until Friday’s news, that it was comfortable just remaining dormant

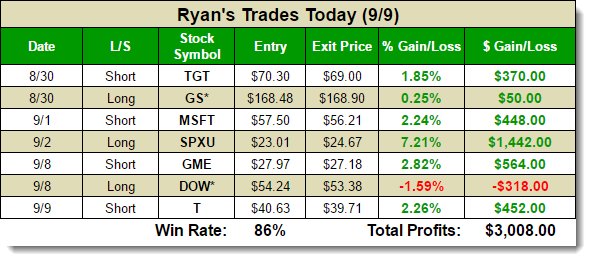

Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership to my service can do for your portfolio. Sign up for a Free 7-Day Trial – with your subscription, you will get each and every trade that I make with real-time text and email alerts (international too) as well as

There’s not a lot of reason to be short on this market… well that depends on the day of the week of course, because on Friday of last week and Monday of this week, things were starting to look grim. Since the debate, the market has been extremely bullish. And it is not because it

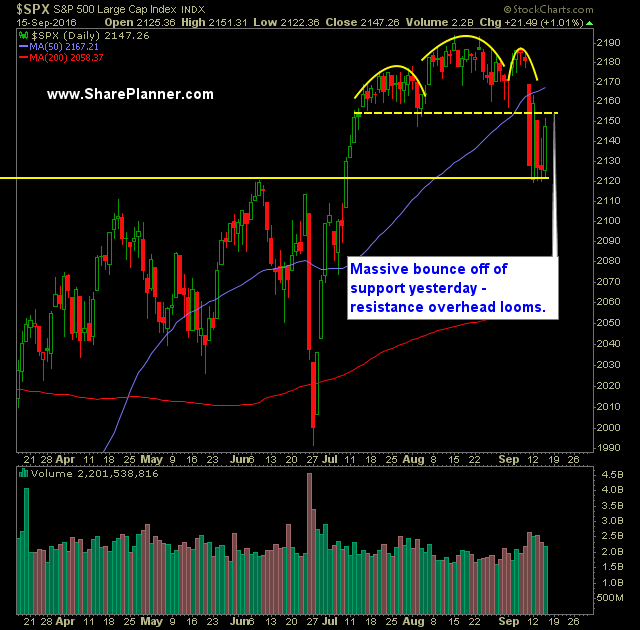

Technical Outlook: Huge bounce on S&P 500 (SPX) yesterday that put in a strong case for a short-term bottom being formed at 2120. The rally yesterday took price back above the 5-day moving average which is something the index has been unable to do over the past week. SPY volume increased yesterday from the day prior

This bounce today is totally different than the one we saw on Monday. The strength is there, it is actually pushing above the 5-day moving average and breaking through the previous day’s highs. Monday’s rally had none of those qualities to it. It was simply a dead cat bounce. As a result you have

The market sold off hard today, and by hard, I mean like “day-after-Brexit-vote” hard. The financial news will tell you it was because of renewed interest rate hike possibilities for September’s meeting. But the story is really in the technicals. You see, the market was in a tight trading range for the better part of

At some point, this dull price action has to end and when it does it is likely to lead to a big move for the market – in one direction or another. But there will ultimately be a big move eventually. It is just a matter of waiting it out and watching the paint dry,

The bulls have had the edge since Friday’s payroll report, rallying slightly on Friday and up a fraction today, despite the sell-off early on. At this point, you can almost bank on the algos and HFT’s to buy the dip when the market sees, by its standards, a massive 2-3 point intraday drop on the